Ethereum (ETH) worth has struggled to maintain tempo with different main cryptocurrencies this cycle. Whereas ETH is up 32% year-to-date, its efficiency lags considerably behind Bitcoin’s 112% and Solana’s 115% positive aspects. Among the many high 10 cash, Ethereum has seen the least progress, outperforming solely Avalanche.

This lackluster efficiency highlights rising uncertainty round ETH, as key metrics like whale exercise and internet trade flows counsel traders are cautious about betting on Ethereum.

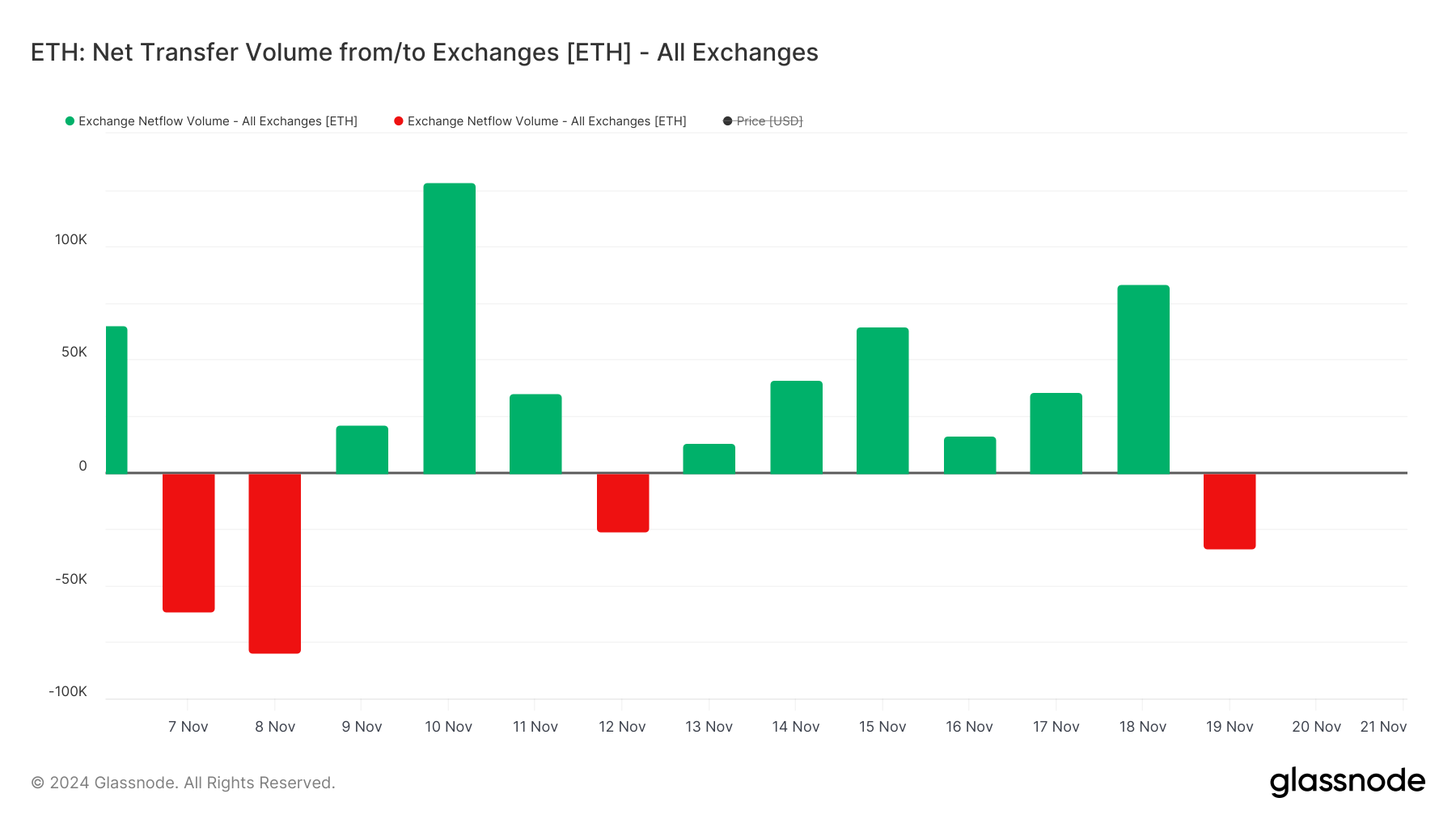

ETH Web Switch Quantity Was Optimistic for six Consecutive Days

Ethereum’s Web Move From/To Exchanges has proven notable fluctuations in current weeks. Between November 13 and November 18, the online movement was constantly constructive, peaking at 83,500 on November 18.

Earlier within the month, it hit its highest worth in two weeks, reaching 128,000 on November 10. Nevertheless, on November 19, the pattern reversed, with the movement turning unfavourable at -33,400.

ETH Web Switch Quantity from/to Exchanges. Supply: Glassnode

A excessive quantity of ETH being despatched to exchanges typically signifies a bearish sentiment, as customers could also be getting ready to promote. Conversely, ETH being withdrawn from exchanges can sign a bullish outlook, as holders sometimes retailer belongings in non-public wallets with long-term intentions.

Regardless of the online outflow on November 19, it adopted six consecutive days of constructive flows. This means that whereas the current withdrawal is a promising signal, sustained unfavourable flows are essential for the sign to show decisively bullish for ETH worth trajectory.

