A Messari analyst sparked heated debate over the weekend after declaring Ethereum is “dying” as community income declined in August.

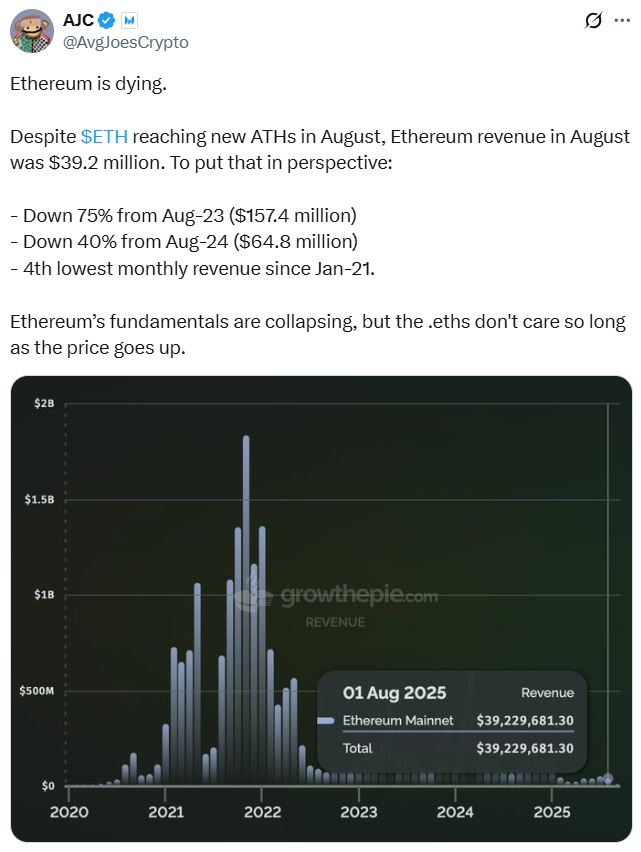

In an X publish on Saturday, Messari analysis supervisor AJC acknowledged that “Ethereum’s fundamentals are collapsing,” as Ethereum’s income from charges in August was $39.2 million, down over 40% year-over-year and roughly 20% month-over-month.

Supply: AJC

However many who learn the publish disagreed, pointing to Ethereum’s rising metrics, app income, stablecoin provide, continued L2 scaling and a distinction between Ethereum being a commodity, quite than a tech inventory — that means it shouldn’t be valued based mostly on income.

Ethereum remains to be a vibrant ecosystem

A big a part of Ethereum’s fall in income has come on account of the Dencun improve in March 2024, which lowered transaction charges for layer-2 scaling networks utilizing it as a base layer to publish transactions.

Talking to Cointelegraph, Henrik Andersson, chief funding officer of funding agency Apollo Crypto, stated it’s unlikely Ethereum is dying, as a result of information from Ethereum L2s analytics instrument growthepie exhibits it’s nonetheless “a vibrant ecosystem with stablecoin provide, throughput, and energetic addresses are all at or near all-time excessive.”

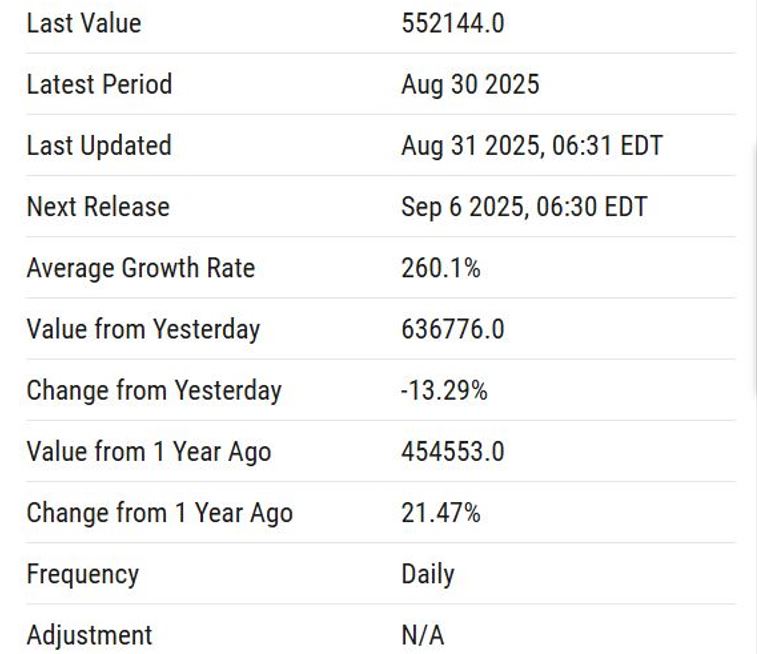

As of Aug. 30, there have been additionally over 552,000 day by day energetic addresses on Ethereum in line with funding analysis platform YCharts, representing a 21% improve because the similar time in 2024.

There have been over 552,000 day by day energetic addresses on Ethereum as of Aug. 30. Supply: YCharts

“We imagine each Ethereum and Bitcoin have a spot in a crypto portfolio,” Andersson stated.

“Ethereum is turning into the impartial decentralized base layer for finance and similar to Bitcoin isn’t valued on income however as a retailer of worth, we don’t imagine Ethereum might be valued solely on its income.”

In response to critics, nonetheless, AJC defended his use of income to worth the layer-1 blockchain, explaining that as a result of it’s collected in Ether (ETH), one of many largest historic demand drivers of consumption is now “trending towards zero.”

On the similar time, AJC argued that energetic addresses and transactions are “meaningless statistics because it pertains to demand.”

