Ethereum has skilled a difficult month and a half, with its worth nearing a 17-month low at $1,802 on the time of writing. Regardless of this ongoing downtrend, which practically despatched ETH right into a bear market, key traders have remained optimistic.

As Ethereum approaches these vital ranges, many market individuals consider {that a} worth rebound could possibly be on the horizon.

Ethereum Traders Capitalize On Low Costs

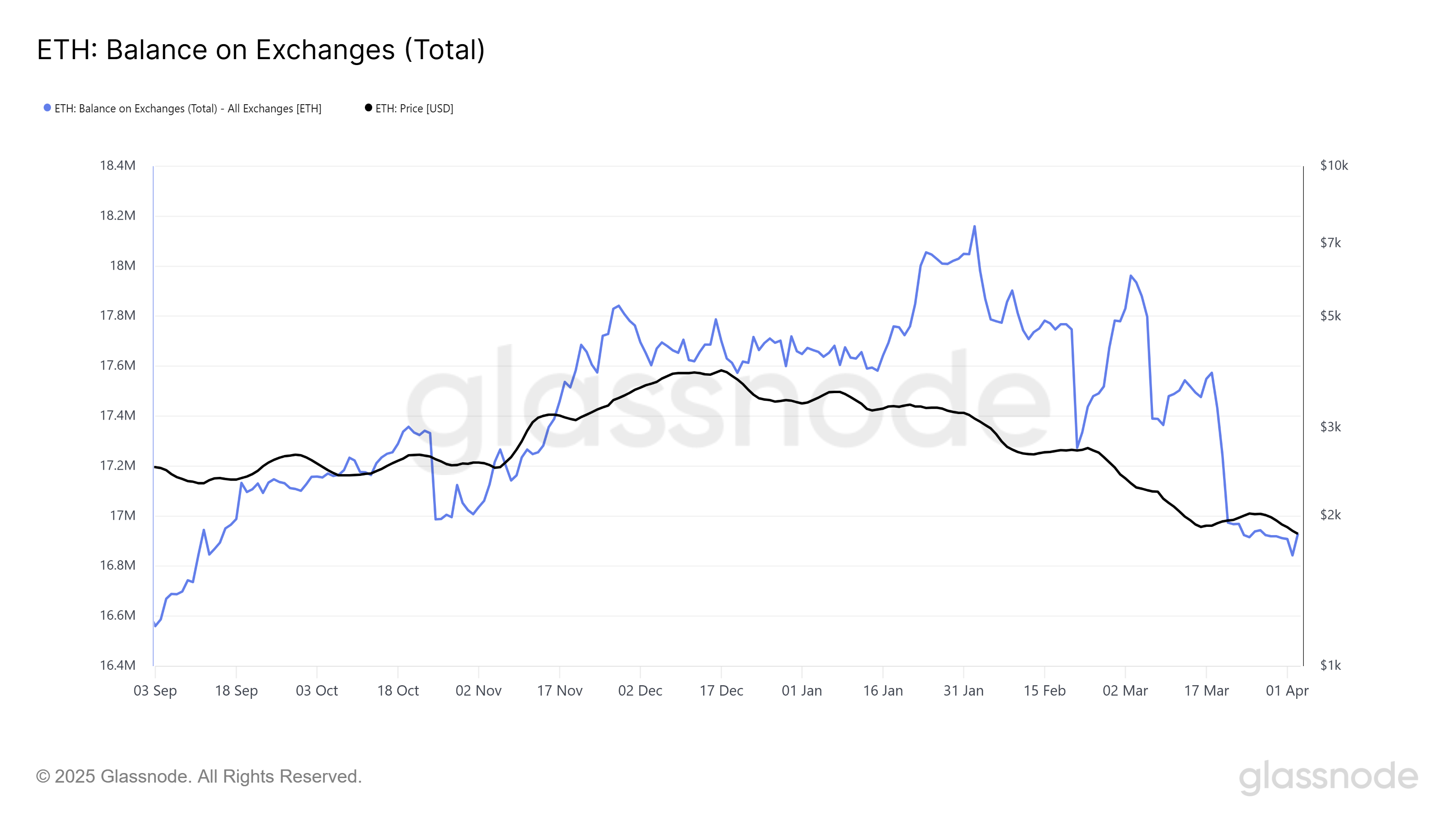

Ethereum’s provide on exchanges has dropped to a six-month low, indicating that traders are more and more holding their belongings off the market. This drop in trade provide is commonly seen as a bullish signal as a result of it means that long-term holders (LTHs) are accumulating extra ETH at these low worth ranges, anticipating future worth appreciation.

These traders aren’t keen to promote, demonstrating robust conviction in Ethereum’s long-term worth. The lower in trade balances additionally signifies much less short-term buying and selling exercise. This means that many traders are ready for the value to rebound earlier than making any strikes.

