Ethereum worth continues to consolidate in a good zone beneath the multi-month resistance band close to $2,562. After weeks of coiling motion, Ethereum worth right this moment is holding agency above the 0.382 Fib retracement from the 2024–2025 decline, with merchants anticipating a decisive breakout.

What’s Occurring With Ethereum’s Value?

ETH worth dynamics (Supply: TradingView)

On the weekly chart, ETH stays locked inside a macro symmetrical triangle stretching again to 2022, with present worth motion approaching the apex. The month-to-month construction exhibits sturdy horizontal resistance close to $2,862 and $3,465, whereas assist stays agency above $2,128 and $1,707.

ETH worth dynamics (Supply: TradingView)

Current worth motion displays a tightening construction between $2,500 and $2,560, with a number of every day closes holding above the weekly 0.382 Fibonacci stage ($2,424.85).

On the 1D chart, Ethereum is buying and selling just below the descending resistance line from April, with rising assist from late Could persevering with to converge. This consolidation suggests a breakout is imminent — both towards $2,745 or again towards the $2,400 zone.

ETH worth dynamics (Supply: TradingView)

On the 4-hour chart, Ethereum is supported by a bullish EMA cluster. The 20/50/100/200 EMAs between $2,503 and $2,544 have shaped a powerful dynamic ground, reinforcing the compression zone. Bollinger Bands are additionally beginning to contract, which generally precedes a big directional transfer.

Why Is The Ethereum Value Going Up As we speak?

ETH worth dynamics (Supply: TradingView)

Why Ethereum worth going up right this moment could be linked to momentum build-up and minor bullish divergences seen throughout a number of indicators. On the 30-minute chart, Ethereum worth motion printed larger lows whereas RSI moved from impartial to barely bullish territory at 54.9.

ETH worth dynamics (Supply: TradingView)

The MACD is printing a bullish crossover with rising histogram bars on short-term timeframes, suggesting rising momentum behind this present uptick. On the 4-hour chart, Parabolic SAR dots have flipped under the worth, reinforcing short-term upside bias. This lack of volatility is mirrored within the Chande Momentum Oscillator, which stays flat close to -17.1, suggesting a possible spring-loaded transfer as soon as compression ends.

