Ethereum (ETH) stays beneath strain, struggling to interrupt above $2,300. Its technical indicators nonetheless level to a downtrend. The BBTrend indicator is enhancing however stays damaging, exhibiting that bullish momentum hasn’t absolutely developed.

On the similar time, the variety of Ethereum whales has elevated barely, probably because of the White Home Crypto Summit, as buyers anticipate regulatory shifts or the inclusion of ETH within the US strategic crypto reserve. For ETH to show bullish, it wants to interrupt key resistance ranges and maintain shopping for strain.

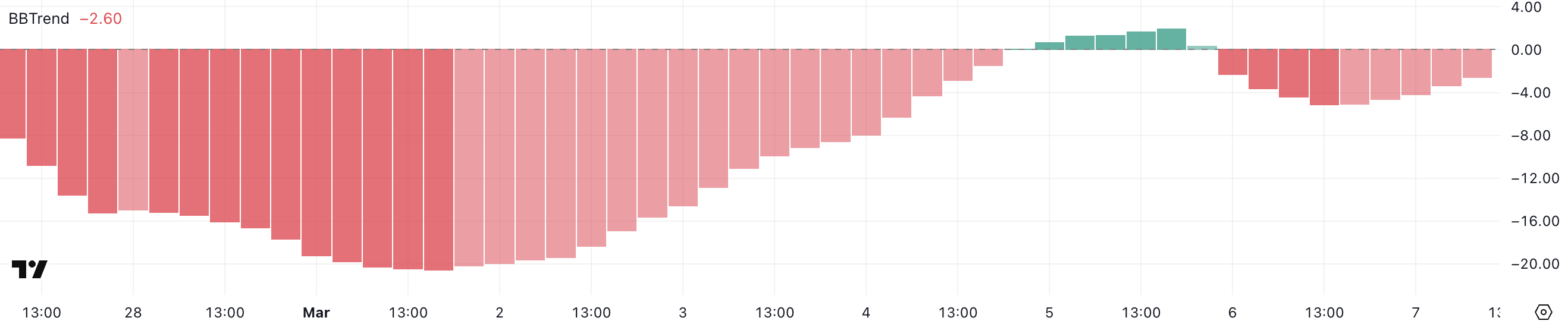

BBTrend Reveals the Uptrend Isn’t Right here But

Ethereum’s BBTrend indicator has climbed to -2.6, enhancing from -5.12 only a day in the past. BBTrend, brief for Bollinger Band Development, is a technical indicator that helps determine value traits and momentum by measuring value deviations from a shifting common.

When the BBTrend is deeply damaging, it suggests robust bearish momentum, whereas a optimistic studying signifies bullish power.

ETH BBTrend. Supply: TradingView.

For Ethereum’s bullish uptrend to achieve traction, BBTrend must cross above 0 and break greater ranges. Two days in the past, it briefly turned optimistic however solely reached 1.98 earlier than reversing decrease, signaling weak shopping for strain.

If BBTrend can push past its earlier excessive and maintain optimistic ranges, it might verify stronger momentum, growing the possibilities of Ethereum’s value sustaining a bullish development.