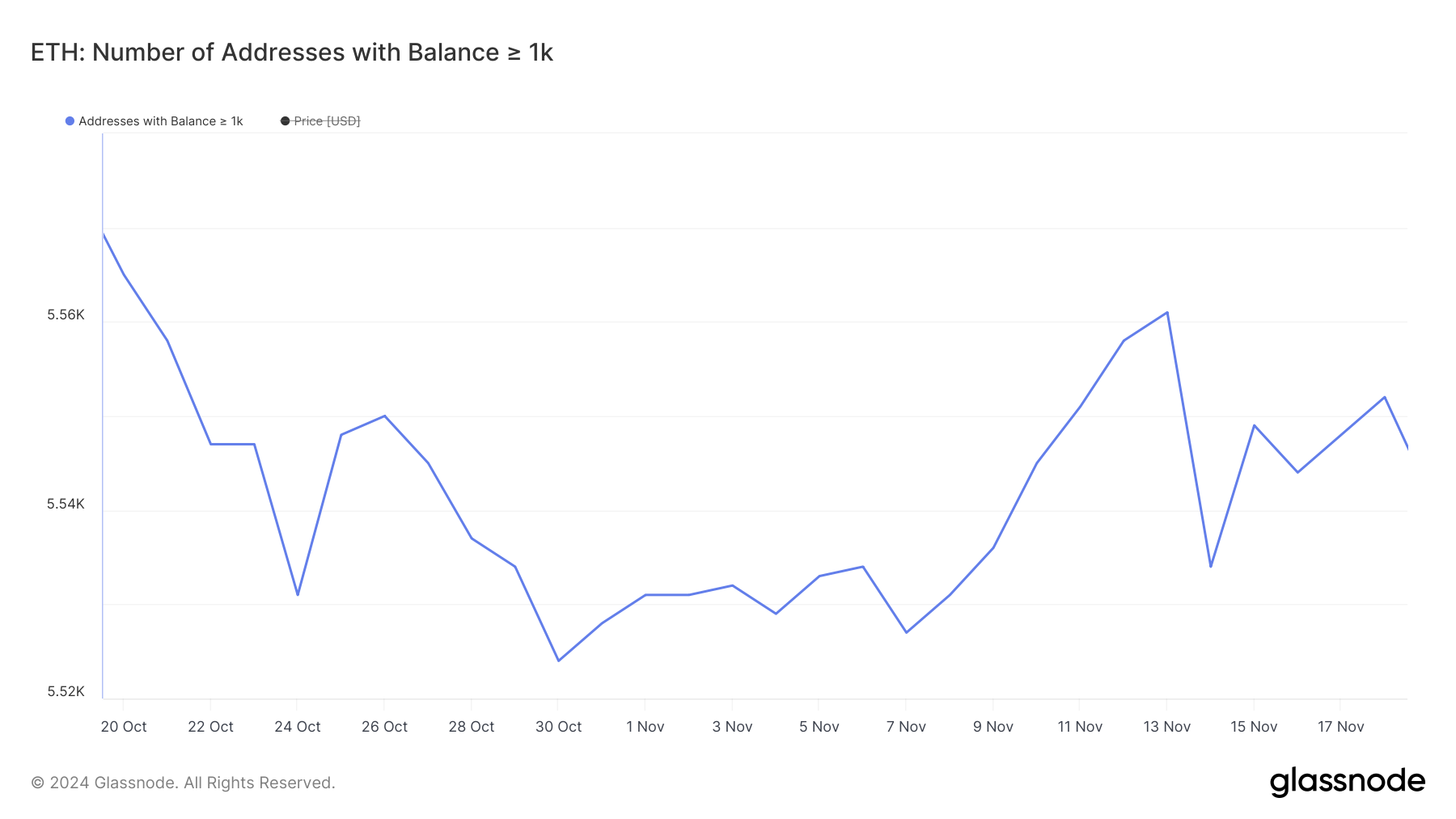

Ethereum Whales Seem To Be Hesitant

The variety of Ethereum whales holding not less than 1,000 ETH surged considerably between November 7 and November 13, growing from 5,527 to five,561. This marked a robust interval of accumulation by massive holders, suggesting heightened curiosity throughout that timeframe.

Addresses with Stability >= 1,000 ETH. Supply: Glassnode

Nevertheless, the quantity dropped sharply on November 14 to five,534 and has struggled to get well since then. Presently sitting at 5,542, the metric’s ups and downs point out lingering uncertainty amongst whales. Their hesitance means that they’re uncertain of ETH worth potential for sustained surges within the close to time period.

ETH Worth Prediction: A Correction or a 15% Upside?

Ethereum’s short-term EMA strains stay above the long-term ones, however the hole between them is narrowing. If the short-term line crosses under the long-term line, it might type a dying cross, a bearish sign that would point out a stronger downtrend forward.

ETH Worth Evaluation. Supply: TradingView

If Ethereum enters a downtrend, it could check its nearest assist at $2,990. A break under this degree may result in additional declines, with the value doubtlessly falling to $2,570.

However, renewed confidence from whales may push ETH worth larger. On this situation, the value would possibly first check resistance at $3,219 after which climb to $3,448, providing a possible upside of round 15%.