Main altcoin Ethereum broke under its slender consolidation vary on Friday, marking the start of a sustained downtrend poised to proceed into the brand new week. The altcoin dipped under $2,300 for the primary time in a month, because the tensions between the US, Israel, and Iran escalated yesterday.

The breakdown has triggered a surge in sell-side strain throughout the Ethereum futures market, elevating issues of a deeper decline forward.

Ethereum Bears Tighten Grip

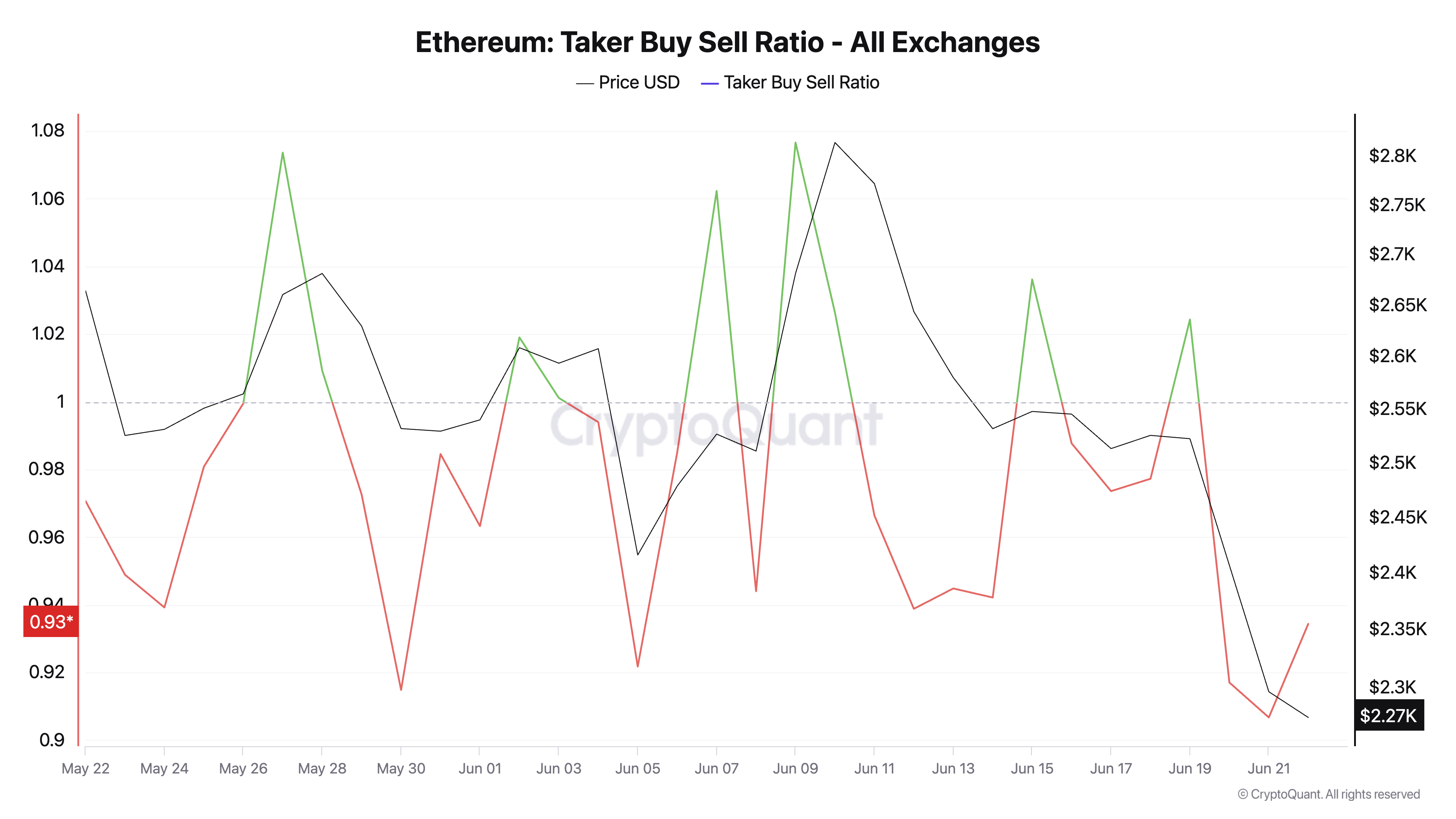

The bearish bias in opposition to ETH is mirrored by its taker purchase/promote ratio, which has constantly posted destructive values since Friday. At press time, this stands at 0.93 per CryptoQuant, indicating that promote orders dominate purchase orders throughout the ETH futures market.

Ethereum Taker Purchase Promote Ratio. Supply: TradingView

An asset’s taker buy-sell ratio measures the ratio between the purchase and promote volumes in its futures market. Values above one point out extra purchase than promote quantity, whereas values under one recommend that extra futures merchants are promoting their holdings.

