Ethereum is at the moment buying and selling round $2,989, after a risky push larger earlier this week that briefly tapped the $3,082 mark. Whereas worth motion has proven indicators of consolidation just under the psychological $3,000 stage, technical and on-chain knowledge recommend bulls stay in management for now. The broader rally is supported by rising institutional accumulation, together with Bit Digital’s $67.3 million ETH treasury growth.

Ethereum Value Forecast Desk: July 16 2025

What’s Occurring With Ethereum’s Value?

ETH worth dynamics (Supply: TradingView)

On the day by day timeframe, Ethereum worth continues to carry above a long-standing ascending trendline stretching from the April swing low close to $1,900. A breakout above the $2,800 resistance zone has now flipped that space into key structural help.

ETH worth dynamics (Supply: TradingView)

Candles are consolidating just under $3,000, with the subsequent fast resistance seen close to $3,120 and the weekly 0.618 Fibonacci zone at $3,256.

The Parabolic SAR stays beneath worth, indicating continued bullish pattern strain, whereas Ethereum trades effectively above the Bull Market Help Band, at the moment between $2,202 and $2,459. The BBP oscillator additionally stays optimistic on the day by day timeframe, signaling purchaser dominance.

Why Ethereum Value Going Up Right now?

The surge in Ethereum worth right this moment is partly fueled by renewed institutional curiosity. Bit Digital introduced a $67.3 million direct share providing to broaden its ETH treasury, having already transformed its whole Bitcoin holdings to Ether. The agency at the moment holds over 100,600 ETH valued round $301 million. This aggressive accumulation coincides with a broader uptick in crypto markets, the place Ethereum has gained 18% over the previous week.

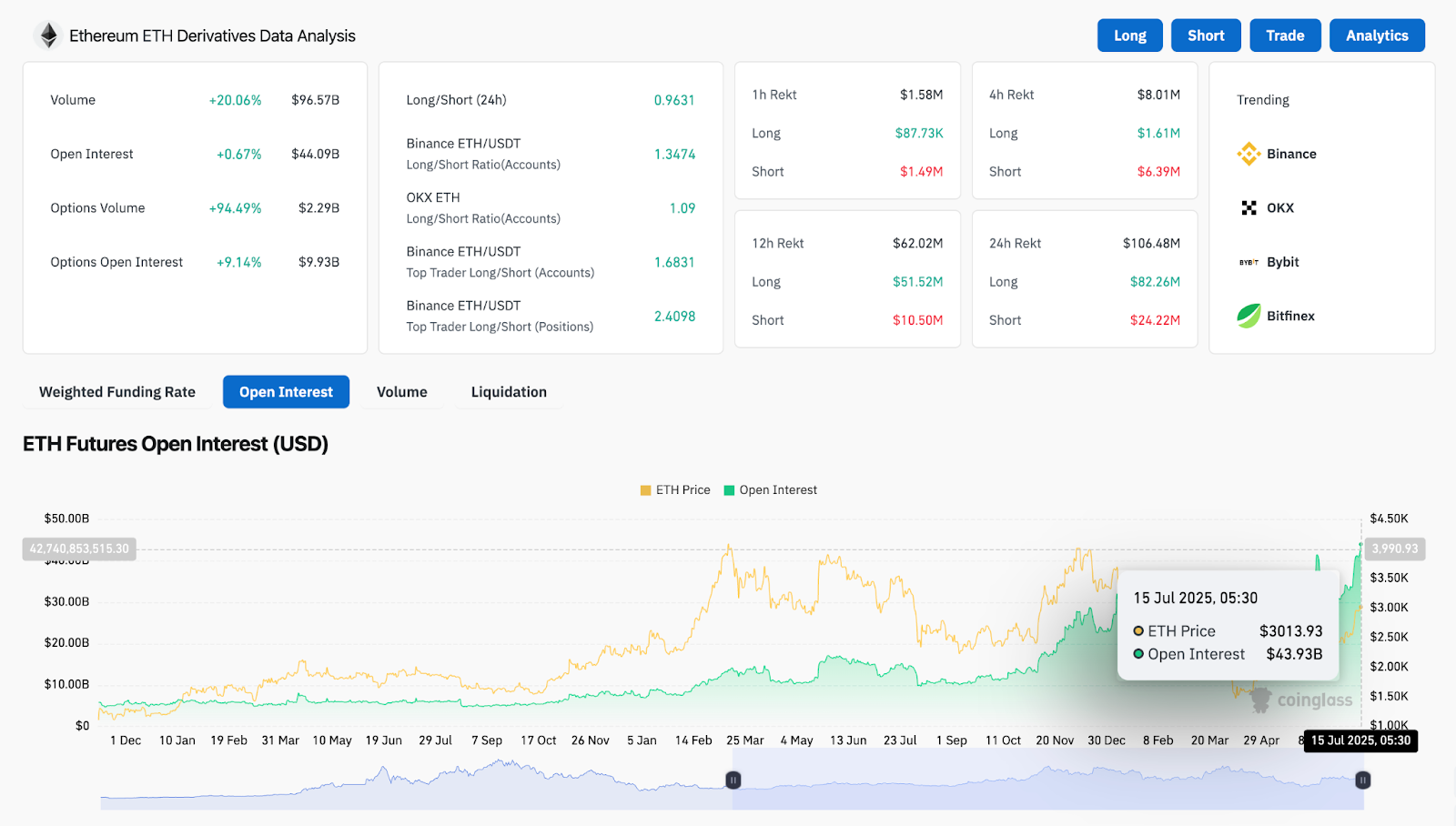

ETH Spinoff Evaluation (Supply: Coinglass)

On-chain derivatives knowledge from Coinglass confirms this bullish momentum. Open curiosity rose to $44.09 billion, whereas choices quantity spiked 94.5% to $2.29 billion. The Binance ETH/USDT lengthy/brief ratio amongst prime merchants is over 2.4, reflecting dominant lengthy positioning. Moreover, whole liquidations over 24 hours hit $106.4 million, with $82 million in shorts worn out, reinforcing bullish dominance.

Bollinger Bands And MACD Counsel Quick-Time period Volatility Forward

On the 4-hour chart, Ethereum worth motion exhibits the asset pulling again barely from its current native excessive at $3,082. Bollinger Bands have began to broaden following a squeeze breakout close to $2,750, indicating that contemporary volatility is coming into the market. Value at the moment hovers close to the mid-band and should check the $2,933 help earlier than making an attempt one other transfer larger.

ETH worth dynamics (Supply: TradingView)

The 30-minute RSI bounced from oversold territory and now sits at 50.1, reflecting a impartial stance after recovering from 38. MACD on the identical timeframe is exhibiting indicators of a possible bullish crossover, though momentum stays tender for now. A confirmed crossover and a transfer above the $3,050 resistance could be wanted to set off the subsequent leg towards $3,256.

Ethereum Value Prediction: Quick-Time period Outlook (24H)

ETH worth dynamics (Supply: TradingView)

Quick-term construction means that Ethereum worth could retest the $2,933–$2,960 help zone earlier than making an attempt one other breakout towards $3,100. A transfer above $3,050 with quantity affirmation would open up a path towards the 0.618 Fib stage at $3,256. On the flip facet, if bulls lose the $2,930 deal with, Ethereum may slide again towards $2,800, the place the earlier breakout zone and ascending trendline intersect.

Given the help from each derivatives and on-chain metrics, upside momentum stays intact. Nonetheless, merchants ought to monitor $3,050 carefully as a pivotal breakout threshold.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t chargeable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.