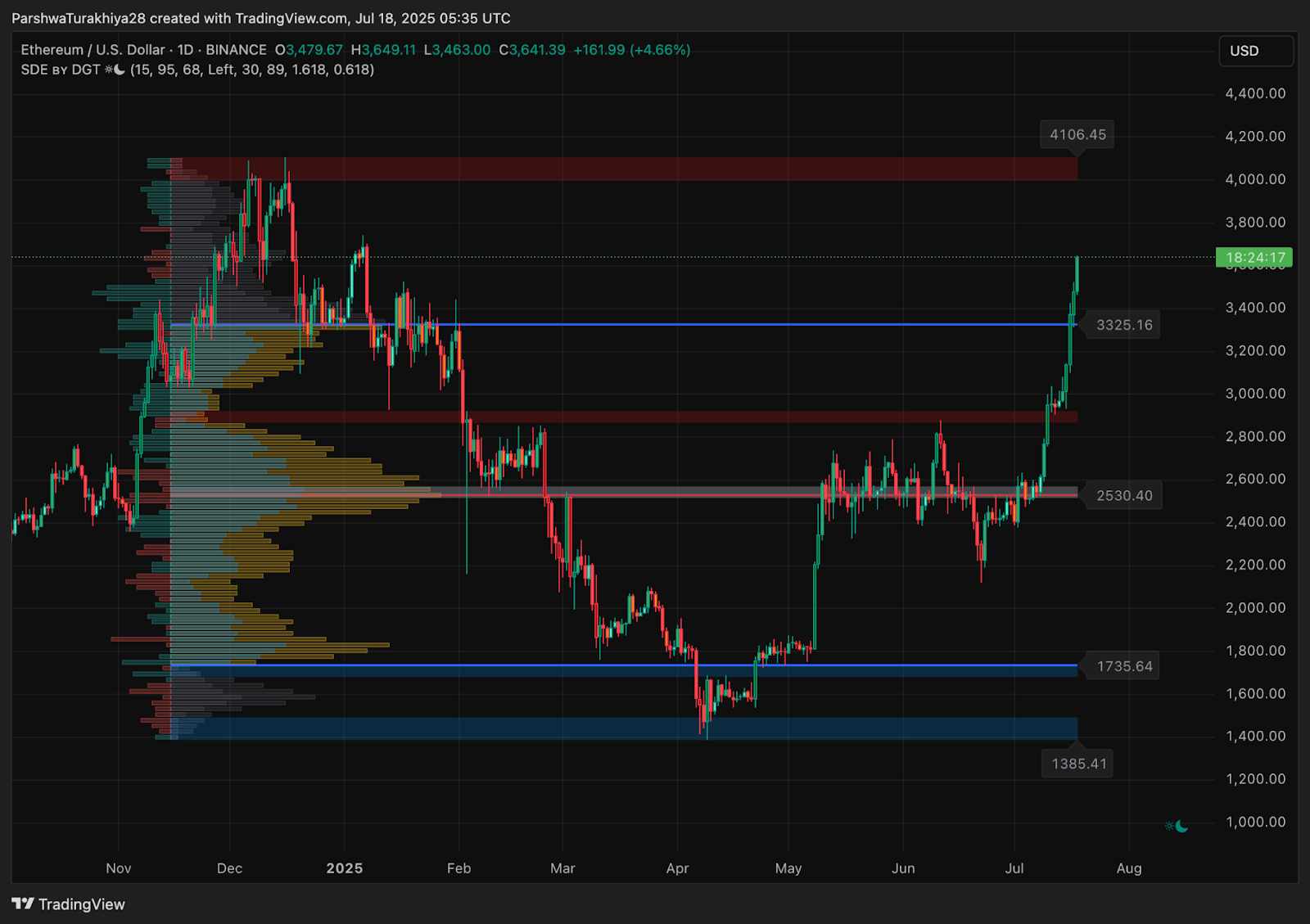

After reclaiming the $3,325 provide zone earlier this week, Ethereum worth has launched right into a vertical rally, rising greater than 20 % in simply three classes. Ethereum worth immediately is buying and selling round $3,655, its highest degree since early 2024. The transfer is pushed by a confirmed breakout from a long-term triangle construction. Bullish continuation now hinges on ETH holding above key former resistance ranges.

