-

Ethereum (ETH) might drop by 11% to succeed in the $2,850 assist stage if closes a day by day candle beneath the $3,200 stage.

-

At present, 53.07% of prime merchants maintain quick positions, whereas 46.93% maintain lengthy positions.

-

At current, the quick positions created by sellers are greater than double the lengthy positions held by patrons.

Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, is flashing a sell-off sign, hinting at a notable worth decline within the coming days. Over the previous three days, sentiment throughout the cryptocurrency panorama has shifted noticeably towards the bearish aspect, resulting in a considerable worth drop.

Ethereum (ETH) Technical Evaluation and Upcoming Ranges

Nevertheless, this worth decline is predicted to proceed as ETH has shaped a bearish worth motion on the day by day timeframe. In accordance with professional technical evaluation, ETH has damaged out of a bearish Head-and-Shoulders sample and breached a vital assist stage at $3,250.

Supply: Buying and selling View

This breakdown of bearish worth motion has pushed merchants towards quick positions, which might affect ETH’s worth within the coming days. Historic knowledge signifies that $3,250 has been a robust assist stage for ETH over the previous three months, persistently offering a ground at any time when market sentiment turned bearish.

Nevertheless, this time, the altcoin has failed to carry this stage. Based mostly on current worth motion, if ETH closes a day by day candle beneath the $3,200 stage, there’s a robust risk of an 11% drop, taking it to the $2,850 assist stage.

Bearish On-Chain Metrics

This bearish outlook has prompted merchants to take quick positions, as reported by the on-chain analytics agency Coinglass. At present, the ETH lengthy/quick ratio stands at 0.884, indicating robust bearish sentiment amongst merchants. Moreover, knowledge reveals that, as of press time, 53.07% of prime merchants maintain quick positions, whereas 46.93% maintain lengthy positions.

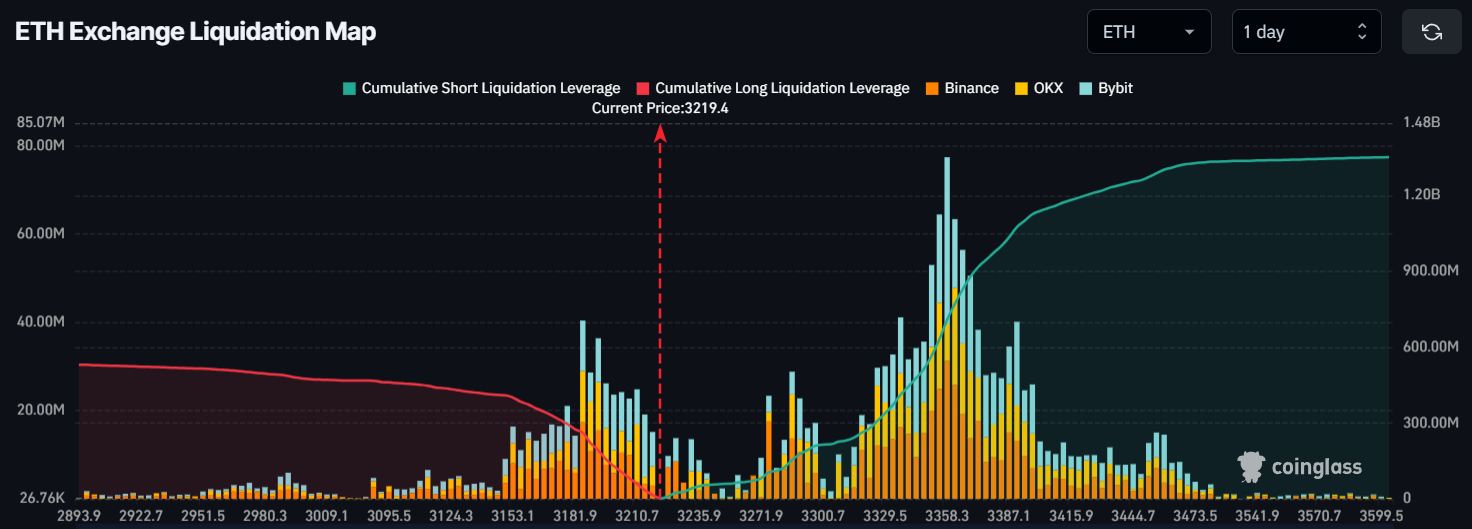

Main Liquidation Ranges

As well as, the most important liquidation areas are on the $3,185.5 stage on the decrease aspect and $3,361.9 on the higher aspect, with merchants closely over-leveraged at these ranges, as revealed by the ETH trade liquidation map.

Supply: Coinglass

If the present sentiment stays unchanged and the value drops to the $3,185.5 stage, practically $261.01 million value of lengthy positions will probably be liquidated. Conversely, if the sentiment shifts and the value rises to the $3,361.9 stage, roughly $708.16 million value of quick positions will probably be liquidated.

This knowledge reveals that the quick positions created by sellers are greater than double the lengthy positions held by patrons, signaling a robust bearish sentiment.

Present Value Momentum

At present, ETH is buying and selling close to $3,225, having skilled a worth decline of over 1.65% up to now 24 hours. Nevertheless, throughout the identical interval, its buying and selling quantity has dropped by 29%, indicating decreased participation from merchants and buyers.