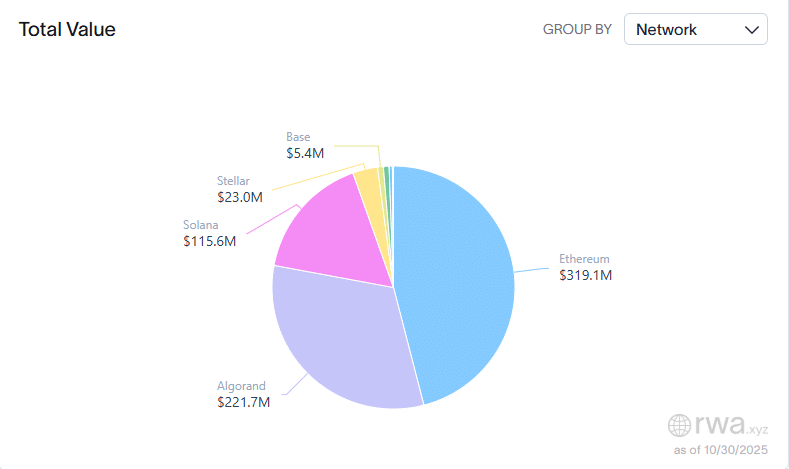

Led by Ethereum, the securities tokenization market is booming, as extra equities turn out to be out there for retail and institutional traders to purchase on-chain.

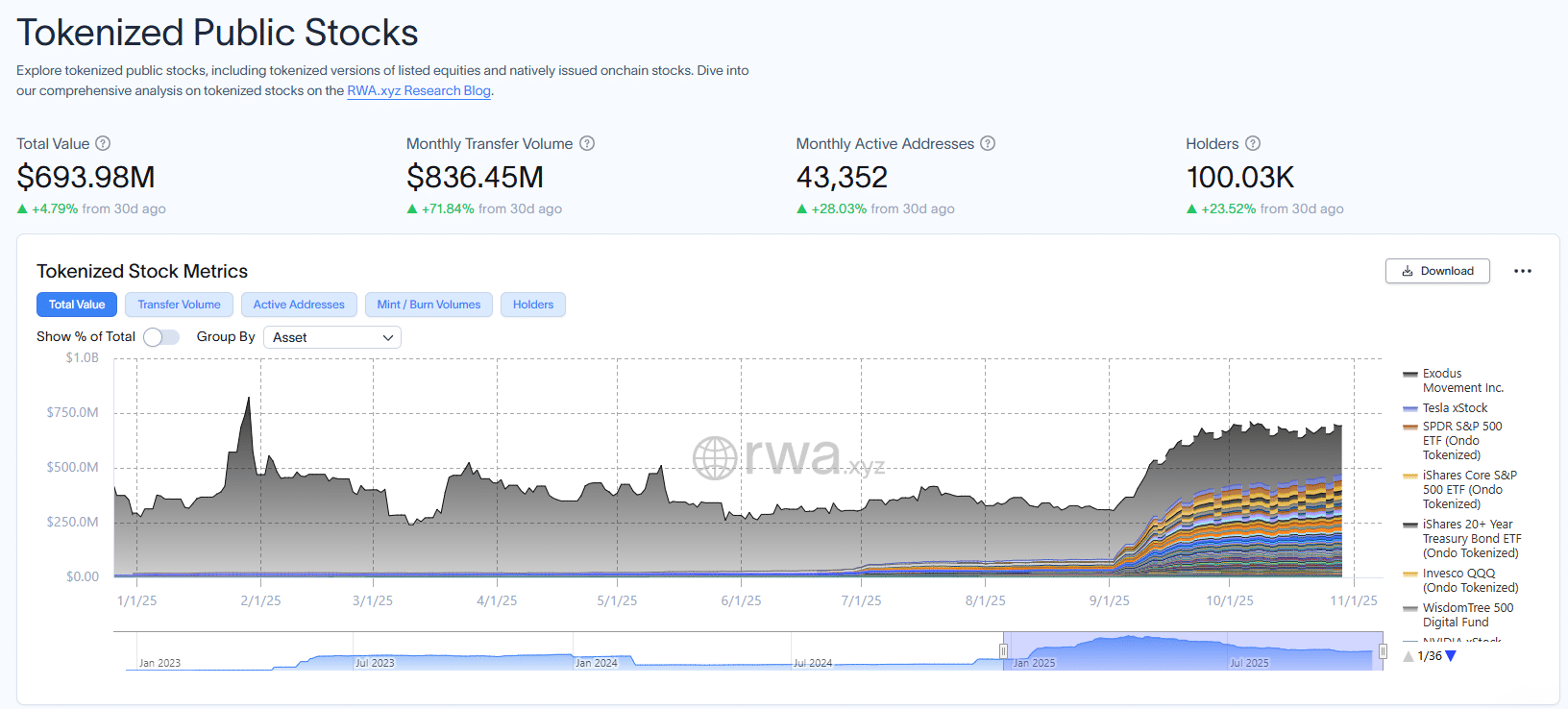

Knowledge from RWA.xyz signifies that the tokenized public inventory sector is on the rise, pushed by rising investor curiosity. Its complete market worth has surged to roughly $694 million, up 4.8% over the previous 30 days.

Actual-World Equities Thriving Onchain

Notably, curiosity in tokenized shares seems much more intense when measured over a long term. On the shut of the second quarter of 2025, the sector had a worth of $302.7 million. The present numbers present an over twofold, or 129%, progress, as capital continues to move into the market.

Whole Worth by Community | RWAxyz

Tokenized Fairness Standing By Suppliers

When it comes to suppliers, Ondo leads the tokenized public shares league desk, with roughly $317.6 million in tokenized belongings on its platform. A few of the main shares supplied on the protocol embody BlackRock’s iShares Core S&P 500 ETF and the SPDR S&P 500 ETF.

Securitize, which lately introduced a partnership with BNY Mellon to launch tokenized funds backed by AAA-rated collateralized loans on-chain, stands in second place. The platform holds about 31.94% of the tokenized inventory market shares, valued at $221 million.

In the meantime, the following is Backed Finance (xStocks), with a complete worth of $121.2 million and a market share of 17.46%. Different platforms, akin to WisdomTree and Centrifuge, maintain lower than 5% of the market share.

The Tokenization Market Is Nonetheless Younger

Notably, the month-to-month switch quantity of the tokenized public inventory market stands at $836.45 million, up 71.84% during the last 30 days. This additionally follows a 28% surge in month-to-month energetic addresses to 43,352 and a 23.5% progress in holders to 100,030.

Tokenized Public Inventory Knowledge | RWAxyz

But many imagine that the sector continues to be in its early phases of adoption. For the uninitiated, the tokenized shares deliver real-world equities onto the blockchain, making them tradable across the clock and accessible to all on-chain customers.

This breaks down regulatory obstacles and geographic constraints, enabling traders to entry the world’s main firms from the consolation of their properties utilizing their crypto wallets.

In the meantime, analysts count on the sector to proceed to develop as extra of those shares come on-chain and customers regularly turn out to be conscious of them. Prime firms like BlackRock and Ripple are massive on real-world asset tokenization, tapping into the sector to draw trillions of {dollars} within the subsequent few years.