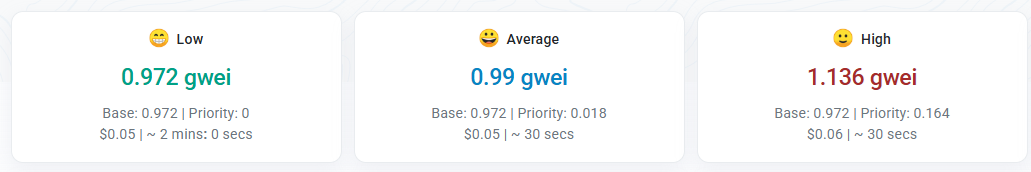

Ethereum (ETH) as soon as once more dipped to extraordinarily low charges, displaying the outflow of customers. Fuel costs moved down below 1 gWEI, or as little as $0.06 for normal transactions.

Ethereum (ETH) alerts lowered demand for transactions, as gasoline charges slide below 1 gWEI. That is the primary interval of low charges since September 2024, as ETH continues to commerce round $2,700 with a extra bearish sentiment.

Ethereum gasoline charges fell as little as $0.06 primarily based on their valuation below 1 gWEI, after an outflow of exercise from the community. | Supply: Etherscan

In consequence, fundamental swaps went as little as $0.06, whereas advanced routing, NFT actions, token swaps and different on-chain actions slid below $1. A budget gasoline situations appeared a couple of days in the past, however the drop below 1 gWEI solely occurred up to now 24 hours. ETH can nonetheless have spikes in exercise and gasoline costs. The not too long ago low gasoline charges are additionally used to resume the XEN token minting contract.

Ethereum till not too long ago levied charges for a number of the swaps of over $25, making it usable just for older crypto holders and whales. The chain, nonetheless, drove out customers who wished to play with small sums, as even a easy swap or bridging transaction destroyed income. In consequence, day by day energetic customers fell towards 477K in 24 hours, after a quick spike above 700K per day on the finish of January.

Because of the low gasoline charges, ETH manufacturing can be increasing, with inflation at 0.56%. Every week, one other 12,345.53 ETH are distributed to validators.

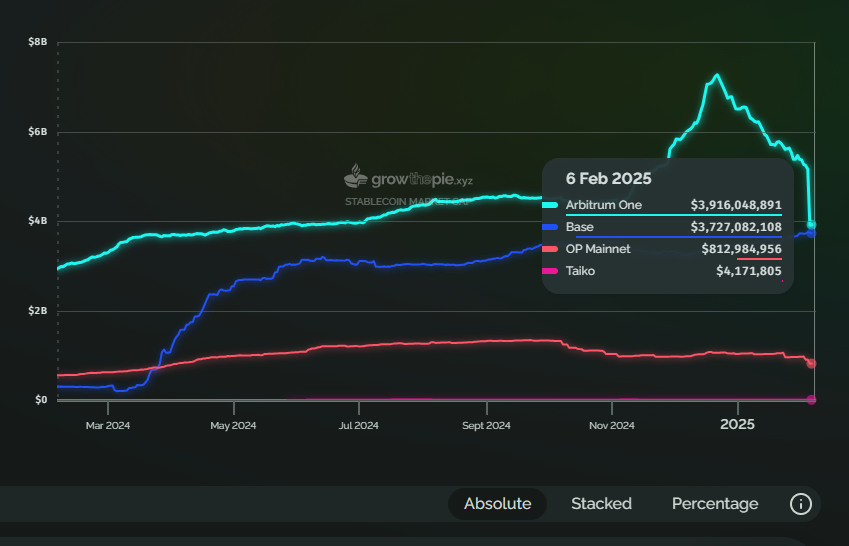

The slowdown of utilization just isn’t solely affecting Ethereum, however its complete L2 ecosystem. Blob charges are again to negligible ranges, falling from round 84 ETH per day all the way down to 62.65 ETH from all L2. These charges are burned to decrease the provision of ETH, however the burn has slowed down currently. Energetic addresses on all L2 chains are down 24% for the previous week, sliding from an all-time peak on the finish of January.

Even Base counts a 30% slide in its day by day transaction depend since its peak in early January. Most chains are additionally paying considerably decrease rents to the L1 Ethereum layer, down over 90% up to now week. The low L1 lease alerts diminished utilization along with the optimized schedule.

The opposite massive shift for L2 chains is the outflow of stablecoins. Arbitrum’s provide peaked over $7B, then noticed a sequence of outflows to Ethereum, retaining simply 3.91B.

Arbitrum (ARB) noticed the largest outflow of stablecoins as Tether readjusted its token balances for USDT. | Supply: GrowThePie

The outflow of customers and liquidity from the Ethereum ecosystem units a query on the way forward for having an altcoin market. Ethereum stays the most typical chain for brand spanking new initiatives, together with the still-ongoing VC-backed and ICO launches. Nevertheless, a weakening demand from customers places a query on whether or not the market will be capable to take in these tokens.

Site visitors shifts to Phantom and the Solana ecosystem

After visitors shifted to the Solana ecosystem, all associated apps are getting forward of Ethereum when it comes to charges. Briefly, Phantom pockets went forward of Ethereum when it comes to 24-hour charges. On a typical day, the pockets brings in over $469K, with as much as $30.54M on a month-to-month foundation. Phantom’s exercise rallied simply after the announcement of including wider multi-chain and multi-currency assist. As Solana and meme token utilization turned international, Phantom now displays asset costs in 16 world currencies.

Solana’s primary ecosystem apps, Jito, Raydium, Pump.enjoyable and Meteora are nonetheless among the many prime 10 charge producers. The chain exhibits a shift in customers, as small-scale merchants choose Solana as a high-risk, high-return venue.

Ethereum, nonetheless, just isn’t totally misplaced. The chain nonetheless carries high-scale DeFi exercise, whereas holding sufficient liquidity to fulfill whale-sized trades and transactions.

Tether and Circle stay the 2 busiest charge producers, as stablecoins are nonetheless Ethereum’s primary use case. Extra USDT has flowed again to Ethereum because of its increased liquidity and entry to centralized exchanges. Ethena (ENA) can be the second-biggest producer of charges up to now 24 hours, after market volatility examined the resilience of USDe and sUSDe.

The present Ethereum exercise displays the current market capitulation of ETH. Open curiosity crashed up to now week, from $16B all the way down to $11B after a sequence of liquidations. ETH traded at $2,736.96, with unfavourable funding charges on Kraken and Deribit. Regardless of the current liquidation, almost 70% of positions are nonetheless longing ETH.

Cryptopolitan Academy: The best way to Write a Web3 Resume That Lands Interviews – FREE Cheat Sheet