Ethereum is nearing a breakout above $1,850 as rising open curiosity, rising lengthy positions, and on-chain quantity tendencies recommend a backside could also be forming.

As Bitcoin climbs above the $97,000 mark, Ethereum struggles across the $1,800 stage. Nonetheless, the day by day chart displays a short-term restoration pattern, nearing a possible breakout rally. Will a post-retest reversal push Ethereum previous the $2,000 mark?

Ethereum Value Evaluation

Within the day by day chart, Ethereum’s worth reversal has breached a long-standing resistance trendline, confirming a bullish breakout from a falling channel sample.

Ethereum is presently buying and selling at $1,821 after a 2.51% surge final night time. Nonetheless, the bullish pattern nonetheless faces robust resistance close to the high-supply zone across the $1,850 stage.

This resistance constrains the breakout rally and should result in a possible retest. Nonetheless, the continued restoration has triggered a optimistic cycle within the MACD and sign strains.

The declining 50-day EMA aligns with the provision zone, performing as a dynamic resistance. A breakout above the 50-day EMA and the provision zone would possible generate a purchase sign for worth motion merchants.

Primarily based on Fibonacci retracement ranges, the following fast resistance lies on the 23.60% stage close to the psychological $2,000 mark. Past that, the 200-day EMA close to the 38.20% stage at roughly $2,400 will function a essential resistance.

On the draw back, key assist stays close to the $1,600 stage.

Close to-Zero Charges Gasoline Surge in Lengthy Positions

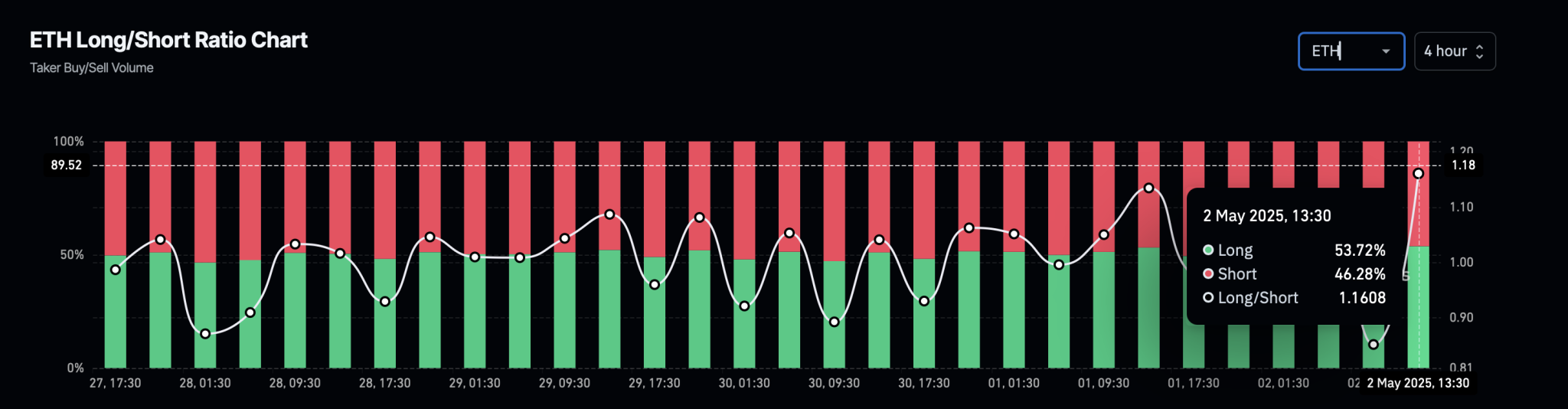

Within the derivatives market, merchants anticipate a serious breakout rally in Ethereum. The Ethereum Lengthy-to-Quick Ratio chart reveals 53.72% lengthy positions collected over the previous 4 hours.

ETH LongShort Positions

This places the Lengthy-to-Quick Ratio at 1.1608, indicating a bullish dominance. Moreover, open curiosity has elevated by greater than 3%, reaching $21.60 billion, whereas the general market funding charge stays close to 0%.

A near-zero funding charge lowers the price of holding lengthy positions, which is probably going reinforcing bullish sentiment.

