Ethereum (ETH) has fallen greater than 8% within the final 24 hours and over 22% up to now 30 days, reflecting a bearish market sentiment. The value was already in decline earlier than the Bybit hack, which additional impacted market sentiment.

Though Bybit has since recovered 84% of its reserves, ETH’s worth stays underneath stress. With key resistance at $2,850 and no break above $2,900 since February 2, Ethereum’s outlook stays unsure as bearish indicators proceed to dominate.

Bybit Is Recovering Its ETH Reserves After the Hack

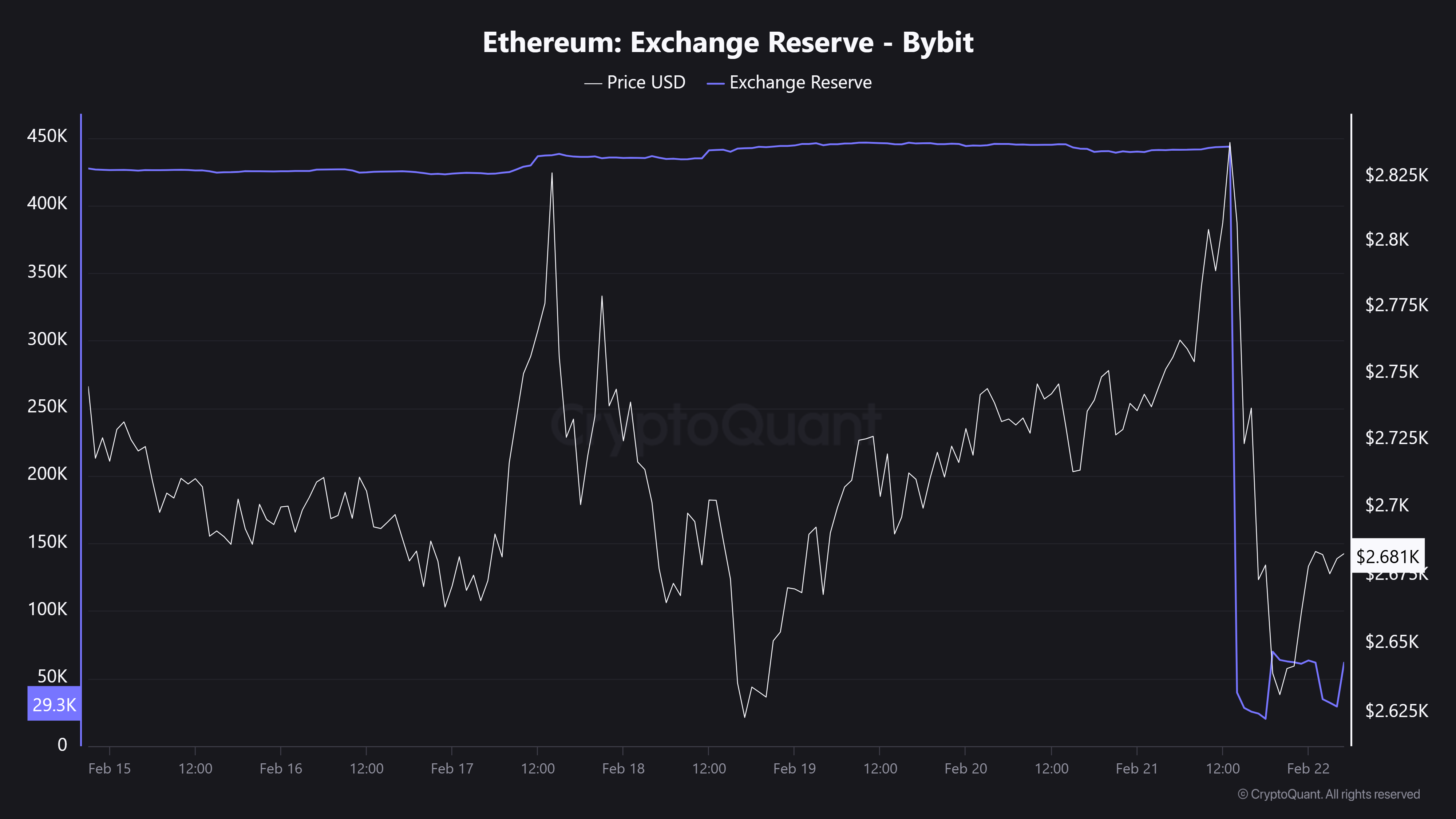

Ethereum’s provide on Bybit skilled a dramatic decline after the hack, plummeting from 443,000 ETH to simply 20,250 ETH in a single day.

This sudden drop triggered panic promoting stress on ETH and in addition on BTC and different cash, as market members feared a possible liquidity disaster.

Ethereum Reserves in Bybit. Supply: CryptoQuant.

The sharp lower in reserves heightened uncertainty, resulting in widespread hypothesis concerning the aftermath. Some customers urged that Bybit is likely to be compelled to purchase again ETH to revive its reserves, probably creating robust shopping for stress.

