Ethereum (ETH) has been struggling, down practically 30% over the previous 30 days as bearish sentiment continues to weigh on the asset. During the last week, ETH has remained caught under the $2,000 mark, unable to regain key resistance ranges.

Whereas some indicators, like BBTrend, are displaying early indicators of stabilization, whale exercise factors to cautious habits amongst giant traders. As Ethereum trades close to important help zones, the market is watching intently to see if the downtrend will deepen or if bulls can stage a significant restoration.

BBTrend Is Now Constructive After 6 Days, However Nonetheless At Modest Ranges

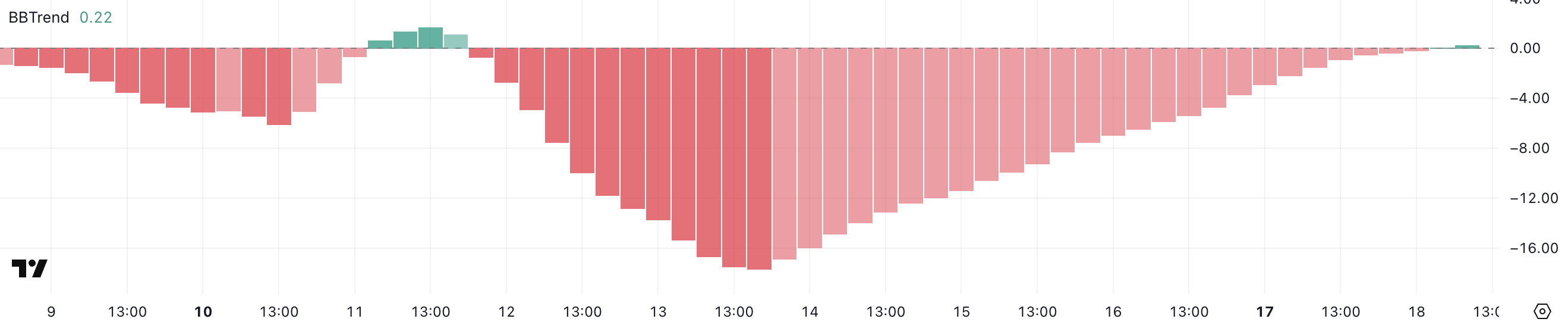

Ethereum’s BBTrend indicator is at present sitting at 0.22, having simply turned constructive after spending six consecutive days in destructive territory.

Throughout that stretch, it reached a destructive peak of -17.68 on March 13, reflecting sturdy bearish momentum.

This shift marks a possible early signal of stabilization for Ethereum. The indicator has crossed again above zero, signaling that sellers could also be shedding management within the quick time period, as Ethereum community exercise not too long ago hit yearly lows.

BBTrend, or Bollinger Band Pattern, is a momentum-based indicator that measures the power and path of a worth development relative to its Bollinger Bands. Readings under 0 usually recommend bearish circumstances, whereas readings above 0 point out bullish momentum.

Thresholds round -10 or +10 usually spotlight durations of stronger development conviction. Ethereum’s BBTrend is now again in constructive territory after a protracted bearish section, suggesting that downward strain is easing.

Nonetheless, at simply 0.22, the indicator continues to be at low ranges, signaling that whereas the sell-off may be cooling, the market has but to transition into a robust bullish development absolutely.

