Saturday has introduced one other market-wide crash within the cryptocurrency house, and Ethereum is among the many poorest performers over the previous day (and week).

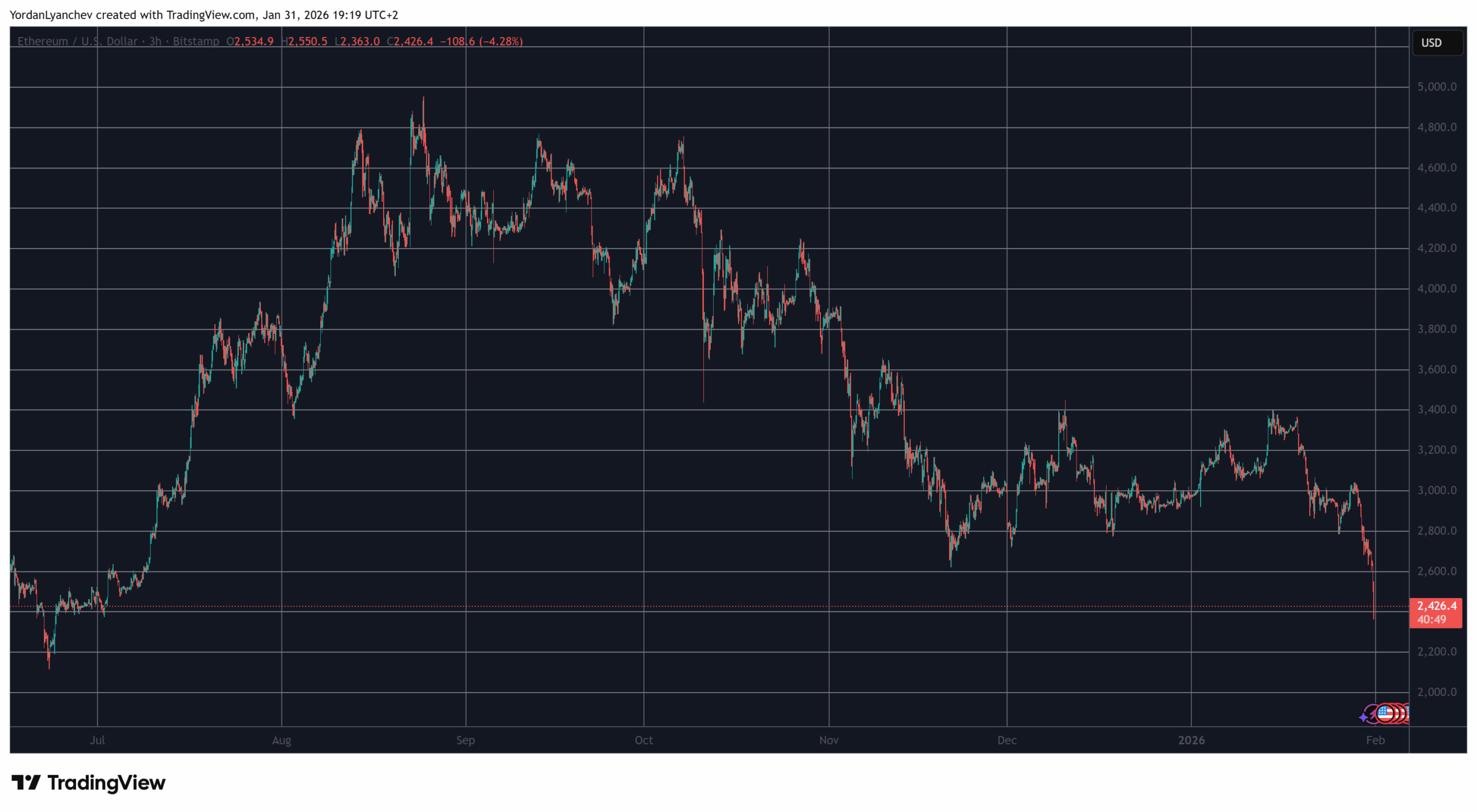

Up to now few hours alone, the biggest altcoin slumped beneath $2,400 for the primary time since July 2. Which means that the asset has plummeted by over 10% up to now day, and it’s down by a whopping 18% weekly.

Recall that $ETH had reclaimed the psychological $3,000 stage on Wednesday when it tapped $3,070 for the primary time in a number of days. This got here earlier than the primary FOMC assembly for the 12 months, however the asset started its spectacular nosedive within the following hours after the Fed paused the rate of interest cuts.

The skyrocketing geopolitical stress within the Center East led to a different crash on Thursday when $ETH, alongside the remainder of the crypto market, tumbled beneath $2,800. Friday was much less eventful within the crypto world, in contrast to the valuable steel market, however the risk-on asset class that trades 24/7 is struggling now as soon as once more.

Ali Martinez knowledgeable that Ethereum traders have been sending tokens en masse to buying and selling platforms, with greater than 70,000 $ETH reaching exchanges up to now three days alone.

Merlijn The Dealer famous that $ETH has dropped beneath a vital help at $2,700, which places it in a “make-it-or-break-it” state of affairs.

On a extra constructive be aware, one other analyst, CW, claimed that Ethereum whales have been internet shopping for the asset much more than $BTC for the previous day.

You might also like:

- Ethereum Pockets Depend Surges Previous 175.5M as Staking Drains Change Provide

- Ethereum Value Reclaims $3K in ‘Fast Turnaround’ Amid Strong Fundamentals

- Ripple (XRP) and Cardano (ADA) Present Deeper Undervaluation Than Bitcoin ($BTC)

Retail traders’ $ETH can also be being stolen by whales.

Whales are additionally taking advantage of quick positions and constructing lengthy positions at decrease costs.

Over the previous 10 hours, whales have internet shopping for $2.97B on the Binance Futures market and $2.42B on the OKX Futures market.

There… pic.twitter.com/LqIENNqBEV

— CW (@CW8900) January 31, 2026

Ethereum’s crash, which is the worst among the many larger-cap cryptocurrencies, has harmed over-leveraged merchants. CoinGlass information present that over $550 million in $ETH longs have been liquidated up to now 24 hours, greater than the $BTC wipeouts ($475 million).