Ethereum Provide On Exchanges. Supply: Glassnode

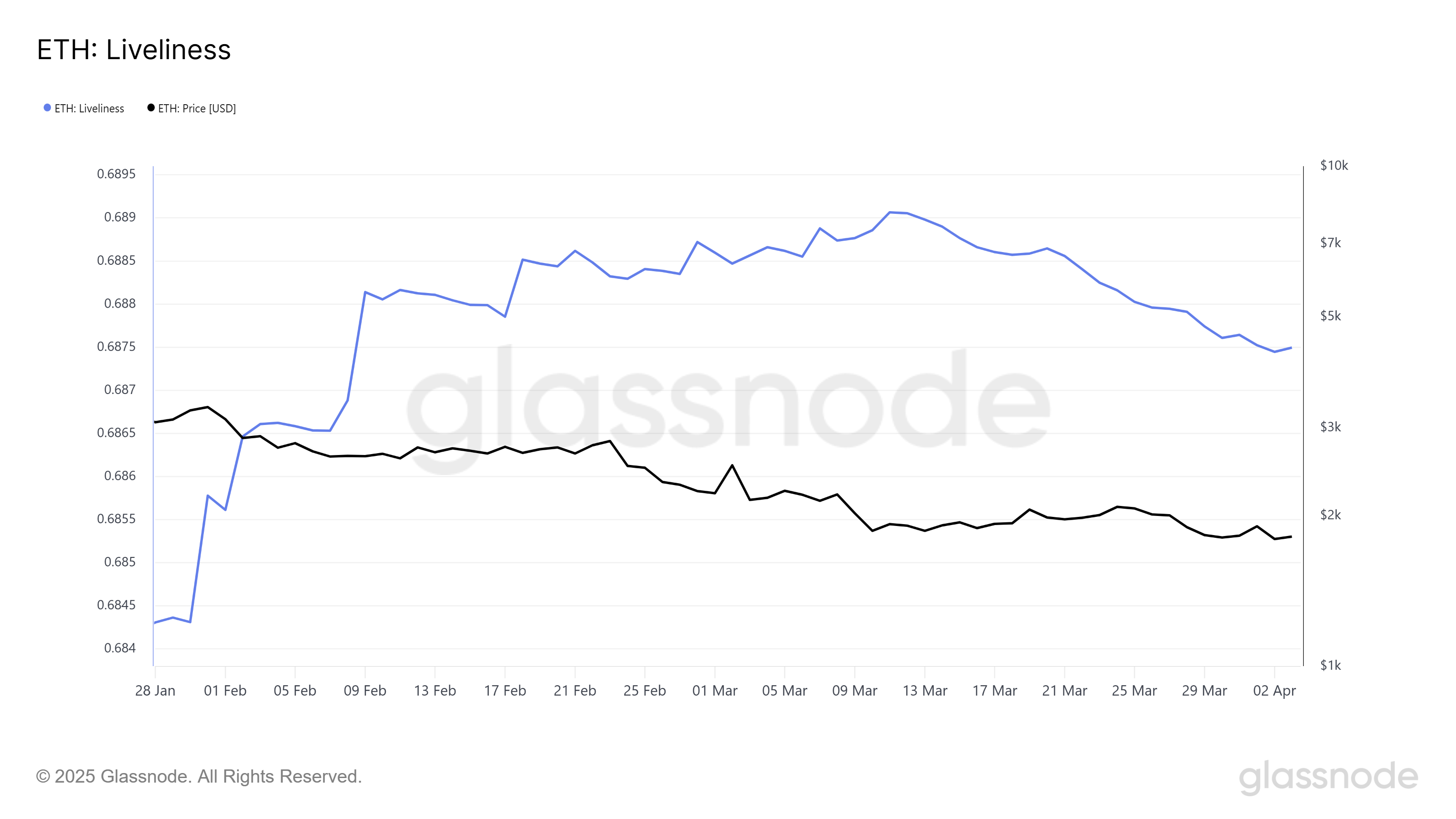

Over the previous month, Ethereum’s Liveliness indicator has declined, signaling that the promoting stress is weakening. Liveliness measures the exercise of long-term holders, and a decline typically factors to accumulation reasonably than promoting.

This drop displays the rising sentiment amongst Ethereum’s long-term traders, who’re growing their holdings and anticipating the value to get well sooner or later. The decline in Liveliness means that many are assured in Ethereum’s fundamentals and are much less involved about short-term fluctuations.

This accumulation part means that Ethereum’s market sentiment could also be shifting. The boldness of LTHs—who maintain vital affect over the asset’s worth—might result in a powerful upward momentum as soon as the market situations enhance.

Ethereum Liveliness. Supply: Glassnode

ETH Worth Wants A Nudge

Ethereum is presently buying and selling at $1,802, just under the resistance stage of $1,862. The worth has been caught underneath this barrier for six weeks, persevering with the downtrend that has outlined a lot of the latest worth motion. Nevertheless, if Ethereum can break above $1,862, it might sign the top of the downtrend and the beginning of a worth restoration.

Given the present market sentiment and accumulation by key holders, it’s potential that Ethereum will proceed to achieve upward momentum. If Ethereum efficiently breaks by the $1,862 resistance, it might transfer towards the $2,000 mark, regaining among the losses from the earlier weeks.

Ethereum Worth Evaluation. Supply: TradingView

Then again, ought to the bearish sentiment intensify, Ethereum’s worth might dip additional towards its 17-month low of $1,745. Failure to safe help at this stage might result in even better losses. This might prolong the latest downtrend and depart many traders uncovered to a protracted bearish market.