Whales Are Not Accumulating Ethereum

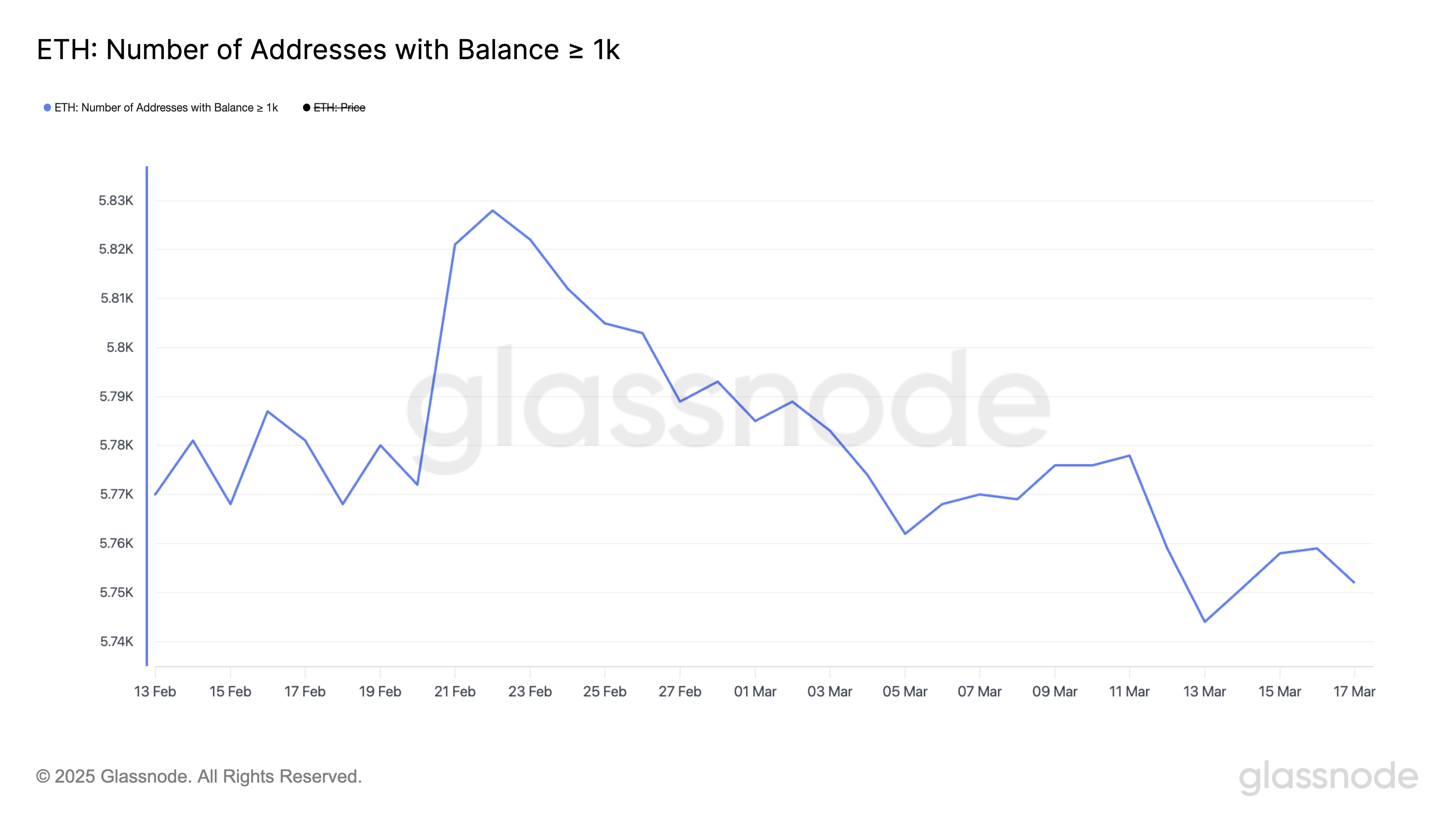

The variety of Ethereum whales—wallets holding at the least 1,000 ETH—has been steadily declining since February 22, after peaking at 5,828 addresses.

The present variety of Ethereum whales stands at 5,752, regardless of a modest try at a rebound in latest days, with Ethereum market dominance hitting its lowest ranges since 2020.

This gradual discount in giant holders factors to a cautious strategy amongst key gamers. Some whales are lowering their publicity or taking income as Ethereum’s worth motion stays combined.

ETH Whales. Supply: Glassnode.

Monitoring whale habits is essential as a result of these giant addresses usually act as market movers, able to influencing worth tendencies via their shopping for or promoting exercise.

A gentle decline in Ethereum whale numbers could recommend waning confidence or a shift towards risk-off sentiment amongst institutional or high-net-worth traders.

This downward development in whale accumulation might restrict the power of any potential rallies, as fewer giant gamers are positioned to supply sturdy shopping for help within the quick time period.

Will Ethereum Fall Beneath $1,700 In March?

Ethereum has been below strain, buying and selling under the $2,000 mark for the previous seven days. Sellers have stored the asset pinned beneath key resistance ranges.

The present help stands at $1,823, and if this stage is examined and damaged, Ethereum might decline additional towards $1,759 and doubtlessly fall under $1,700 for the primary time since October 2023, regardless of some specialists defending its future echoes early Amazon and Microsoft.

ETH Value Evaluation. Supply: TradingView.

Nonetheless, if Ethereum’s worth manages to stabilize and construct an uptrend, it might problem the rapid resistance at $1,956.

A breakout above this stage could open the trail for a rally towards $2,106, with additional bullish momentum doubtlessly pushing ETH to retest $2,320 and even $2,546.

A break above $2,500 would mark the primary time Ethereum reclaims that stage since March 2, signaling a notable shift in market confidence and purchaser power.