Ethereum worth right this moment is buying and selling close to $4,605, consolidating just under the $4,638–$4,665 resistance zone. Consumers have defended the $4,520–$4,547 space, the place short-term EMAs are stacked, protecting worth motion constructive. The important thing query is whether or not ETH can prolong increased towards $4,700, or if sellers cap the transfer and drive one other retest of the $4,476–$4,370 help band.

Ethereum Value Holds Rising Trendline

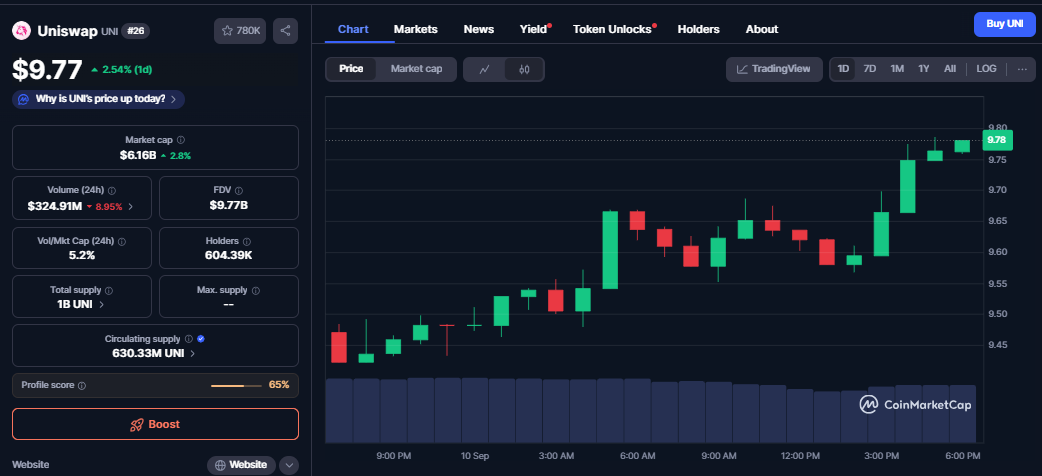

ETH Key Technical Ranges (Supply: TradingView)

The 4-hour chart reveals ETH respecting its ascending trendline, with increased lows constructing since early September. The Supertrend indicator has flipped bullish, now resting round $4,639, aligning with instant resistance. A breakout above this degree would expose $4,700 and probably $4,820, whereas failure to clear it dangers a pullback towards the $4,476 and $4,370 zones.

Momentum stays balanced. The RSI sits close to mid-50s, avoiding overbought extremes whereas sustaining upward bias. The 100-EMA and 200-EMA present deeper trendline cushions close to $4,493 and $4,370, reinforcing ETH’s broader bullish construction so long as these ranges maintain.

