Ethereum wakened spicy Sunday as spot markets and derivatives desks steered the tone whereas spot value hovered close to $4,014 after a $3,971–$4,031 intraday jog.

Calls Rule the Board, Places Rule the Day: Inside Ethereum’s Derivatives Combine

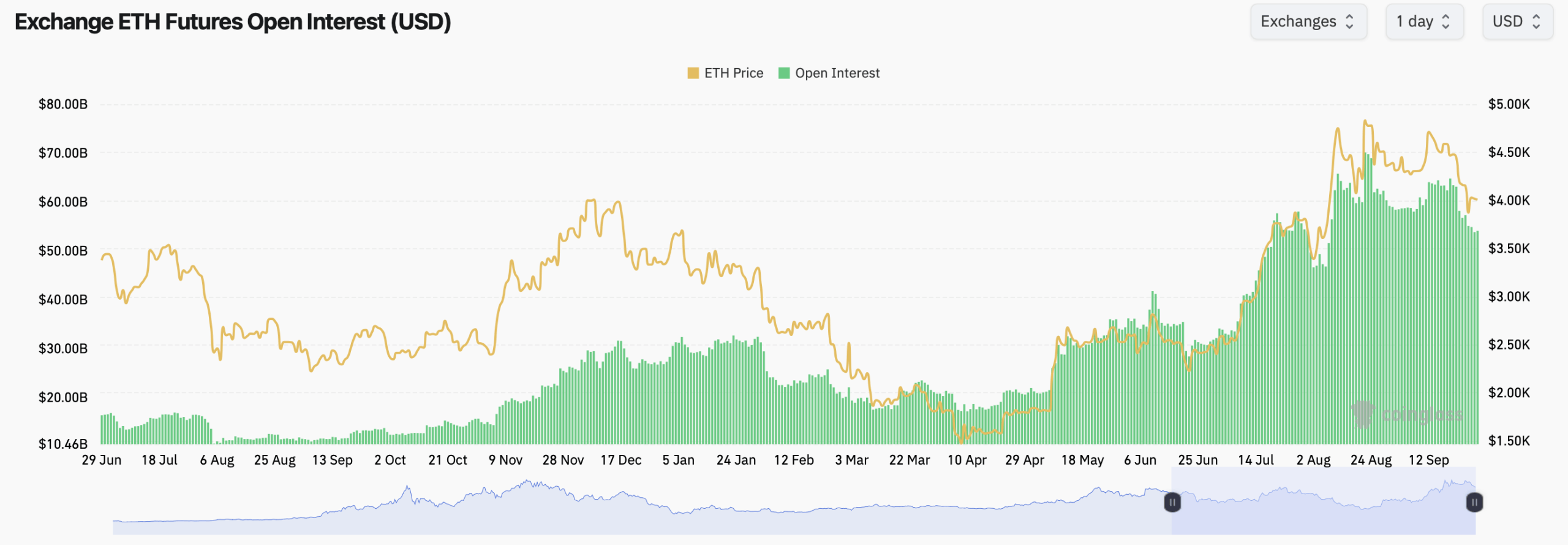

Futures positioning stayed vigorous. Coinglass figures present trade ether open curiosity (OI) elevated versus early summer time, peaking in August and easing into late September, whilst value cooled from the current push above $4,500 again towards the low $4,000s and under that vary.

Futures trade leaderboards are crowded forward of the upcoming week. CME exhibits 2.19 million ETH in open curiosity (~$8.76 billion), Binance lists 2.65 million ETH (~$10.62 billion), and OKX carries about 820,500 ETH (~$3.29 billion). Bybit sits close to 1.21 million ETH, Bitget at 1.46 million, Gate round 1.20 million, MEXC at 538,000, WhiteBIT 484,000, BingX 202,000, and Kucoin 111,000.

Intraday flows have been blended. One-hour OI ticks have been inexperienced throughout most venues, but 24-hour adjustments confirmed pink at CME, Binance, OKX, Kucoin, WhiteBIT, BingX, and MEXC, whereas Bybit, Gate, and Bitget notched small positives. Ratios of OI to 24-hour quantity skewed excessive at WhiteBIT and Bitget and lean at OKX and BingX.

