Ethereum (ETH) has skilled a modest 1% value improve over the previous 24 hours, reflecting the broader cryptocurrency market’s uptrend. This rebound comes after a week-long decline, largely attributed to political tensions within the Center East.

Though the rally provides short-term reduction for ETH holders, BeInCrypto’s evaluation signifies it could be short-lived. Weak on-chain demand and a persistent bearish sentiment surrounding the altcoin recommend that the restoration may wrestle to keep up momentum.

Ethereum Witnesses Poor Demand

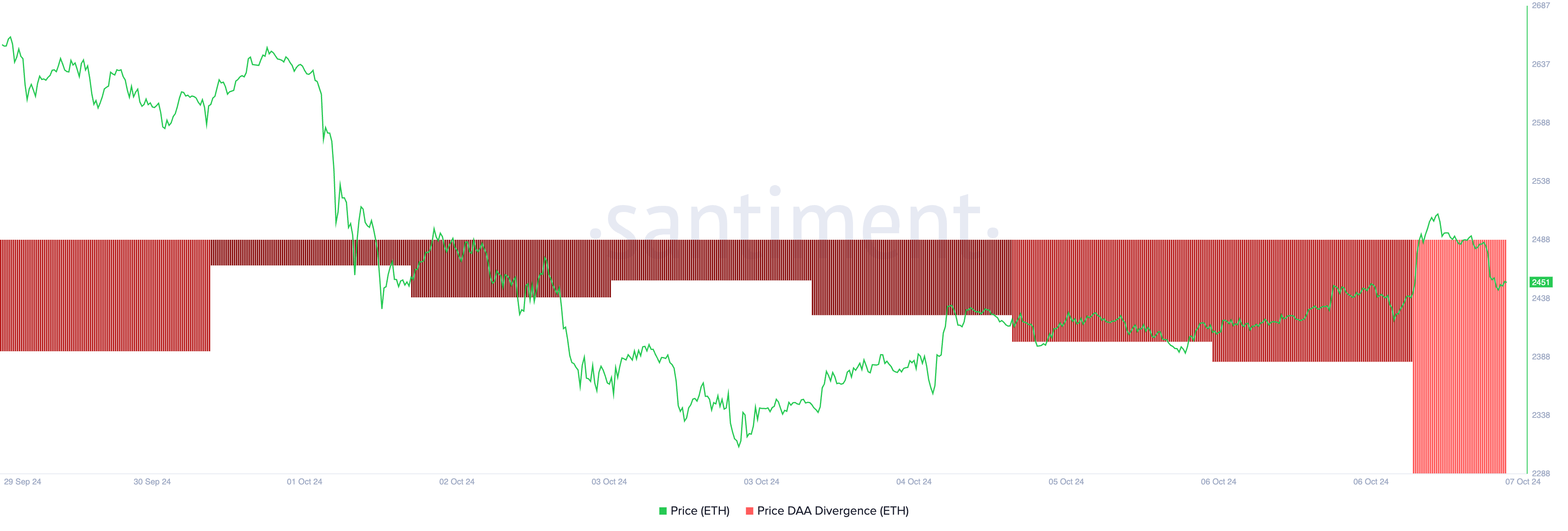

The unfavorable readings from ETH’s value every day lively tackle (DAA) divergence replicate the poor demand for the altcoin amongst market members. This metric, which measures an asset’s value actions with the modifications in its variety of every day lively addresses, is at -70.34% at press time.

For context, DAA have remained unfavorable regardless of its value rally since final weekend. Traditionally, when an asset’s value rises whereas lively addresses lower, it’s thought of a promote sign. This implies the rally is pushed by hypothesis reasonably than actual demand, implying that the worth surge could also be short-lived.

Learn extra: Easy methods to Spend money on Ethereum ETFs?

Moreover, Ethereum’s Parabolic Cease and Reverse (SAR) indicator, which helps establish pattern path and potential reversal factors, reinforces the bearish outlook. Presently, the indicator’s dots are positioned above ETH’s value.

When the Parabolic SAR dots seem above an asset’s value, it alerts downward strain and means that the pattern is probably going bearish. Merchants sometimes view this as an indicator to carry or think about initiating brief positions, anticipating additional value declines.

Ethereum Parabolic SAR. Supply: TradingView

ETH Worth Prediction: August 5 Low on the Horizon

The Parabolic SAR dots above the worth can act as a type of dynamic resistance. If the worth tries to rise, it’d face promoting strain close to these dots, reinforcing the bearish pattern.

These dots presently relaxation at $2620, suggesting that ETH will face a surge in promoting strain as soon as it approaches this stage. If promoting strain strengthens, Ethereum’s value dangers falling 14% to its August 5 low of $2,116.

Learn extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Ethereum Worth Evaluation. Supply: TradingView

Nevertheless, if it witnesses a resurgence in demand, ETH might break above the resistance fashioned on the $2,700 value stage and goal $3,338.