What’s Occurring With Ethereum’s Worth?

ETH worth dynamics (Supply: TradingView)

The weekly chart exhibits that Ethereum worth has surged previous the 0.618 Fibonacci retracement degree at $3,067 and is now approaching the 0.786 degree close to $3,524. This rally is unfolding simply after ETH confirmed a breakout from the multi-year symmetrical triangle seen on the month-to-month chart. That construction has capped ETH since 2022, and the breakout candle now displays a long-awaited shift in macro pattern.

ETH worth dynamics (Supply: TradingView)

On the every day timeframe, ETH reduce by means of main ranges together with $2,530 and $3,325 with sturdy momentum. The quantity profile highlights a low-liquidity pocket between $3,500 and $3,700, growing the probabilities that worth continues climbing towards the $4,100 zone. Quantity growth has supported the transfer, and no important provide zones have been encountered but.

Why Is The Ethereum Worth Going Up At this time?

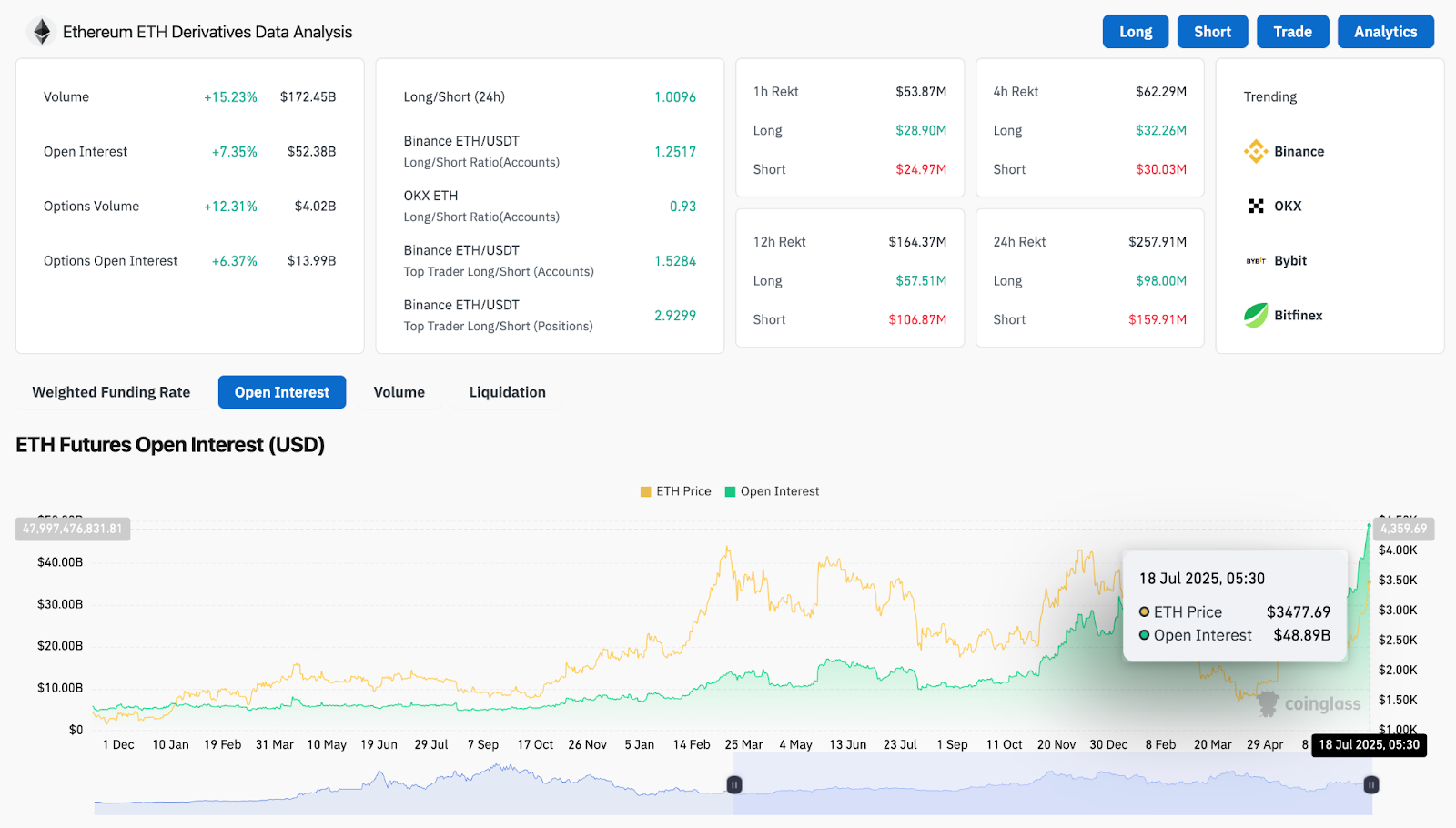

The highly effective rally in Ethereum worth immediately is supported by sturdy derivatives circulation and market participation. As per Coinglass, ETH open curiosity is up 7.35 % at $52.38 billion whereas quantity has jumped 15.23 % to $172.45 billion. The Binance long-short ratio stands at 2.92 for prime merchants, indicating a heavy desire towards lengthy positions.

ETH worth dynamics (Supply: TradingView)

Technically, Ethereum worth motion on the 4-hour chart is supported by a bullish EMA alignment. The 20 EMA at $3,323 and the 50 EMA at $3,103 are actually effectively under the present worth. The MACD stays constructive and the RSI, whereas overbought, continues to point out no bearish divergence. Parabolic SAR dots have flipped under worth on the every day timeframe, confirming bullish pattern management.

