Ethereum (ETH) is up greater than 10% over the past seven days because the market exhibits indicators of renewed exercise. Nonetheless, key technical indicators reveal a mixture of weakening pattern energy and cautious optimism from patrons.

ETH is at the moment battling vital resistance zones that might outline whether or not the rally continues or fades. With momentum nonetheless fragile, Could could possibly be a decisive month for Ethereum’s subsequent main transfer.

Ethereum’s Development Weakens Sharply as Bears Shut In

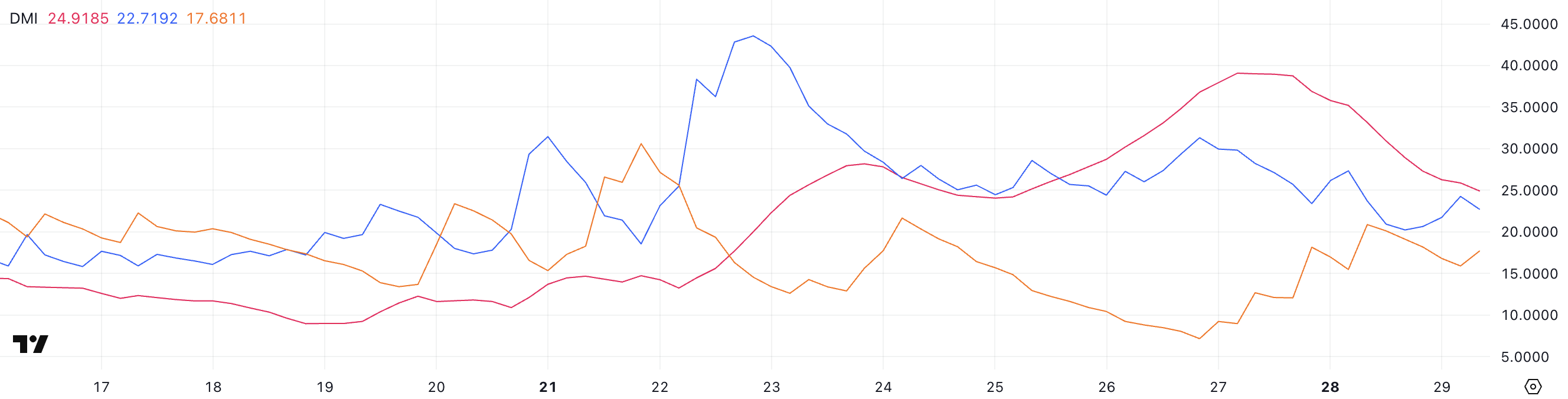

Ethereum’s DMI chart exhibits its ADX is at the moment at 24.91, a pointy decline from 39 two days in the past. The ADX, or Common Directional Index, measures the energy of a pattern, whether or not up or down.

Typically, an ADX studying above 25 indicators a powerful pattern, whereas values under 20 recommend the market is getting into a interval of weak spot or range-bound buying and selling.

The steep drop in ADX signifies that Ethereum’s current momentum is shortly dropping energy. With out renewed shopping for or promoting strain, ETH may stay caught in a extra unstable, sideways sample over the quick time period.

In the meantime, the directional indicators are displaying a transparent shift. The +DI, which tracks bullish strain, has dropped to 22.71, falling from 31.71 three days in the past and 27.3 yesterday.

In distinction, the -DI tracks bearish strain has climbed to 17.68, up from simply 7.16 three days in the past and 15.64 yesterday. Yesterday, the hole between patrons and sellers practically closed, with +DI at 20.91 and -DI at 20.1, suggesting sellers virtually regained market management.

This rising bearish momentum and a weakening pattern energy increase the danger of Ethereum’s value slipping decrease if patrons can not defend key ranges. Nonetheless, if bulls handle to carry floor and reclaim momentum, ETH may nonetheless mount one other try at restoration.

ETH RSI Climbs After Sharp Drop: Will the Restoration Maintain?