Since February 22, Bybit’s ETH reserves have proven important restoration, surging from 29,000 ETH to 372,000 ETH by February 24, which accounts for 84% of its pre-hack reserves.

The market’s preliminary panic promoting seems to have been non permanent, and the rebound in reserves may result in renewed shopping for curiosity in ETH. Nonetheless, Ethereum’s worth has not recovered to ranges earlier than the hack but.

Indicators Present No Indicators of a Bullish Momentum

The Relative Power Index (RSI) for Ethereum was recovering after the Bybit hack, reaching 63.2 yesterday, indicating robust shopping for momentum.

Nonetheless, it has since dropped sharply and is now at 43, signaling a major shift in market sentiment. RSI is a momentum oscillator that measures the pace and alter of worth actions, starting from 0 to 100.

Usually, an RSI above 70 means that an asset is overbought, indicating potential promoting stress, whereas an RSI under 30 signifies that an asset is oversold, probably signaling shopping for alternatives.

An RSI between 30 and 70 is usually thought of impartial, with actions inside this vary reflecting regular market fluctuations.

ETH RSI. Supply: TradingView.

Ethereum’s RSI dropping from 63.2 to 43 in simply sooner or later suggests a fast shift from bullish to bearish sentiment. This important decline may point out elevated promoting stress or lowered shopping for curiosity, presumably as a result of lingering considerations concerning the aftermath of the Bybit hack.

A drop to 43 additionally brings RSI nearer to the oversold territory, which, if continued, may point out an extra bearish pattern. Nonetheless, if shopping for curiosity resumes, the RSI may stabilize and even rebound, suggesting a possible restoration.

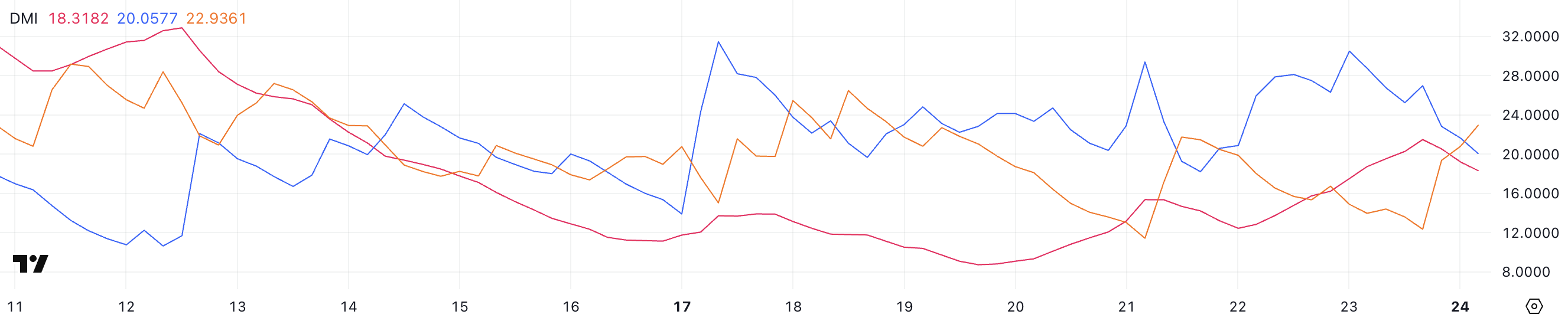

Ethereum’s DMI chart exhibits the ADX at 18.3, down from 21.4 yesterday, indicating weakening pattern power. An ADX under 20 suggests an absence of clear momentum, aligning with Ethereum’s ongoing downtrend.

ETH DMI. Supply: TradingView.

In the meantime, the +DI dropped from 30.4 to twenty, exhibiting decreased shopping for curiosity, whereas the -DI rose from 12.3 to 22.9, signaling elevated promoting stress.

The crossover of -DI above +DI confirms bearish dominance, suggesting continued downward stress on Ethereum’s worth.

The weakening ADX, mixed with rising -DI, factors to a declining pattern that will persist except shopping for momentum returns. This might end in additional worth drops or sideways motion within the brief time period

Ethereum Worth Has Been Under $2,900 For Three Weeks

Ethereum has struggled to interrupt above the $2,850 resistance, which has been repeatedly examined in current weeks. If the present downtrend continues, ETH may take a look at the help at $2,551, and if that stage fails, it would drop additional to $2,159.

Notably, Ethereum hasn’t damaged above $2,900 since February 2, highlighting robust resistance on this vary.

ETH Worth Evaluation. Supply: TradingView.

Nonetheless, if Bybit efficiently restores its reserves to pre-hack ranges, this might increase constructive sentiment for ETH. On this situation, an uptrend would possibly retest the $2,850 resistance, and if damaged, Ethereum worth may rise to $3,020.

Ought to momentum proceed, the following goal could be $3,442. A break above $2,900 could be important, as ETH has struggled with this stage since early February, probably signaling a bullish reversal.