On June 20, a key on-chain metric monitoring the habits of ETH’s long-term holders (LTHs) closed at its all-time excessive, signaling mounting promoting strain from this cohort.

This comes at a time when broader market momentum has cooled considerably. With demand for ETH weakening and traders largely sidelined amid a persistent market lull, bearish sentiment is rising.

Ethereum Liveliness Hits Document Excessive

Based on Glassnode, ETH’s Liveliness spiked to an all-time excessive of 0.69 throughout Friday’s buying and selling session. This metric tracks the motion of long-held/dormant tokens. It does this by measuring the ratio of an asset’s coin days destroyed to the entire coin days accrued.

ETH Liveliness. Supply: Glassnode

When this metric falls, the LTHs of an asset are shifting their property off exchanges, a transfer seen as a sign of accumulation. Then again, as with ETH, when it climbs, LTHs are shifting their cash to exchanges to promote them.

This spike in ETH’s Liveliness to 0.69 means that its LTHs are more and more liquidating their positions as uncertainty grows. It displays the rising insecurity within the coin’s near-term worth restoration.

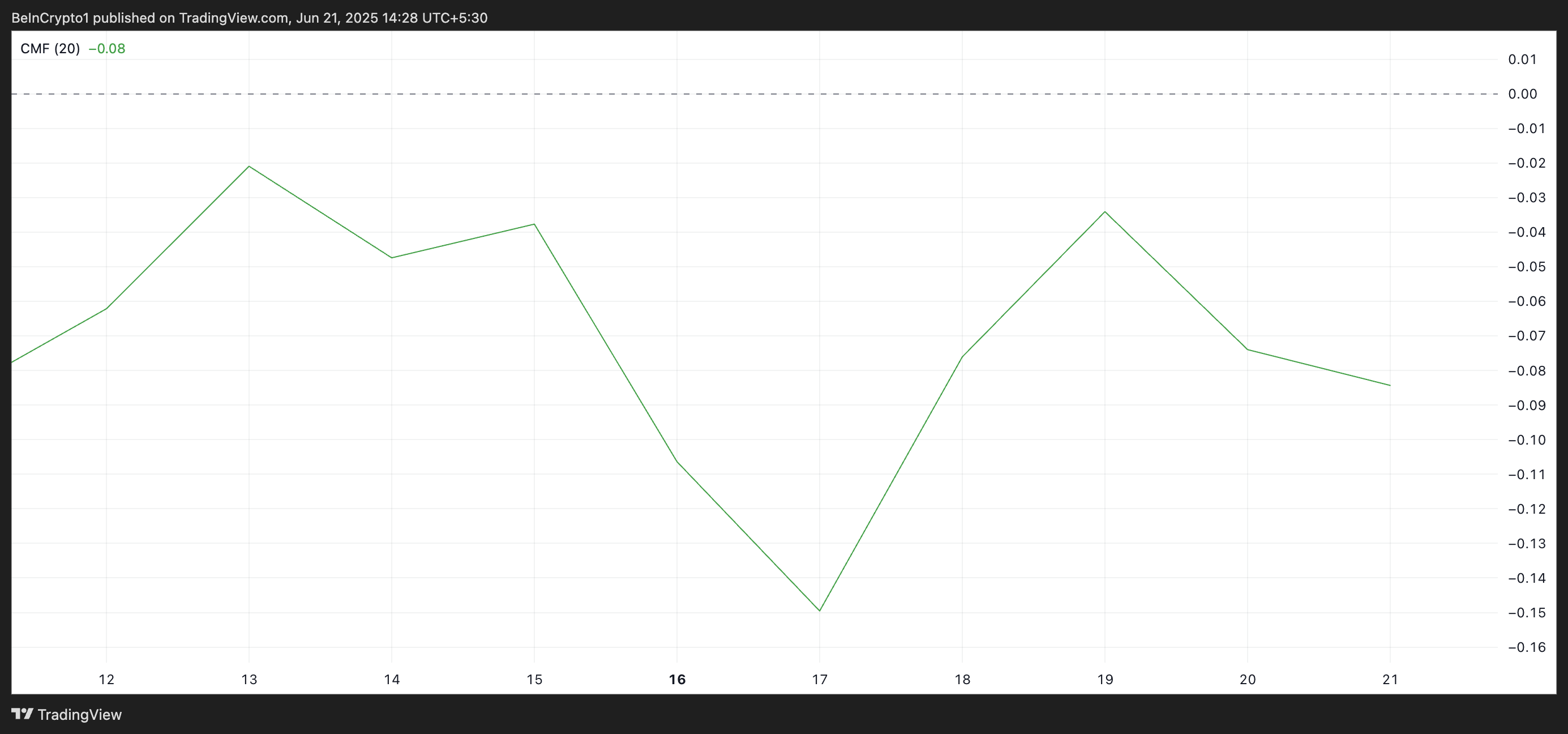

Extra affirmation of this bearish pattern may be discovered on ETH’s day by day chart, the place the coin’s Chaikin Cash Circulation (CMF) is adverse and is trending downward. As of this writing, ETH’s CMF stands at -0.08, indicating a drop in capital inflows.

ETH CMF. Supply: TradingView

The CMF indicator measures the move of cash into and out of an asset. When its worth is adverse, it indicators low shopping for curiosity and validates the shift towards distribution reasonably than accumulation.

ETH Eyes Drop to Could Lows

Persistent offloading by ETH’s long-term holders, mixed with falling market-wide demand for the coin, might trigger it to see a deeper correction within the close to time period.

At press time, the main altcoin trades at $2,429. If selloffs persist amongst ETH’s seasoned holders, the coin might drop towards $2,185. If this worth ground fails to carry, the coin might dip additional to $2,027, a low it final reached in Could.

ETH Value Evaluation. Supply: TradingView

Conversely, a resurgence in new demand for the altcoin will invalidate this bearish outlook. In that state of affairs, its worth might reverse its downtrend and climb towards $2,745.