Amid the continuing market uncertainty, Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, has been hit onerous, ensuing within the greatest liquidation of 2025. In the present day, January 13, 2025, ETH has witnessed a worth decline of over 7.5% prior to now 24 hours, making it the most important loser among the many high 10 cryptocurrencies.

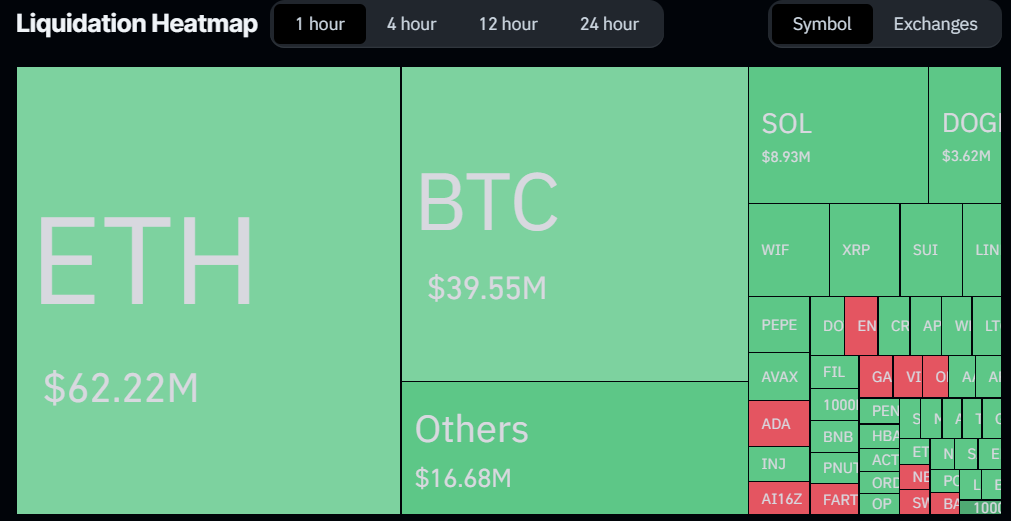

Supply: Coinglass

Merchants Lose $171 Million Price of Ethereum (ETH)

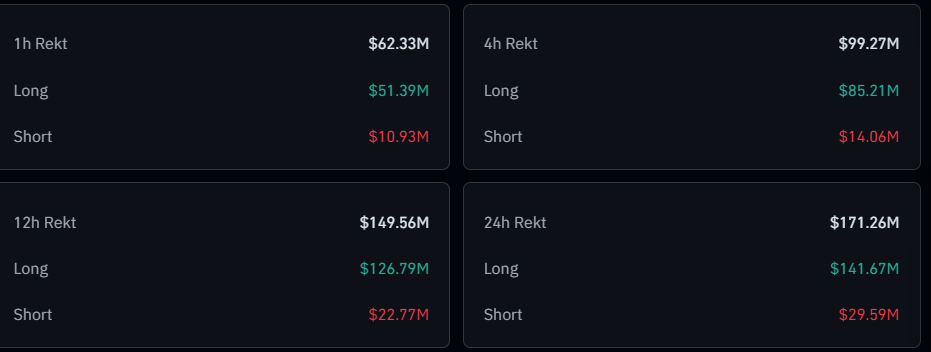

This huge worth decline has resulted within the liquidation of a major $171.50 million price of merchants’ open positions, as reported by the on-chain analytics agency Coinglass.

Supply: Coinglass

Nonetheless, the vast majority of the liquidation occurred prior to now 4 hours, throughout which merchants have misplaced practically $100 million price of positions. Of this substantial liquidation, $85 million comes from merchants holding lengthy positions, whereas quick sellers have witnessed $14 million price of liquidation.

This liquidation that the general market witnessed occurred when ETH failed to carry the essential help on the $3,200 mark and in addition breached the help supplied by the 200 Exponential Transferring Common (EMA) on the each day time-frame.

Ethereum (ETH) Worth Prediction

Given the numerous worth decline, skilled technical evaluation means that ETH has shifted towards a downtrend, with a powerful risk of reaching the $2,850 degree. The potential cause for this daring hypothesis is the breakdown of the essential help degree and the present market sentiment.

Supply: Buying and selling View

Earlier, on January 9, 2025, ETH broke down from a bearish head and shoulders worth motion sample and later entered consolidation. Throughout this era, bulls, hopeful of additional upside momentum, constructed heavy positions. Nonetheless, at present, with the bearish market sentiment, ETH has failed to carry the help and has fallen considerably.

Present Worth Momentum

At the moment, ETH is buying and selling close to $3,020 and has witnessed a worth decline of seven% prior to now 24 hours. Nonetheless, throughout the identical interval, its buying and selling quantity elevated by 170%, indicating heightened participation from merchants and buyers in comparison with the day gone by.

Together with ETH, the general cryptocurrency market has been witnessing a massacre, with merchants holding lengthy positions being those most severely affected.

Moreover ETH, the general crypto market has witnessed a large $700 million price of crypto liquidations, with $593 million coming from merchants holding lengthy positions and $108 million from merchants holding quick positions.