The regular dip in ETH’s taker purchase/promote ratio over the previous few days factors to a climbing sell-off amongst futures merchants. This mounting sell-side strain confirms weakening sentiment and will speed up worth declines if it continues.

As well as, ETH stays considerably under its 20-day Exponential Shifting Common (EMA), which exhibits the bearish sentiment surrounding the asset. At press time, this key shifting common types dynamic resistance above ETH’s worth of $2,497.

ETH 20-Day EMA. Supply: TradingView

The 20-day EMA measures an asset’s common worth over the previous 20 buying and selling days, giving weight to current costs. When the value falls under the 20-day EMA, it alerts short-term bearish momentum and suggests sellers are in management.

This additional confirms the weakening bullish construction round ETH, because the asset struggles to reclaim short-term development assist.

Will Ethereum Maintain the Line?

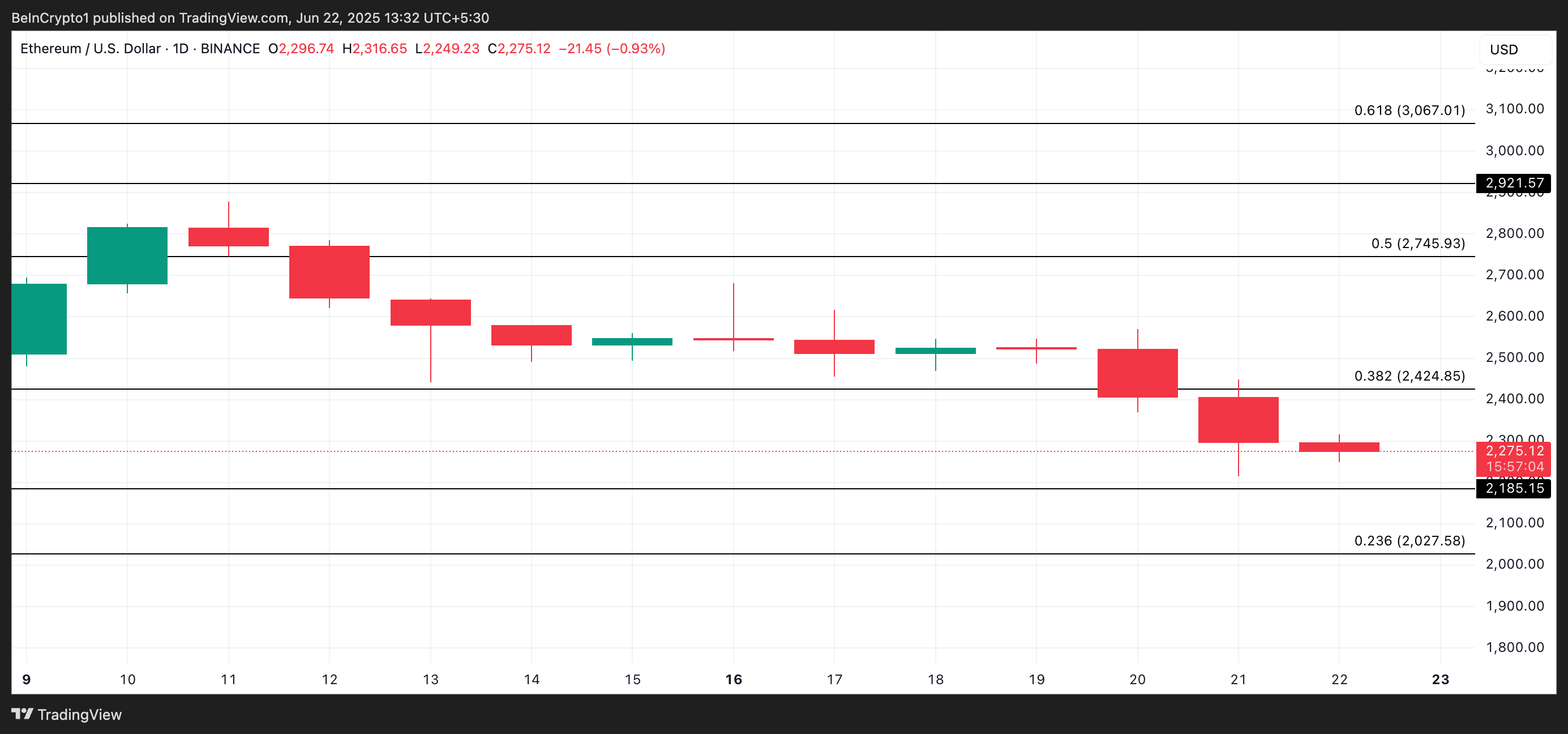

ETH at present trades at $2,272, noting a 6% decline amid the broader market’s pullback of the previous 24 hours. With climbing promote strain throughout its spot and futures market, ETH dangers pulling towards the assist at $2,185.

If this assist fails, ETH’s worth might plummet additional to $2,027.

ETH Value Evaluation. Supply: TradingView

Nevertheless, if shopping for strain regularly positive aspects momentum, ETH might rebound and climb to $2,424.