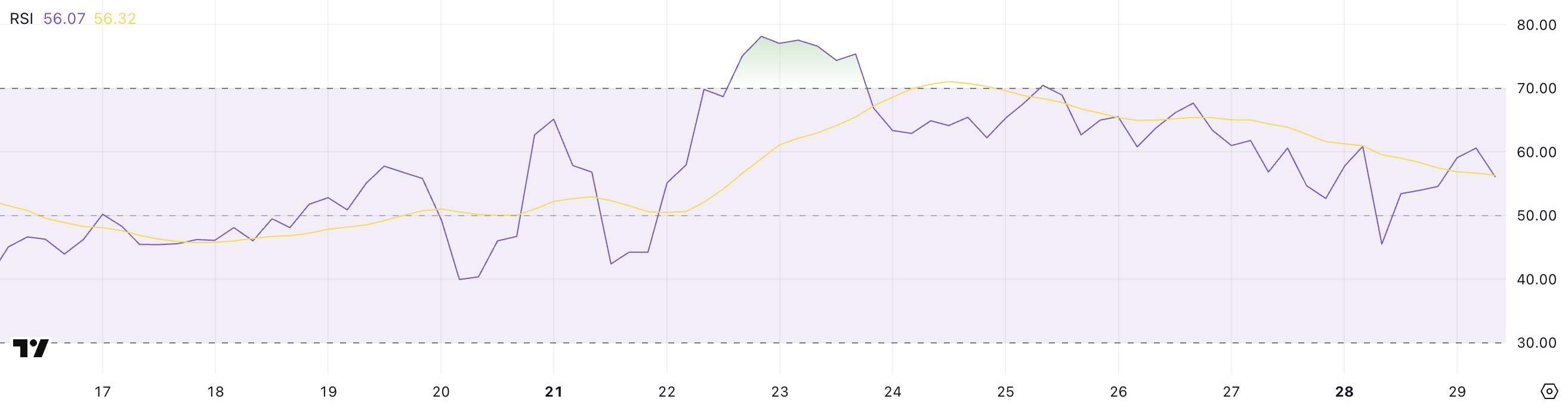

Ethereum’s RSI is at the moment sitting at 56, up from 45.5 at some point in the past, after reaching 70.46 4 days in the past. The Relative Energy Index (RSI) is a momentum indicator that measures the velocity and magnitude of value actions.

Usually, an RSI above 70 suggests an asset is overbought and could also be due for a pullback, whereas an RSI under 30 signifies oversold circumstances and the potential for a rebound.

Readings between 30 and 70 are thought-about impartial, with ranges round 50 typically signaling a market at a call level. The sharp swing in Ethereum’s RSI over the previous few days displays the current unstable sentiment round ETH.

ETH RSI. Supply: TradingView.

With the RSI again as much as 56, Ethereum has regained momentum after dipping into neutral-to-bearish territory. A studying above 50 leans barely bullish, suggesting that patrons have began to reassert some management, although not with overwhelming energy.

If the RSI continues to climb towards 60 and past, it may sign a renewed push increased for ETH costs.

Nonetheless, if momentum stalls once more and the RSI turns again down, it might recommend the restoration is dropping steam and that Ethereum may fall again right into a broader consolidation or perhaps a correction section.

Ethereum Battles Key Resistance as Breakout or Breakdown Looms

Ethereum value has made a number of makes an attempt over the previous few days to interrupt above the resistance degree at $1,828. If ETH manages to interrupt and maintain above this degree decisively, it may open the door for a stronger transfer upward.

The following main goal could be $1,954, and if bullish momentum stays sturdy, an extra rally towards $2,104 may unfold. Ethereum may ultimately check $2,320 in an much more aggressive uptrend, marking a big bullish extension.

These ranges might be key to look at as they might outline the energy and sustainability of any breakout within the coming days.

ETH Value Evaluation. Supply: TradingView.

On the draw back, if Ethereum fails to carry its present ranges and the pattern reverses, the primary vital help to look at lies at $1,749. A break under that might set off a transfer decrease towards $1,689.

If promoting strain intensifies, ETH may lengthen the downtrend even additional, with main help ranges at $1,537 and $1,385 coming into play.

Shedding these ranges would sign a a lot deeper correction, suggesting that the current makes an attempt at restoration have been solely short-term earlier than a extra extended bearish section units in.