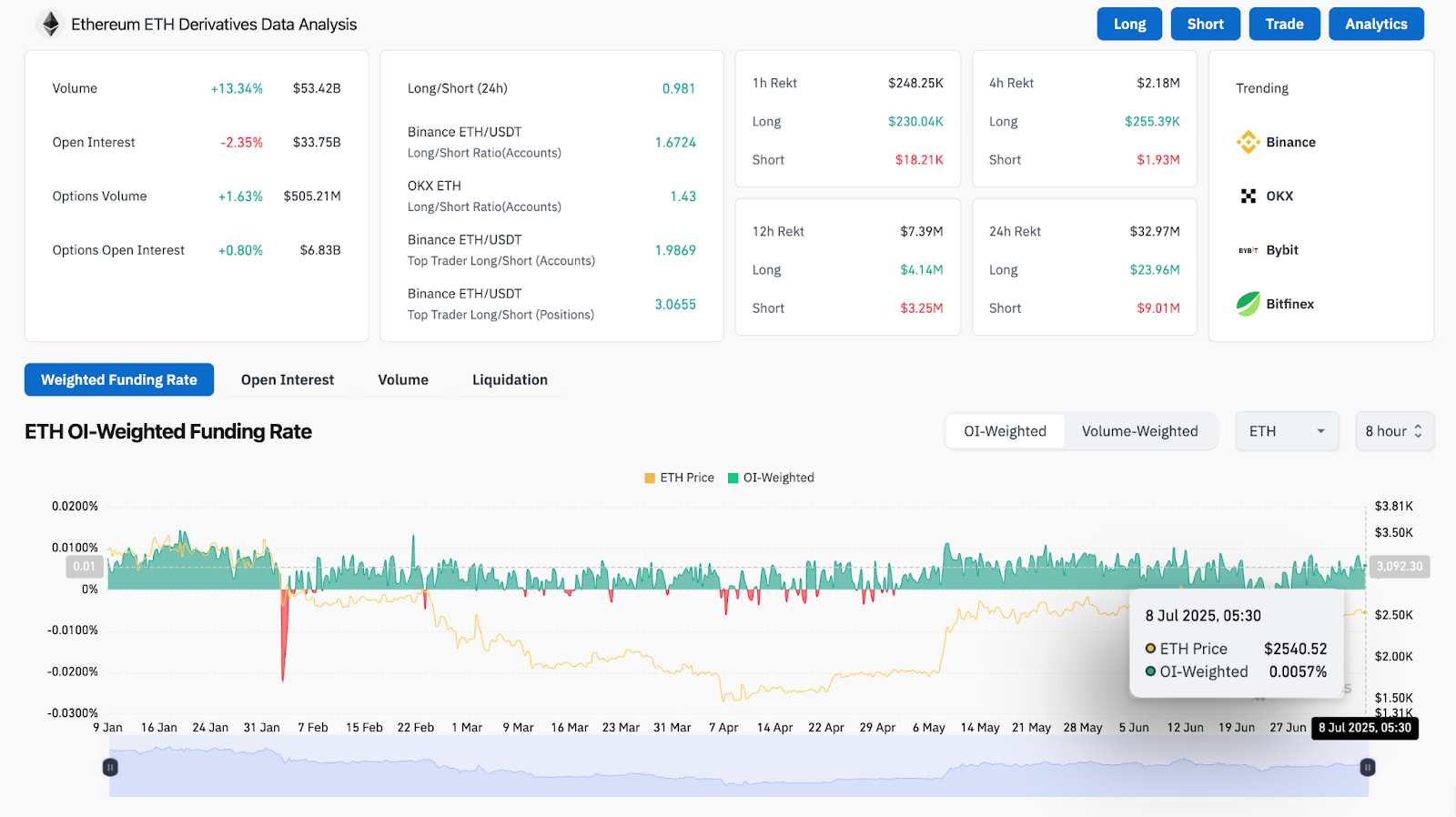

ETH Spinoff Evaluation (Supply: Coinglass)

From a broader positioning standpoint, Coinglass derivatives knowledge exhibits ETH quantity is up 13.3% to $53.4B. Nonetheless, open curiosity is barely down by 2.35%, suggesting latest worth motion is being pushed extra by spot momentum than leverage. Apparently, prime dealer lengthy/brief ratios on Binance stay extraordinarily skewed towards longs (3.06:1), exhibiting sturdy conviction amongst whales and establishments.

