Ethereum (ETH) traded across the $2,200 vary, rising from a latest dip underneath $2,000. At this place, ETH is exhibiting alerts of being undervalued based mostly on its historic efficiency.

Ethereum (ETH) has been actively traded prior to now three months, as whales strategically rolled over their positions. The choice to keep away from holding and promote close to native tops has been one of many causes for the ETH value weak spot.

Whales, however, tried to reabsorb ETH at a cheaper price, reaching a typically decrease common. Holders with accumulation at $3,500 have been the primary to distribute their cash, then return for extra shopping for across the $2,500 vary.

Patrons that first amassed ETH at $3,500 used lively promoting and re-buying to lower their value foundation to $3,200.

Actively buying and selling whales additionally bought close to the native prime of $2,500, re-buying decrease. Most ETH rallies have been used to re-distribute cash, as ETH confirmed a long-term downward pattern. ETH can be right down to 0.025 BTC, holding merchants on the alert for added value dips.

ETH enters underpriced zone

Near $2,000, ETH is now touching the undervalued zone based mostly on a ratio of market value to realized value. The lively promoting meant whales retained a better realized worth, whereas the present market worth was underpriced compared.

The Market Worth to Realized Worth (MVRV) ratio is giving an underpriced sign when it falls under 1. Values under 1 imply an opportunity to purchase at ranges near the common buy value for each retail and whale patrons.

Accumulating at this degree, nonetheless, doesn’t assure a rally, as there are additionally bearish predictions for extra ETH capitulations.

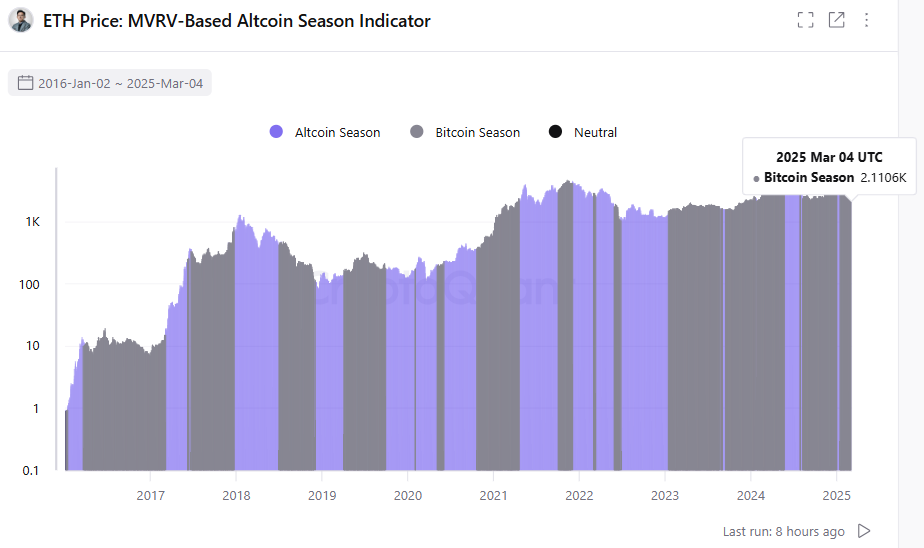

The present MVRV chart for Ethereum can be traditionally exhibiting the market is in a Bitcoin season. The present values counsel ETH and altcoins could also be underpriced in comparison with earlier cycles.

ETH realized value additionally signifies a Bitcoin season, with altcoins undervalued. | Supply: Cryptoquant

The present value ranges are nonetheless not a assure for a rally, as some altcoins have misplaced their attraction and will have an issue in rebuilding demand.

ETH stays a controversial bid

ETH has been exhibiting an oversold sign for weeks, however this has not led to a value rally. One of many causes is the try to understand positive aspects quick, whereas re-buying close to lows. ETH whales have anticipated a rally above $4,000, later making an attempt to decrease their common entry value.

Regardless of the value weak spot, ETH has been coming into extra accumulation addresses. ETH retains its utility as a part of the DeFi ecosystem, and can be utilized as collateral or as a liquidity token. ETH noticed a peak influx into accumulation addresses in January.

In whole, over 19M ETH are held in accumulation addresses. ETH is comparatively extra accessible than BTC, and exhibits completely different behaviors for its cohorts of holders.

Ethereum (ETH) is flowing into accumulation addresses, however whales should not appearing as long-term holders. | Supply: Cryptoquant

Total, small-scale holders of 100-1000 ETH have realized the very best value at over $2,600. Among the greatest ETH whales, which can additionally correspond to DeFi addresses or swimming pools, have the bottom realized value at round $2,300. For ETH, the bigger the whale’s holdings, the decrease the realized value.

The present staked ETH realized value is at $2,775, suggesting some stakers could also be underwater. The $2,800 degree is seen as one doable promoting level, the place an enormous cohort of holders might determine to promote. Primarily based on present information, staked ETH can be within the undervalued zone. Any hike above $2,800 can be useful to your entire ETH DeFi ecosystem, resulting in expanded worth, safer mortgage alternatives and better earnings.

ETH is at present pressured as there’s nonetheless a lack of perception within the utility of the community. Whereas ETH nonetheless carries a number of legacy initiatives, the chain has not reached the promised ranges of progress. The Ethereum Basis’s method can be seen as too summary, resulting in stagnant value progress.