As soon as once more, the value of Ethereum (ETH) has risen above $3,900. This bounce has hinted at an extra value enhance for the altcoin earlier than the tip of the yr.

However does this imply the cryptocurrency can surpass its earlier all-time excessive inside this quick interval? This on-chain evaluation reveals whether or not that’s doable.

Ethereum Loses Bullish Dominance in Two Main Zones

Ethereum at the moment trades round $3,939, which signifies that the altcoin’s value has elevated by 67.30% in 2024. One indicator that performed a key position in ETH’s rally throughout the yr is its Open Curiosity (OI).

The OI refers back to the worth of the sum of all open contracts out there. When it will increase, it signifies that extra liquidity has flowed into contracts associated to a cryptocurrency. Within the derivatives market, this means rising shopping for strain, which might result in increased costs.

On the flip facet, a lower within the OI signifies promoting strain. The decline means that merchants are more and more closing their positions and withdrawing liquidity from the market.

In keeping with Santiment, Ethereum’s OI climbed to $14.50 billion yesterday, December 15. Nonetheless, as of this writing, it has decreased to $13.94 billion, indicating that publicity to ETH has decreased. Given the circumstances above, this decline means that Ethereum Value dangers one other decline if the OI sustains this place.

Ethereum Open Curiosity. Supply: Santiment

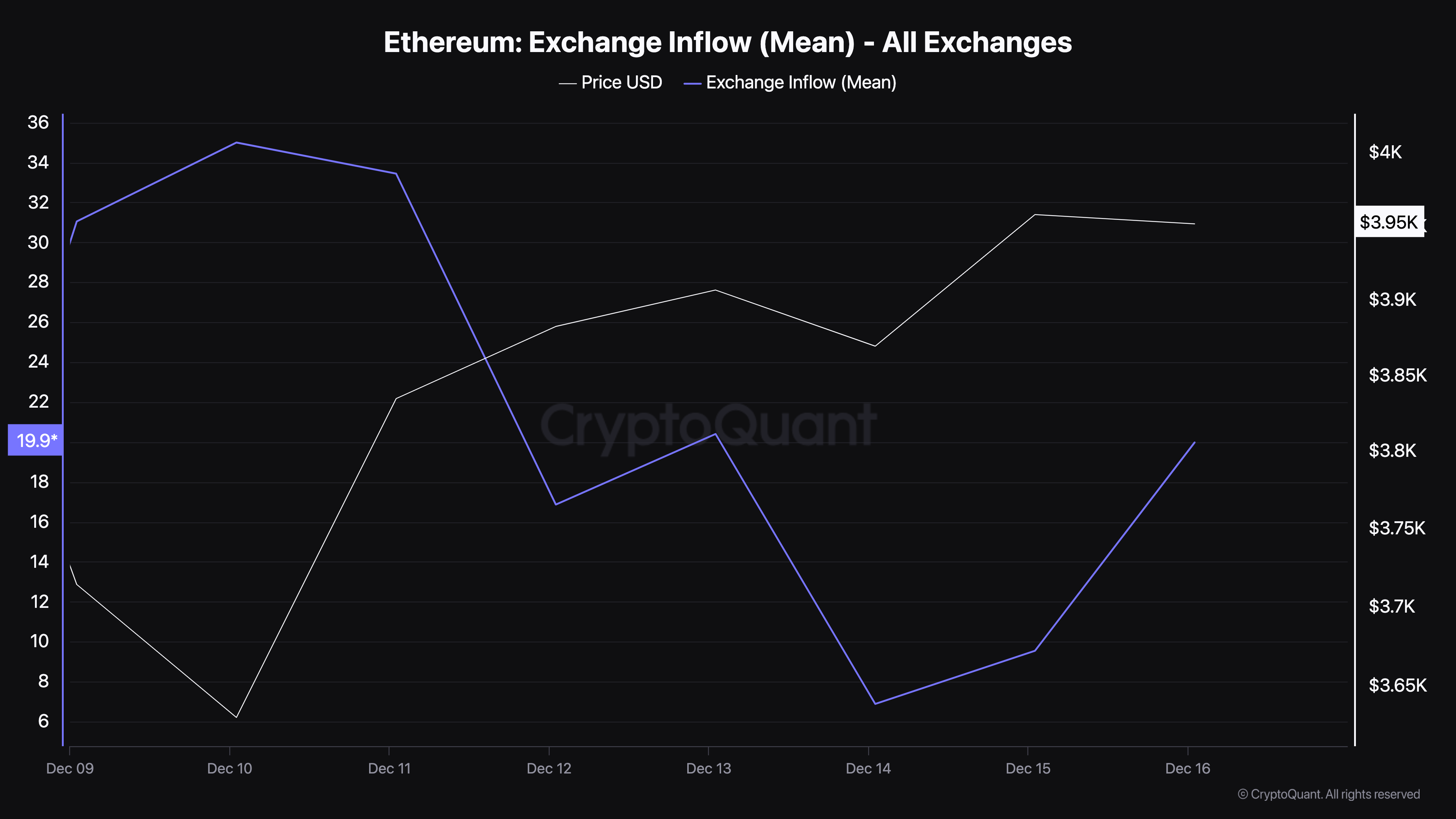

One other indicator that helps this bias is the Ethereum trade influx. Alternate influx is the imply quantity of cash per transaction despatched to exchanges. A excessive worth means that buyers are transferring bigger quantities, signaling elevated promoting strain, which might probably drive costs decrease.

A low trade influx within the metric, nevertheless, suggests a decline in promoting strain. In keeping with CryptoQuant, the trade influx has climbed from what it was on December 14, indicating that promoting strain round ETH has elevated.

If sustained, this might hinder the cryptocurrency from rising towards $4,500 or hitting a brand new all-time excessive earlier than 2024 closes.

Ethereum Alternate Influx. Supply: CryptoQuant

ETH Value Prediction: Now $4,500 But

In keeping with the day by day chart, the Parabolic Cease-and-Reverse (SAR) indicator has risen above ETH’s value. The SAR is a technical indicator that reveals whether or not a cryptocurrency has encountered resistance or stable assist.

When the dotted strains are beneath the value, it signifies vital assist that would drive costs increased. Nonetheless, at the moment, the dotted strains are above Ethereum’s value. Due to this fact, the cryptocurrency is dealing with resistance.

So long as ETH trades beneath the indicator, the value is more likely to fall, with doable targets round $3,315. If that’s the case, then Ethereum’s value may not hit a brand new all-time excessive earlier than the yr ends.

Ethereum Day by day Evaluation. Supply: TradingView

Nonetheless, if Open Curiosity will increase and trade influx drops to an especially low level, the forecast may be invalidated.