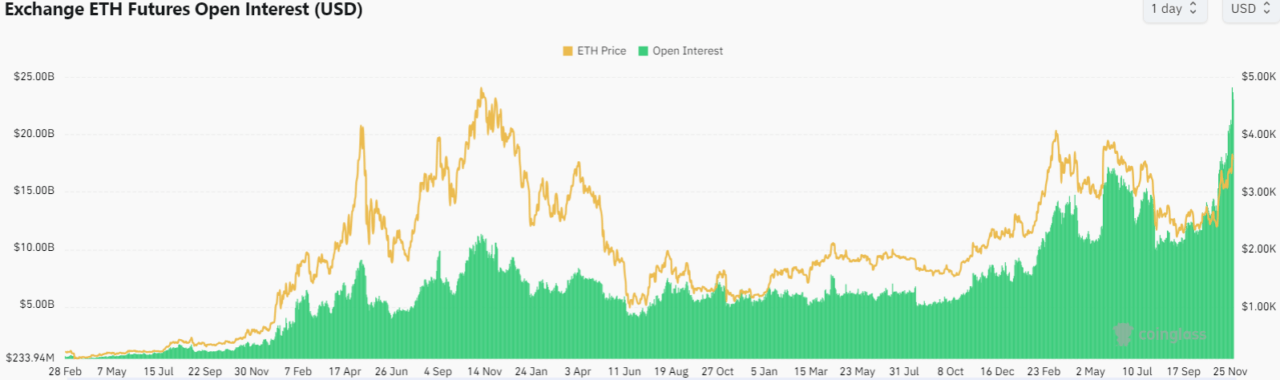

Knowledge reveals that open curiosity on Ethereum derivatives contracts has just lately exploded upward to a brand new all-time excessive of $23 billion, up from round $7 billion originally of the yr, in an upward transfer that one analyst counsel is “assured for heavy fireworks.”

Based on knowledge from CoinGlass, there at the moment are $23 billion price of ETH futures open curiosity, suggesting a rising quantity of positions are being created on the cryptocurrency as recent capital flows into the market.

The inflow of capital might result in rising volatility within the close to future by amplifying potential value actions, therefore its potential to result in “heavy fireworks,” in accordance with CryptoQuant analyst Maartunn.

Supply: CoinGlass

The rise in open curiosity comes at a time through which the worth of Ethereum has been considerably underperforming that of Bitcoin, with knowledge from CryptoCompare displaying that whereas the flagship cryptocurrency is up greater than 156% during the last 12-motnh interval, ETH solely rose 77%.

As CryptoGlobe reported, an enormous Ethereum whale that amassed practically 400,000 ETH when the second-largest cryptocurrency by market capitalization was buying and selling at round $6 per token has just lately restarted promoting.

Based on knowledge shared by on-chain evaluation agency Lookonchain, the whale amassed a complete of 398,889 ETH for round $2.4 million between January and March 2016, with the tokens now being price over $1.34 billion after Ethereum’s value exploded within the final eight years.

The cryptocurrency is now buying and selling at $3,600 per token and has a $433 billion market capitalization. Per Lookonchain, the large Ethereum whale remained dormant for over eight years, earlier than it restarted promoting on November 7.

Whereas Bitcoin is buying and selling close to a report, Ethereum continues to be removed from its all-time excessive close to $4,600 seen again in 2021. As CryptoGlobe reported, late final month the quantity of ETH being held on cryptocurrency exchanges has plunged by round $750 million after large withdrawals of the second-largest cryptocurrency by market capitalization from these platforms.

Featured picture through Unsplash.