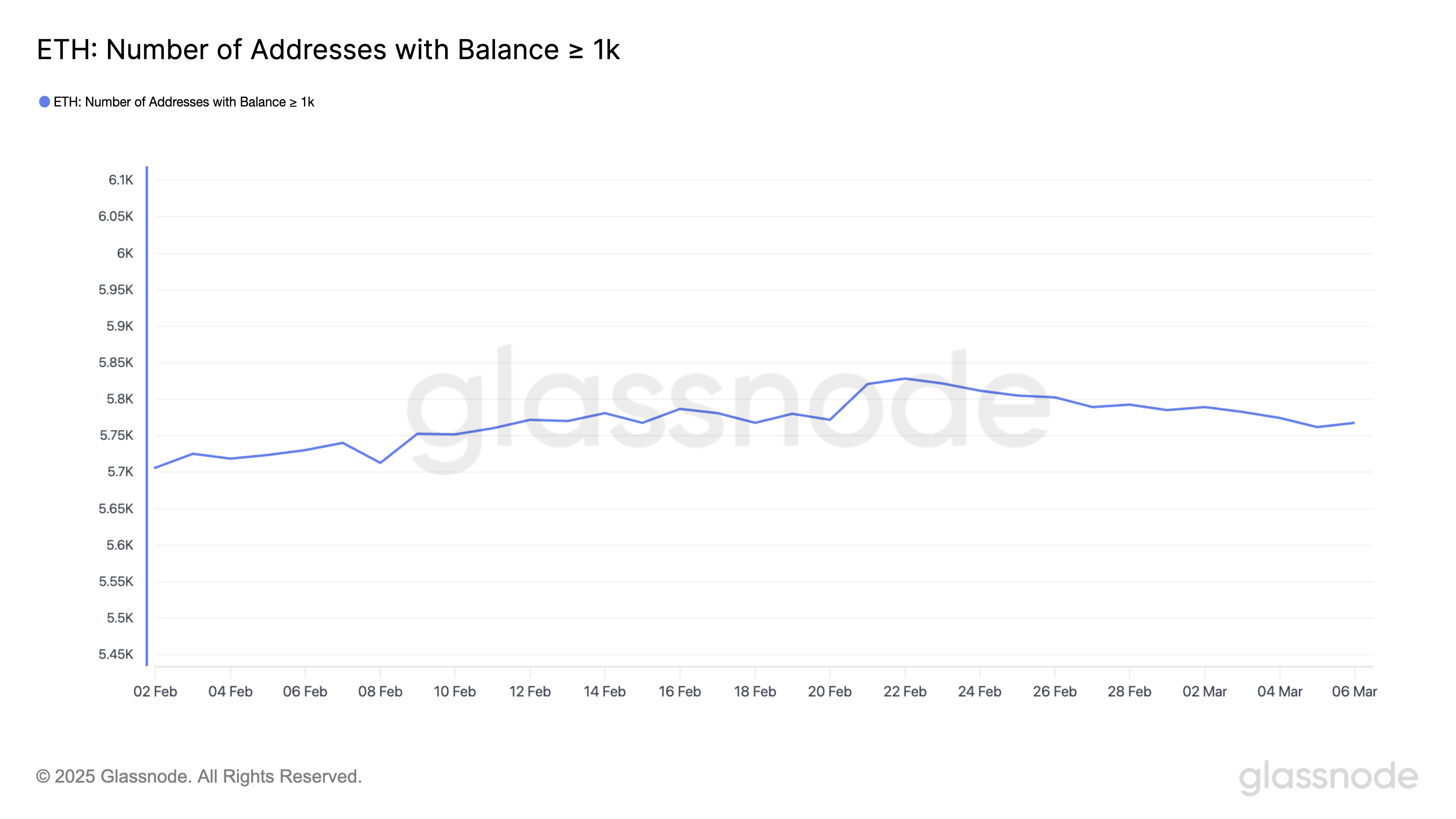

Whales Accrued ETH, However The Total Development Is Nonetheless Down

The variety of Ethereum whales – addresses holding no less than 1,000 ETH – has risen barely to five,768, up from 5,762 on March 5. Nevertheless, the broader development stays downward, because the depend was 5,828 on February 22.

Monitoring these giant holders is essential as a result of whale exercise usually alerts shifts in market sentiment, with accumulation suggesting confidence in value appreciation and distribution indicating potential promoting strain.

ETH Whales. Supply: Glassnode.

This latest uptick in whale numbers may very well be linked to the White Home Crypto Summit, as main buyers could also be positioning themselves forward of potential regulatory developments and the inclusion of ETH within the US strategic crypto reserve.

If this enhance continues, it might point out renewed confidence in Ethereum’s long-term outlook. Nevertheless, for a stronger bullish case, a sustained rise in whale accumulation could be wanted, reversing the latest downtrend.

Will the White Home Crypto Summit Profit Ethereum?

Ethereum has struggled to interrupt above $2,300 in latest days. Its EMA traces nonetheless sign a downtrend as short-term averages stay under long-term ones.

If promoting strain will increase, Ethereum value might take a look at assist at $2,077, and a breakdown under this degree would possibly push it as little as $1,996, reinforcing the bearish outlook.

ETH Value Evaluation. Supply: TradingView.

Nevertheless, if Ethereum reverses its development, it might problem resistance at $2,550 and probably climb towards $2,855.

A robust breakout above these ranges might set the stage for ETH to reclaim $3,000, a degree it hasn’t reached since February 1, 2025, signaling renewed bullish momentum.