Key Insights:

- ETH inflows to Binance hit the very best stage in 14 months, Ethereum value may be impacted.

- Revenue-taking returns as SOPR enters warning zone.

- Worth sits at key determination level close to $2,440–$2,520.

Ethereum (ETH) is struggling to remain above $2,500. Whereas there hasn’t been a significant correction but, stress is constructing. On-chain information reveals a number of indicators that promoting might return quickly. If ETH fails to reclaim greater ranges, the draw back could come quicker than anticipated.

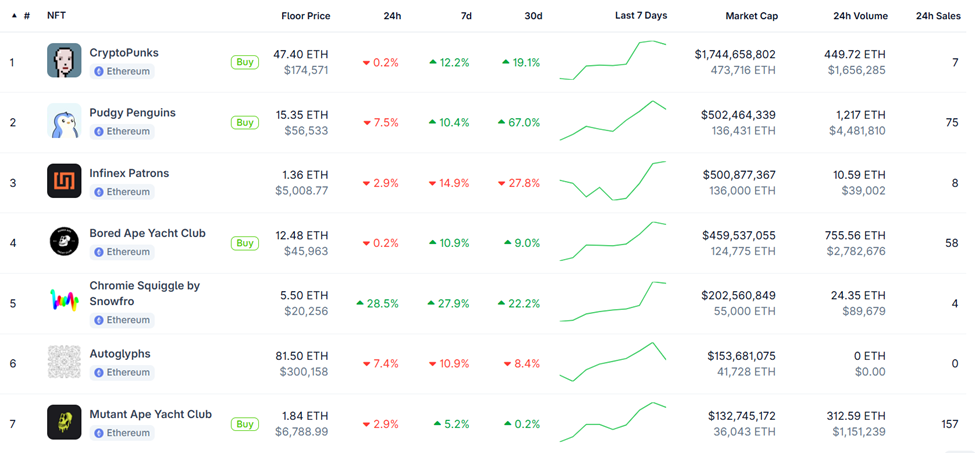

Inflows Are Excessive, Sadly

Ethereum change reserves on Binance simply jumped to 4.9 million ETH. That’s probably the most since Might 2023.

This rise means giant wallets are shifting cash to exchanges. That usually indicators they’re able to promote.

Binance inflows- Supply: CryptoQuant

The ETH value hasn’t reacted sharply but, however this similar sample has appeared earlier than previous dips. ETH additionally hasn’t cleared $2,600, a key resistance zone.

If these reserves proceed to rise, it might sign a bigger correction, within the type of a sell-off.

Trade reserves measure how a lot ETH sits on buying and selling platforms. A rising determine usually suggests upcoming promote stress. Generally, individuals attempt to promote their change holdings over time.