Historic Returns Counsel Bullish Reversal

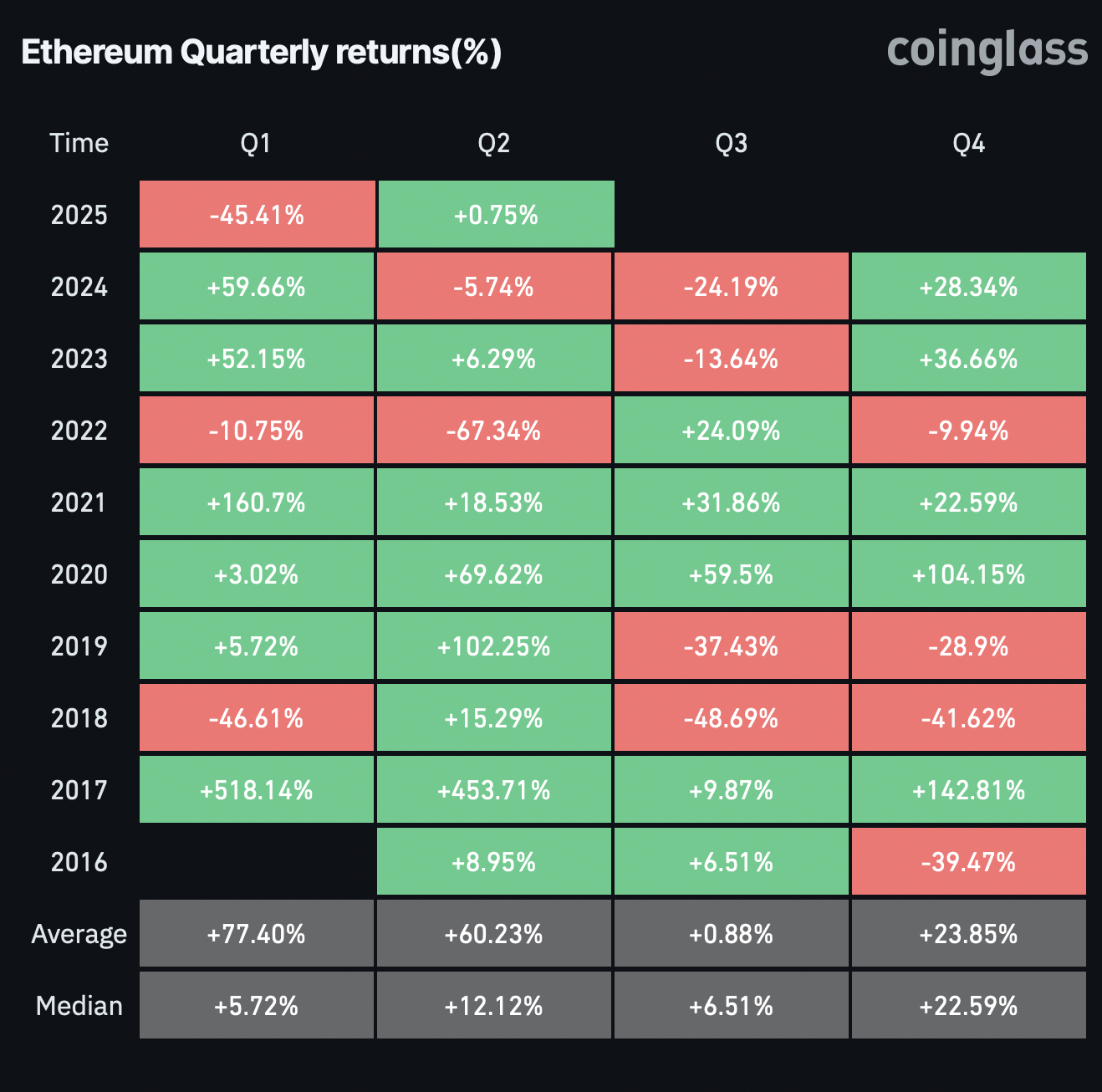

The historic worth returns in Ethereum assist the opportunity of a breakout rally. Primarily based on the information from CoinGlass, the Ethereum quarterly returns spotlight a chance of a bullish comeback.

Since 2016, Ethereum has posted optimistic Q2 ends in seven out of 9 years—excluding 2022 and 2024. The common Q2 return stands at practically 60%, with a median return of 12.12%.

Historic Quarterly Returns

Ethereum Promoting Stress Waning

In keeping with knowledge from CryptoQuant, promoting stress within the derivatives market is regularly easing. The online taker quantity turned optimistic on April 23 and 24 — an indication of rising purchaser aggression.

As of Might 1, the 30-day shifting common stood at $311,406, reflecting a notable enchancment. If this pattern persists, Ethereum might be within the course of of building an actual backside.

This shift might assist a bullish restoration and enhance the probability of a broader pattern reversal within the coming weeks.

ETH Web Taker Quantity