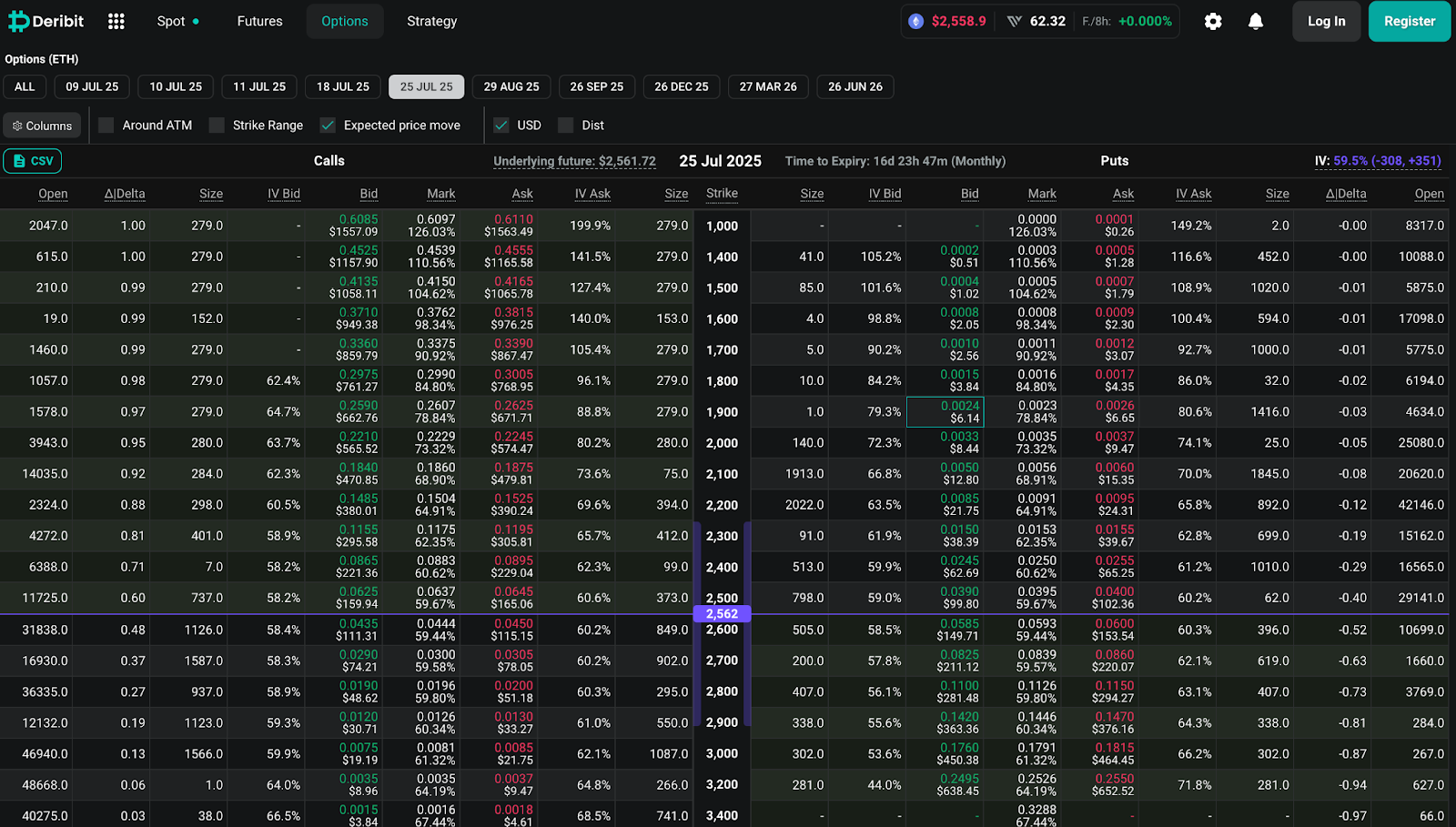

ETH Choice Chain Knowledge (Supply: Deribit)

Choices knowledge additionally displays sturdy assist on the $2,500–$2,520 vary, whereas name exercise across the $2,600–$2,700 strikes suggests merchants are positioning for a breakout towards $2,745.

ETH Indicators Present Bullish Construction With Waning Volatility

The 4-hour Bollinger Bands present a transparent squeeze formation as worth trades inside a slim vary close to the mid-band ($2,540).

ETH worth dynamics (Supply: TradingView)

In the meantime, the Supertrend on the every day chart stays bullish above $2,420, however worth should break $2,660 to flip the development on the next timeframe. The Directional Motion Index (DMI) exhibits ADX flattening however +DI stays barely dominant, sustaining short-term bullish management.

Ethereum can be buying and selling simply above session VWAP and is beginning to reclaim short-term management, reinforcing intraday power. Nonetheless, merchants ought to look ahead to affirmation through a every day shut above $2,562.

Ethereum Value Prediction: Quick-Time period Outlook (24H)

As Ethereum worth right this moment holds above the $2,540 assist area, the market is coiling in a symmetrical triangle that’s nearing decision. A confirmed breakout above $2,562 might open the door towards the $2,745 Fibonacci stage, adopted by the macro resistance zone close to $2,862.

If the breakout fails and worth falls under the $2,500–$2,480 assist zone, bears could retest the $2,424.85 Fib stage and even $2,300, the place earlier demand zones stay untested.

Given tightening volatility, a powerful MACD setup, bullish EMA alignment, and derivatives bias, Ethereum seems poised for a decisive breakout throughout the subsequent 24–48 hours — with route depending on quantity and breakout power.

Ethereum Value Forecast Desk: July 9, 2025

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be accountable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.