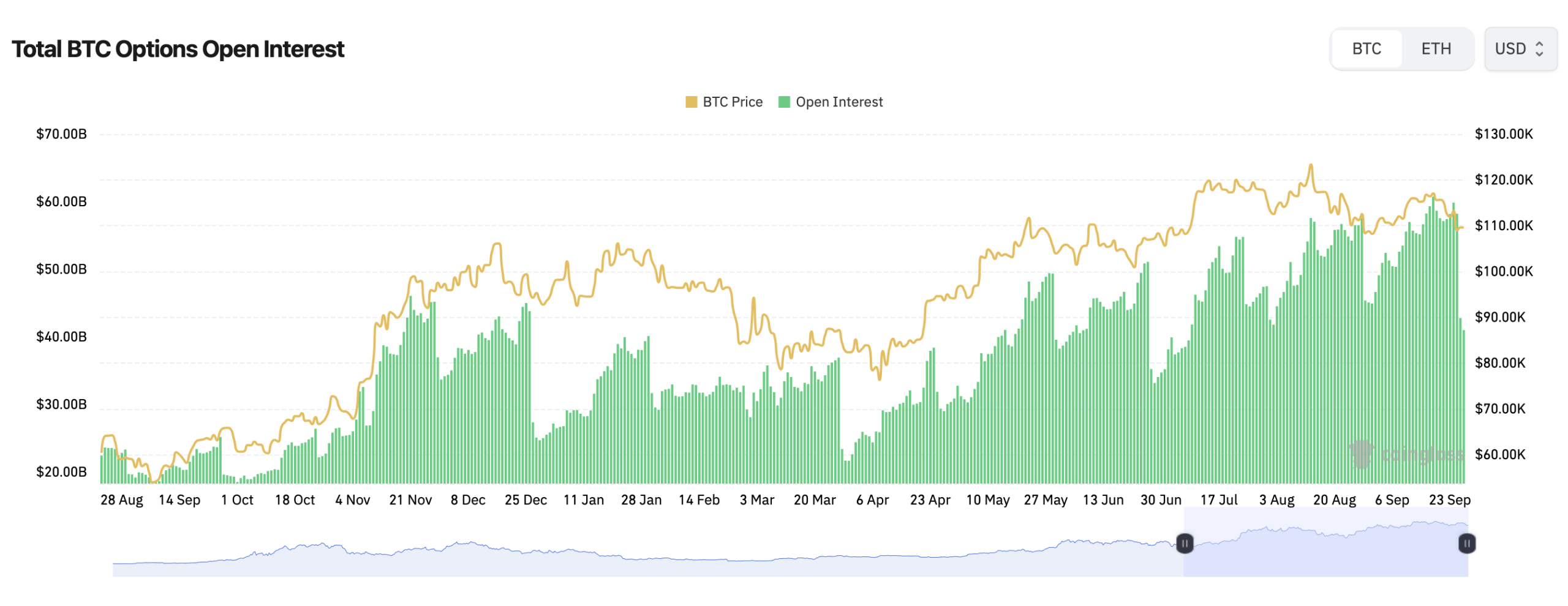

ETH choices merchants have additionally saved the board fairly busy. This weekend, information exhibits that calls maintain 63.49% of open curiosity, equal to 1,645,409 ETH, whereas places make up 36.51%, or 946,368 ETH. However the final day’s tape favored safety: places took 62.11% of quantity, versus 37.89% for calls, roughly 87,280 ETH to 53,241 ETH.

Most bets are aimed toward year-end. On Deribit, merchants maintain essentially the most name choices (bets on increased costs) for late December: the $6,000 strike has about 92,738 ETH in open curiosity, adopted by $4,000 (76,104 ETH), $7,000 (60,682 ETH), and $5,000 (55,058 ETH). There are additionally stable stacks at $3,000 and $2,000.

At this time’s heaviest buying and selling leaned protecting. Bybit noticed massive quantity in places (draw back hedges): the Oct. 17 $2,000 put traded about 29,019 ETH, and the March 27, 2026 $500 put traded about 10,967 ETH. On the upside, Deribit’s Oct. 31 $6,000 name moved ~3,502 ETH, whereas OKX’s Sept. 29 $4,100 name and Binance’s Sept. 29 $3,750 put are additionally energetic.

“Max ache” — the worth the place essentially the most choices expire nugatory — sits close to $4,000 within the close to time period. It dips towards roughly $2,500 across the Mar. 27, 2026 expiry, then bends again towards $4,000 into late June and early fall 2026, suggesting merchants are hedging for some uneven, range-bound motion.

Put merely, leverage prefers increased strikes by December whereas flows hedge the stomach. That blend hints at range-respect close to $4,000 with fatter tails each methods as macro and exchange-traded fund (ETF) headlines rotate by the calendar.

With ethereum parked round $4,014, futures and choices collectively say persistence pays. Bulls have the open-interest stack, bears have the contemporary quantity, and each side have loads of exits marked round $4,000. Volatility sellers could lean in if rallies fade into resistance quickly.