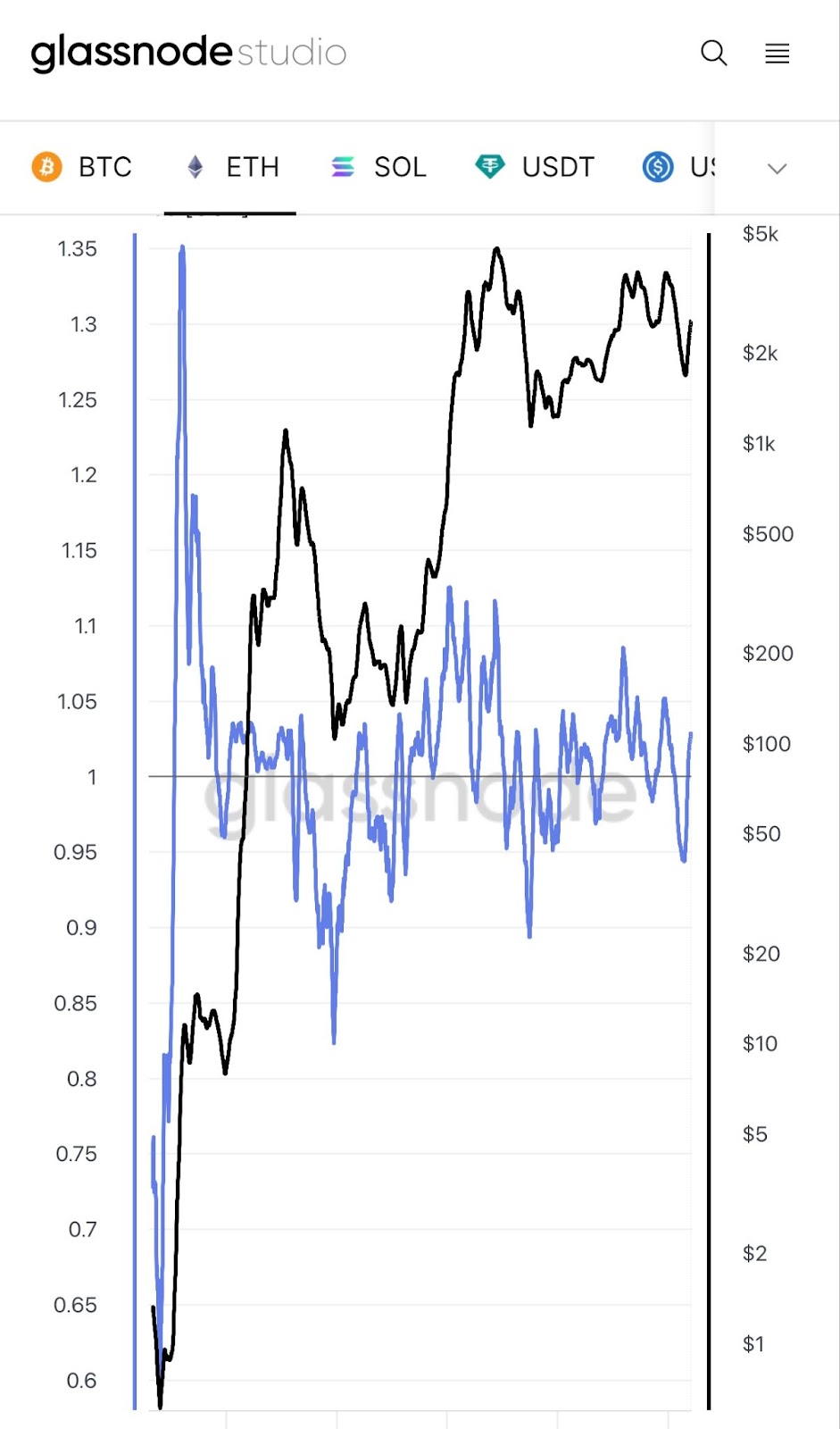

Ethereum Worth SOPR Reveals Revenue-Taking Is Right here

ETH’s Spent Output Revenue Ratio (SOPR) is hovering close to 1.05. This stage reveals that almost all ETH being bought was purchased earlier at a less expensive value. Sellers at the moment are cashing out in revenue.

ETH SOPR-Supply: Glassnode

That itself isn’t a nasty factor. However in previous cycles, when SOPR stayed between 1.05 and 1.15, the worth usually bought rejected. One key instance was in March 2024, when ETH value dropped over $300 after the same SOPR spike.

We aren’t but seeing panic. If this ratio climbs additional and Ethereum value stalls beneath $2,600, a correction towards $2,300 turns into seemingly.

SOPR is an on-chain metric that tracks whether or not cash moved on-chain are bought at a revenue or loss. When the worth is above 1, it means cash are being bought at a revenue.

A rising SOPR with flat value motion usually means sellers are getting forward of demand.

SOPR is helpful as a result of it reveals real-time investor conduct. It doesn’t depend on change information alone. If holders are assured, they normally wait.

However once they begin promoting into energy, it means they’re not sure about future upside. Merely put, ETH, at this juncture, can not afford a steeper SOPR rise.

