Ethereum’s circulating provide has surged over the previous week, reaching ranges not seen since February 2023. On-chain knowledge reveals that 12,353 ETH valued above $39 million have been added to circulation over the previous seven days.

This comes amid a drop within the community’s demand, which has impacted ETH’s efficiency.

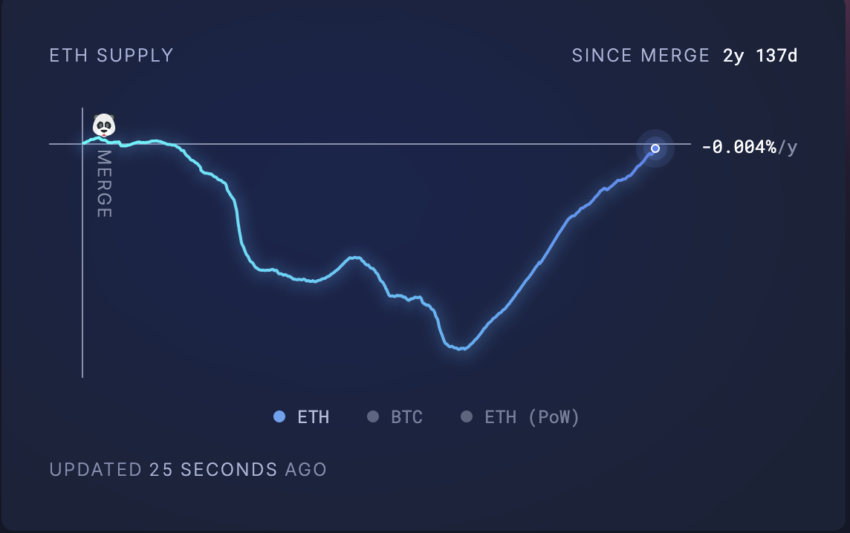

Ethereum Faces Inflationary Stress as Circulating Provide Spikes

Ethereum’s circulating provide, which measures the variety of cash or tokens at present out there to the general public, has rocketed by a further 12,353 ETH prior to now seven days. This brings the coin’s complete circulating provide to 120.51 million ETH, a excessive final recorded in February 2023.

Normally, ETH sees a spike in its circulating provide when consumer exercise on the Ethereum community declines. In response to Artemis, this has been the case for the proof-of-stake (PoS) community.

ETH Circulating Provide. Supply: Ultrasoundmoney

Prior to now week, the variety of distinctive addresses which have accomplished a minimum of one transaction involving the altcoin has dropped 4%. In consequence, the variety of day by day transactions executed on Ethereum has decreased by 1% throughout the identical interval.

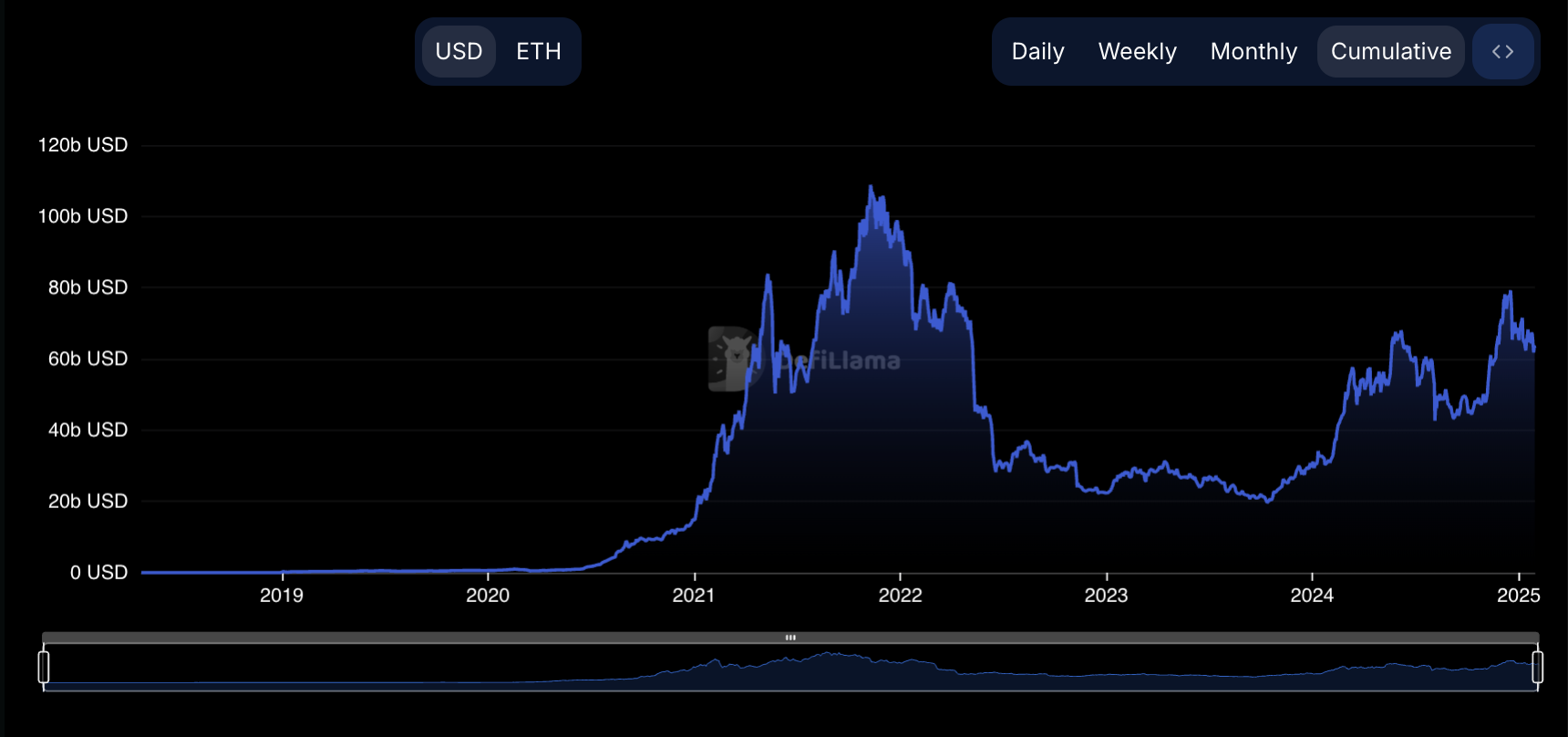

The previous week’s decline in Ethereunm’s consumer exercise is mirrored by the falling complete worth locked (TVL) throughout its decentralized finance (DeFi) ecosystem. Per DefiLlama, this has dropped by 4% throughout the overview interval.

ETH TVL. Supply: DefiLlama

ETH Value Prediction: Will It Break Under $3,000?

The decline in exercise on the Ethereum community has impacted ETH’s demand, inflicting its worth to drop 4% prior to now seven days. An evaluation of the ETH/USD one-day chart reveals that purchasing exercise stays minimal amongst market contributors.

Readings from its Shifting Common Convergence Divergence (MACD) indicator verify this bearish outlook. As of this writing, the main altcoin’s MACD line (blue) rests beneath its sign line (orange).

The market development is bearish when this momentum indicator is about up this fashion. It signifies that promoting exercise exceeds accumulation amongst market contributors, hinting at a possible extension of ETH’s worth decline.

ETH Value Evaluation. Supply: TradingView

On this state of affairs, ETH’s worth might slip beneath $3,000 to commerce at $2,945. Nevertheless, if the coin witnesses a surge in new demand, this might drive its worth towards $3,369.