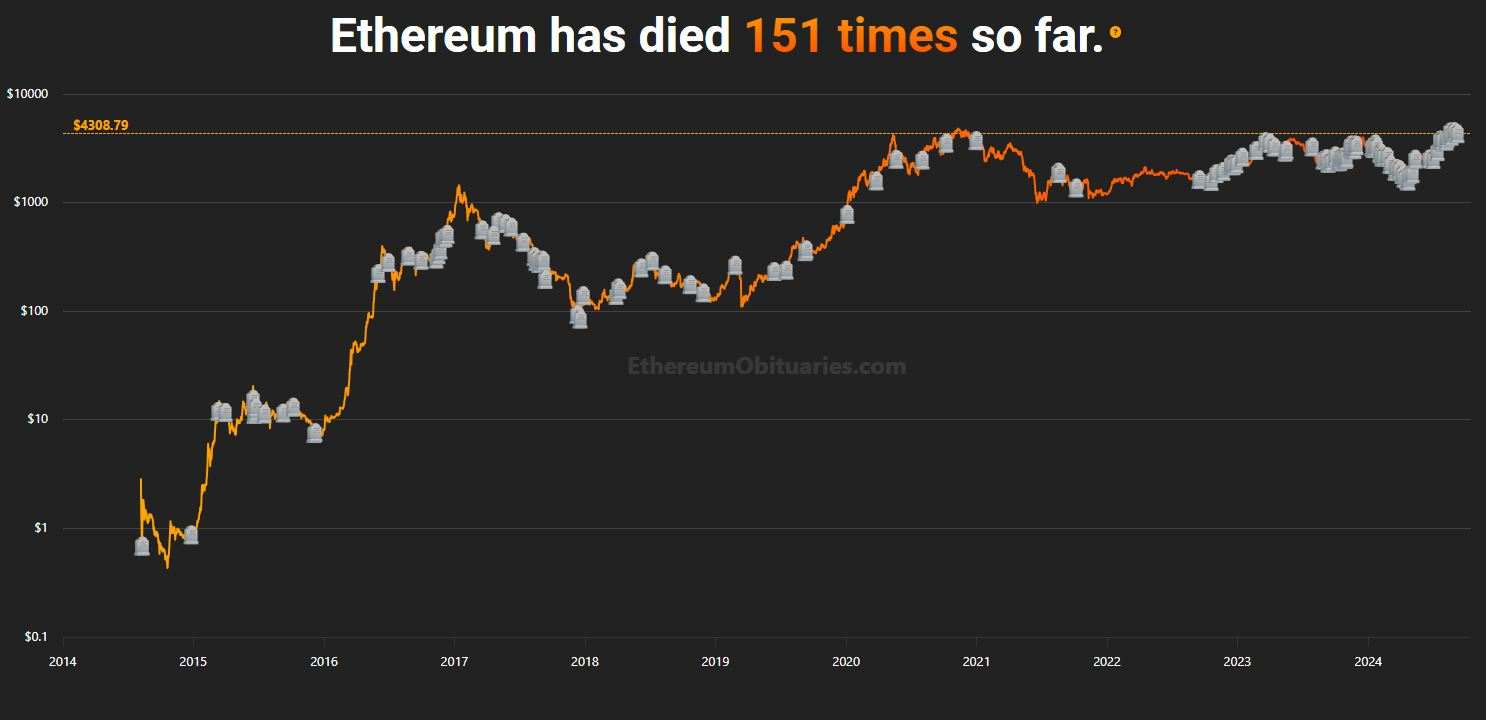

Ethereum has been declared “useless” 40 instances this 12 months

Ethereum has been declared by varied sources not less than 150 instances since 2014; most of those deaths have been recorded this 12 months, with about 40, in line with Ethereum Obituaries.

Ethereum has been declared useless 150 instances earlier than ACJ’s publish. Supply: Ethereum Obituaries

Ryan McMillin, chief funding officer at Merkle Tree Capital, instructed Cointelegraph that Ethereum continues to adapt and is usually declared useless in moments of narrative weak point, falling charges, transaction trending decrease, or when rivals outpace it.

He stated that in concept, as a result of good contracts are a aggressive sector, builders and capital may slowly however completely migrate elsewhere.

“However in observe, its developer group, entrenched DeFi protocols, and regulatory acceptance give it extra endurance than the obituaries recommend; its present narrative is it is going to be the TradFi chain of selection, though the SOL ETF might disrupt that too,” McMillin stated.

“The larger story is that crypto is maturing into an ecosystem of differentiated property, and Ethereum will stay one of many central items for years to return, and competitors with different L1s could be very wholesome.”

McMillin stated he doesn’t suppose Ethereum is “dying,” however stated it has been caught in a “tough spot” for almost two years as a result of it’s trapped between Bitcoin’s narrative as digital gold and Solana’s pitch because the sooner, cheaper various.

Associated: Ether whales have added 14% extra cash since April value lows

“Ethereum’s ultra-sound cash framing was by no means going to win in opposition to Bitcoin’s tougher financial premium, and with regards to throughput and value, Solana merely provides magnitudes of enchancment,” he stated.

One space that has helped Etherum in 2025 is its spot exchange-traded funds, which unlocked conventional finance flows and positioned Ether as a levered play on stablecoin adoption and community development, in line with McMillin.

“However that benefit might not final lengthy, spot Solana ETFs are anticipated within the coming weeks, which may rapidly stage the enjoying discipline for mainstream capital inflows.”

Journal: Korean invoice to legalize ICOs, Chinese language agency’s Ethereum RWAs thriller: Asia Specific