ETH had earlier consolidated close to $2,900 and fashioned a strong base earlier than breaking out. That consolidation zone now acts as the primary structural assist if a pullback happens.

ETH Worth Indicators Volatility Growth Above $3,600

Bollinger Bands on the 4-hour timeframe are widening considerably, suggesting the rally is coming into a high-volatility growth part. Ethereum worth is hugging the higher band, which is a typical attribute of trending strikes. Regardless of overbought RSI readings, the dearth of reversal indicators means bulls stay in full management for now.

ETH worth dynamics (Supply: TradingView)

The every day worth construction exhibits ETH holding firmly above $3,600. The $3,325 degree now acts because the closest assist, whereas $4,100 stands as the following main resistance. This space additionally coincides with the complete Fibonacci retracement from the 2024 excessive, making it a key degree to look at.

VWAP readings point out that worth is buying and selling comfortably above the typical session degree, and there’s no instant weak point on decrease timeframes.

Ethereum Worth Prediction: Brief-Time period Outlook (24H)

ETH worth dynamics (Supply: TradingView)

So long as Ethereum worth immediately holds above $3,325, short-term bullish management stays intact. A profitable retest of the $3,525 to $3,600 zone might propel ETH towards $3,850 and finally $4,106. That space marks the complete Fibonacci retracement and likewise aligns with heavy historic resistance.

If bulls fail to defend $3,325, the worth might slide again towards the $3,103 EMA area or the broader $2,900 consolidation base. Nonetheless, with open curiosity rising, pattern construction flipped bullish, and spinoff knowledge displaying sturdy lengthy curiosity, the bias stays in favor of continuation towards $4,000 within the coming classes.

Ethereum Worth Forecast Desk: July 19, 2025

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be accountable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.