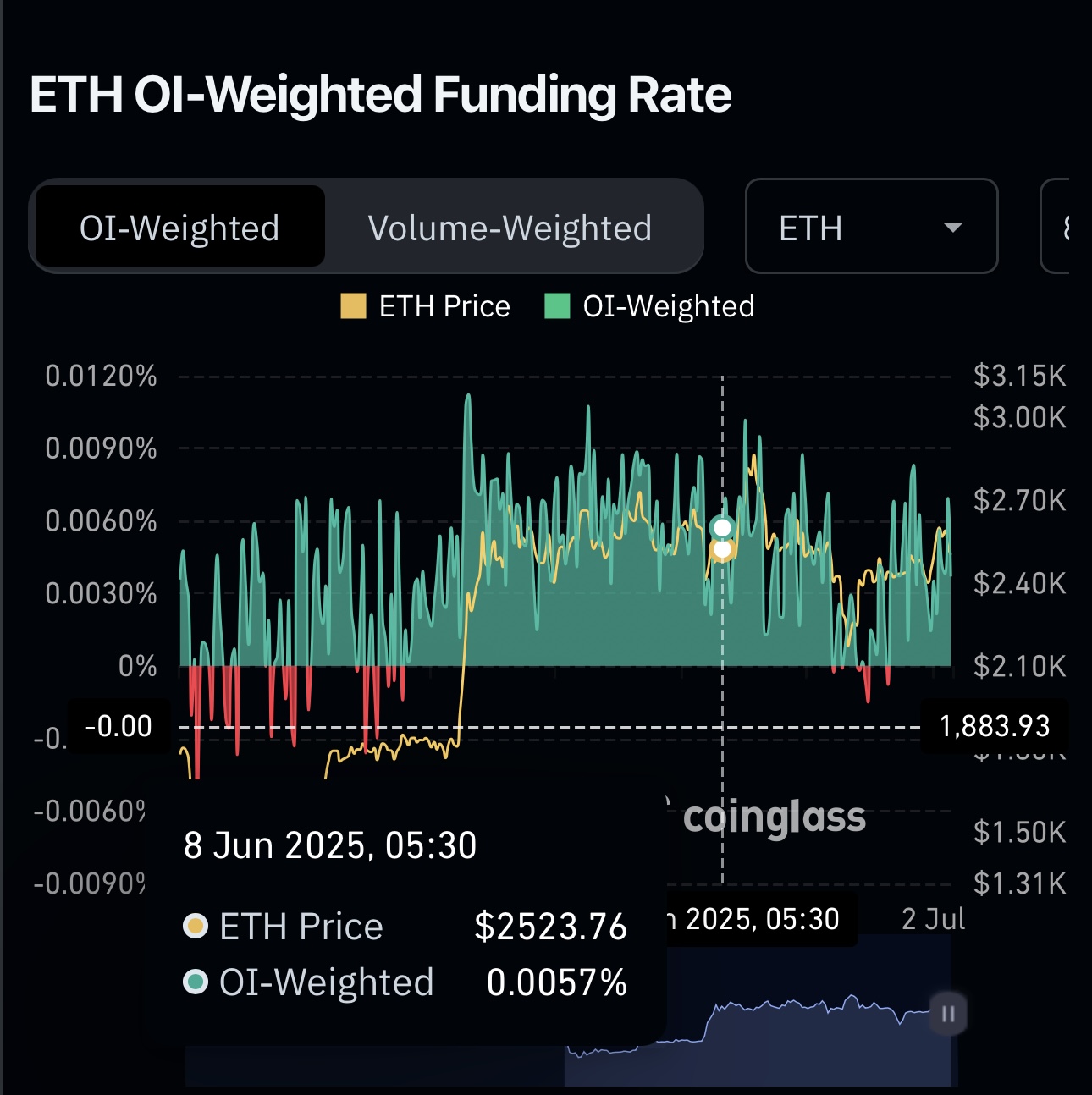

Funding Fee Stays Constructive, However Weak

Open Curiosity-weighted funding charge continues to be barely constructive. Merchants are paying to carry lengthy positions.

This reveals that bulls are nonetheless lively. However the quantity hasn’t jumped, and that issues.

When funding charges are flat, it means there is no such thing as a sturdy perception in a breakout. Proper now, the market is leaning bullish, however not by a lot.

ETH OI-weighted funding

Funding charge is the associated fee merchants pay to carry lengthy or brief positions. Constructive means extra longs. Destructive means extra shorts. But, positives can not assure an ETH value transfer if the identical isn’t backed by change outflows and whale buys.