Alternate Flows Spotlight Accumulation

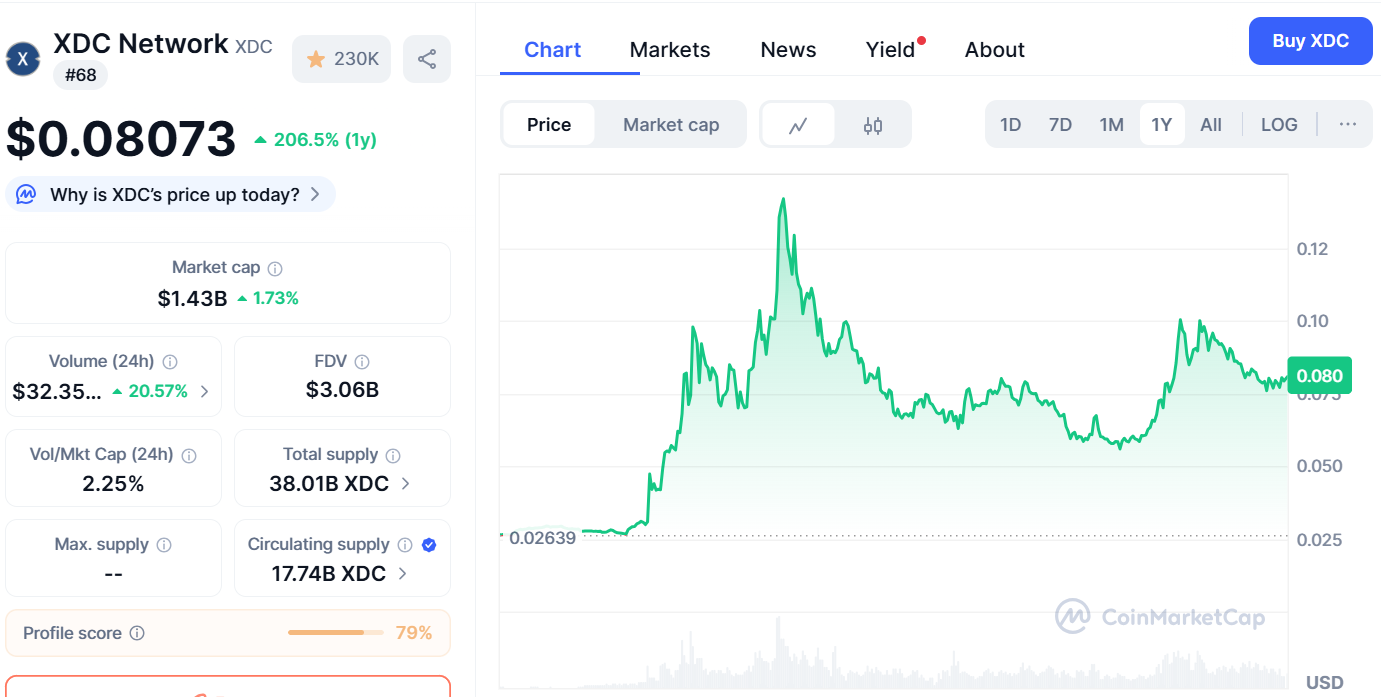

ETH On-Chain Accumulation (Supply: Coinglass)

On-chain knowledge helps the bullish undertone. Spot netflows present constant outflows, with $77.6 million withdrawn from exchanges on September 18. This development reduces obtainable provide and sometimes indicators investor choice for holding ETH off-exchange, a sample that has traditionally preceded bullish worth extensions.

Regardless of occasional spikes of inflows, the dominant circulate construction since August has been unfavourable, offering a gentle supply-side constraint. Analysts argue that sustained outflows of this magnitude can create the inspiration for a push past resistance ranges.

Stablecoin Development Strengthens Ethereum’s Function

Stablecoins on Ethereum L1 + L2s have now crossed $171B in circulation ATH

– Ethereum mainnet alone holds $152.8B (+78% YoY). It stays the undisputed hub of stablecoin liquidity.

– L2s mixed account for $18B+, with Arbitrum ($8.8B) and Base ($3.9B) main the cost.

-… pic.twitter.com/5KrzQa5A3F— Francesco Andreoli ᵍᵐ (@francescoswiss) September 17, 2025

Fundamentals add additional weight to Ethereum’s bullish case. Knowledge reveals stablecoins on Ethereum mainnet and Layer 2s have surpassed $171 billion in circulation, with the mainnet alone holding $152.8 billion. This represents a 78% year-on-year improve, underscoring Ethereum’s standing because the dominant hub for stablecoin liquidity.

Development is accelerating throughout scaling networks. Arbitrum accounts for $8.8 billion, whereas Base holds $3.9 billion. Rising L2s like Mantle and Linea have additionally posted triple-digit development. The dimensions of liquidity targeting Ethereum not solely strengthens its ecosystem but additionally bolsters confidence in ETH as collateral and settlement asset throughout DeFi markets.

Technical Outlook For Ethereum Value

Key ranges for Ethereum within the brief time period:

- Upside targets: $4,638, $4,700, and $4,820 if bullish momentum continues.

- Draw back helps: $4,547, $4,476, and $4,370 as near-term protection zones.

- Pattern help: $4,200 because the broader structural flooring if promoting stress accelerates.

Outlook: Will Ethereum Go Up?

Ethereum’s instant path rests on whether or not consumers can pierce the $4,638–$4,665 ceiling. On-chain outflows, mixed with document stablecoin liquidity anchored to Ethereum, recommend a powerful elementary backdrop.

Analysts stay cautiously optimistic so long as ETH holds above $4,500. Whereas a drop beneath $4,476 would delay the bullish thesis and permit for deeper consolidation close to $4,370, a breakout above $4,665 may speed up the rally towards $4,820 and probably $5,000. For now, Ethereum worth continues to lean bullish inside its broader ascending cycle.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be answerable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.