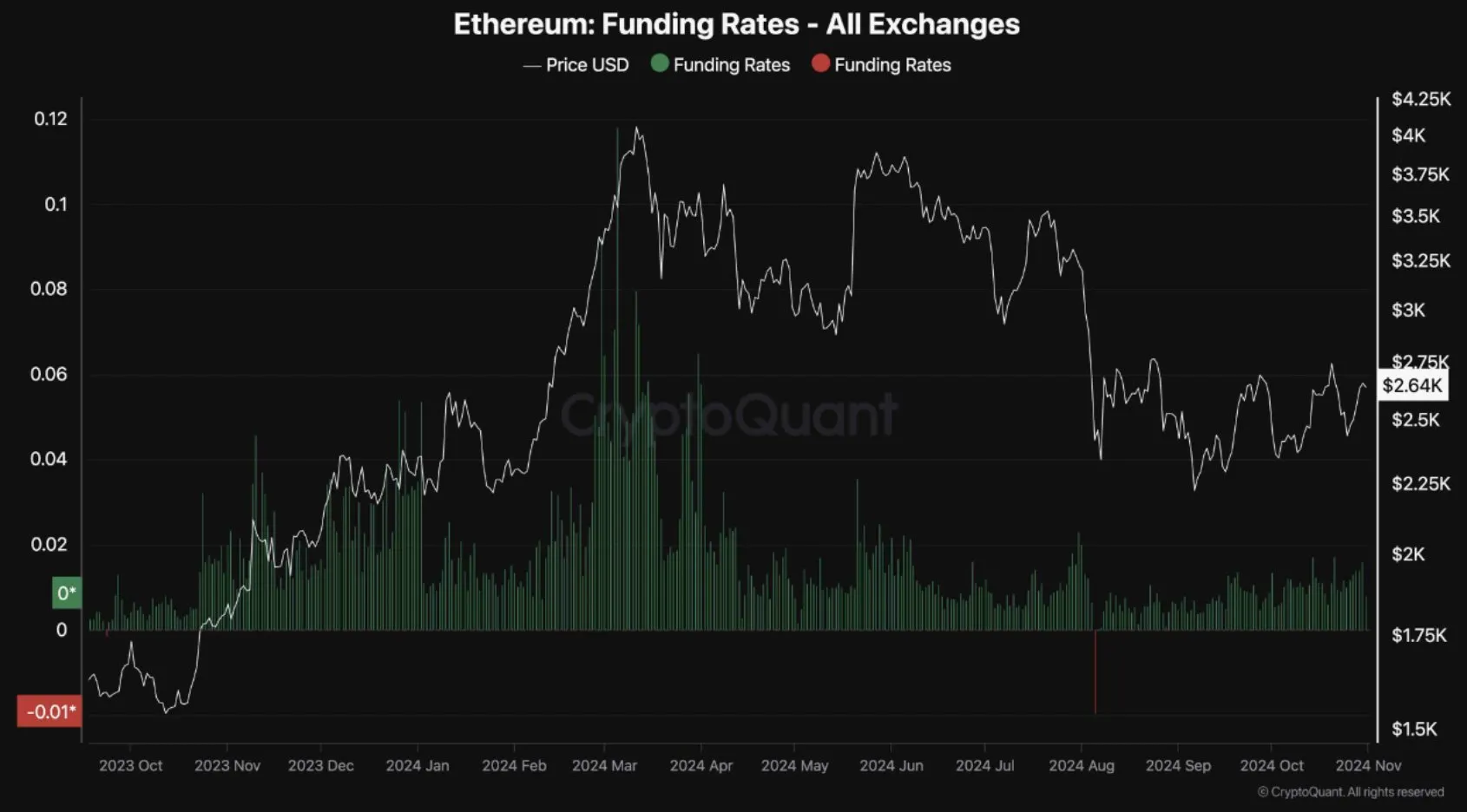

Bullish sentiment has intensified in Ethereum futures, with optimistic funding charges pointing to optimism in ETH’s worth potential.

The funding fee metric in futures markets displays purchaser aggression, the place optimistic values point out bullish sentiment and unfavourable values counsel bearishness.

Not too long ago, ETH funding charges turned optimistic, displaying a shift towards optimism. Though the charges have but to succeed in ranges seen throughout earlier robust rallies, the pattern suggests growing confidence in Ethereum’s potential for a rally.

Supply: CryptoQuant

For Ethereum to beat vital resistance ranges, funding charges must climb larger. Rising charges would point out stronger shopping for curiosity from futures merchants, including upward stress to ETH’s worth.

If this pattern continues, larger funding charges may sign confidence, elevating the chance of a sustained worth breakout.

Such optimistic sentiment may drive ETH’s worth larger if it aligns with broader bullish developments within the cryptocurrency market.

ETH’s Features Stay Susceptible Regardless of Bullish Divergence

Whereas bullish sentiment grows, Ethereum’s worth stays susceptible to reversals. Historic knowledge exhibits ETH usually struggles to carry features, indicating volatility.

If ETH continues to make decrease lows, this bullish divergence may lose credibility, weakening its momentum in opposition to Bitcoin (BTC). Additional financial knowledge may influence ETH’s worth motion, making warning obligatory.

Decrease lows may point out market instability, suggesting traders ought to search for indicators of reversal earlier than assuming any sustained uptrend.

Supply: Buying and selling View

At present ranges, ETH exhibits weak point in opposition to BTC, with every bounce shortly reversing. The worth motion displays a sample the place ETH struggles to keep up assist, resulting in cheaper price factors.

If ETH reaches a brand new low across the 0.031 BTC degree, it may open new shopping for alternatives. Buyers ought to look ahead to modifications in momentum as ETH’s worth may discover assist on this space.

Endurance may reveal an excellent shopping for window, particularly as ETH may regain energy nearer to early 2025.

Bond Yields and Financial Elements Form Ethereum’s Path

U.S. 2-year authorities bond yields lately confirmed a bearish divergence, trending downward after reaching a peak. Decrease yields typically level to slowing financial progress and a possible shift in rate of interest insurance policies.

As yields drop, fixed-income investments grow to be much less interesting, which can drive traders towards higher-risk property like Ethereum. This surroundings may create favorable situations for ETH, as traders search higher returns in riskier markets.

If bond yields proceed their downward pattern, Ethereum may see larger demand. Falling yields may additionally trace at a dovish stance from the Federal Reserve, presumably slowing down or pausing fee hikes.

Supply: Buying and selling View

Such a shift would possible improve liquidity, benefiting risk-on property like ETH. Nonetheless, this pattern comes with the chance of short-term volatility, as shifting financial situations may lead traders to hunt safe-haven property.

ETH’s worth would stay delicate to macroeconomic indicators and broader liquidity developments.

What’s Subsequent?

Ethereum’s path to sustained worth progress depends on a couple of key elements. Optimistic funding charges sign rising confidence, however ETH wants stronger momentum to interrupt previous resistance.

Nonetheless, ETH’s vulnerability in opposition to BTC signifies warning, as any financial uncertainties may disrupt this optimistic outlook.

For now, Ethereum’s worth trajectory will depend on each investor sentiment and financial knowledge. The potential decline in bond yields may increase ETH demand, however volatility dangers persist.

Buyers ought to regulate funding charges and key financial developments, as these elements would information ETH’s worth motion within the coming months.