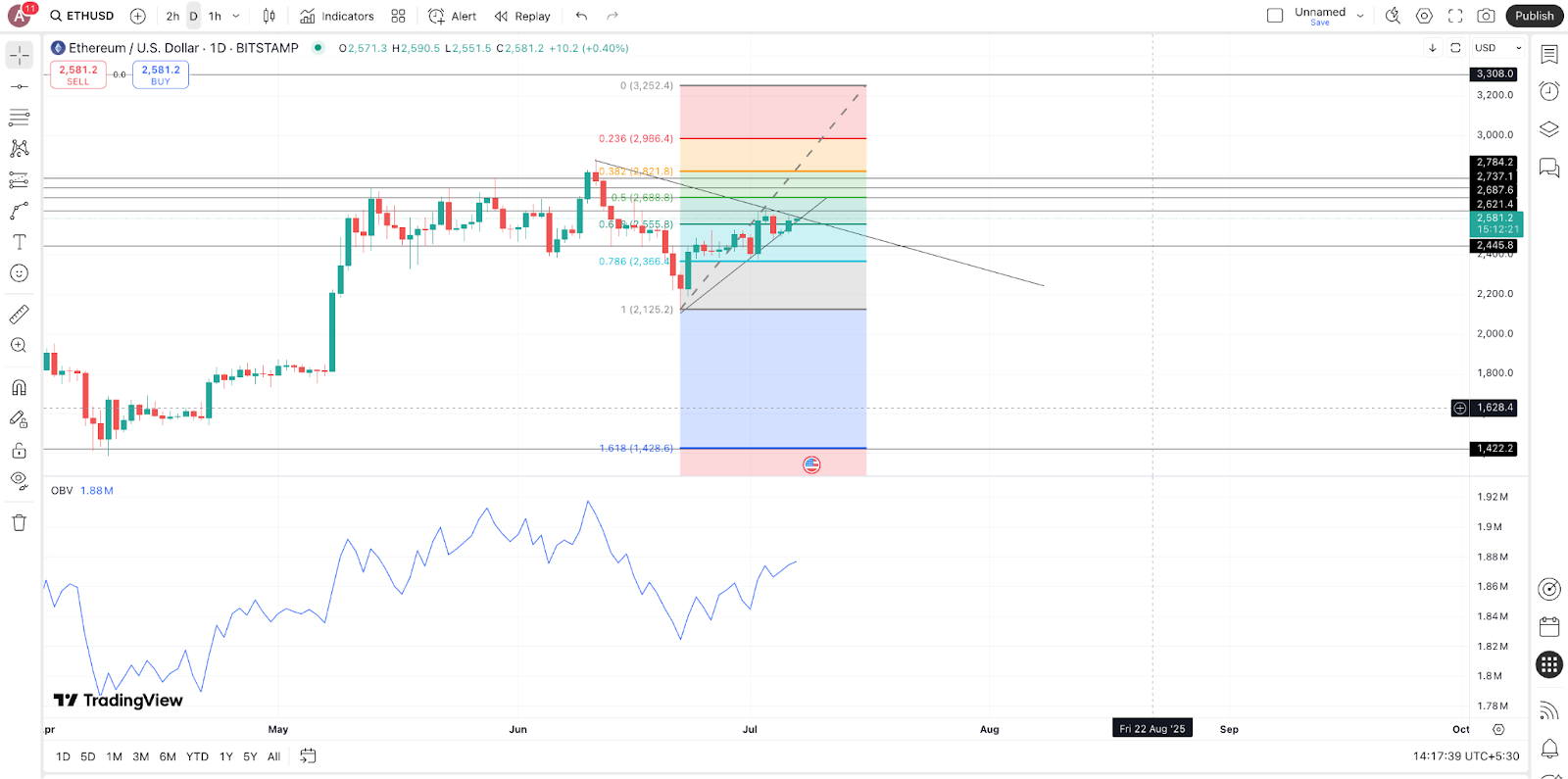

Ethereum Worth Motion Reveals it Can Appropriate

ETH value is now buying and selling inside a pennant sample, caught between two development strains. The assist stage sits close to $2,440. Resistance is simply above $2,520.

This sample usually breaks with excessive volatility. If ETH drops beneath assist, the primary draw back goal is $2,350. That aligns with the 0.382 Fibonacci stage. If that fails, $2,280 (0.5 Fib stage) might observe.

On the upside, ETH should reclaim $2,600 and flip resistance to assist. Solely then does a push towards $2,750 turn into potential.

Fibonacci retracement is a device used to identify assist and resistance based mostly on earlier value strikes.

ETH value action- Supply- TradingView

OBV Divergence Suggests Weak spot

On Steadiness Quantity (OBV) has been flat whereas the worth moved up. This can be a unhealthy signal.

If the worth rises, quantity ought to rise too. OBV tracks this relationship. If OBV flattens whereas value goes up, it usually indicators that consumers are getting drained.

Proper now, the OBV will not be supporting the breakout. That provides threat to any bullish case.

OBV provides quantity on inexperienced candles and subtracts on purple ones. It reveals if quantity helps the development.

Ethereum’s on-chain setup is starting to resemble previous native tops. Inflows are rising. SOPR is within the warning zone. OBV is flat. ETH value nonetheless holds contained in the pennant, however with out stronger demand, the sample could break to the draw back.

Except the worth flips $2,600 and quantity kicks in, a drop to $2,300 continues to be in play.