The Ethereum community witnessed one other main stablecoin issuance, with $991.9 million in ETH-backed USDT minted simply hours in the past, based on onchain information shared by analyst Maartunn. This massive-scale mint by Tether comes at a vital time, as each Ethereum (ETH) and Bitcoin (BTC) face rising stress throughout the market.

Ethereum has struggled to determine stable assist over the previous few days, buying and selling close to current native lows as investor sentiment turns more and more cautious. In the meantime, Bitcoin continues to check range-bottom ranges not seen since June, signaling that the broader crypto market stays in a corrective section following final week’s violent liquidation occasion.

Massive Tether mints, notably these issued on Ethereum, are sometimes seen as indicators of incoming liquidity — traditionally coinciding with short-term rebounds or preparations by market makers to “purchase the dip.” Nevertheless, given present volatility and declining momentum, merchants stay divided over whether or not this mint represents a bullish setup or a liquidity security measure throughout uncertainty.

Market Makers Could Be Positioning for a Brief-Time period Bitcoin Bounce

Based on Maartunn, the current ETH-backed Tether mint of practically $1 billion could possibly be an early signal that market makers are making ready to purchase the dip. Traditionally, giant USDT mints — particularly these occurring throughout market downturns — have preceded short-term rebounds in Bitcoin (BTC) and different main property. These mints usually function liquidity injections, enabling buying and selling desks and institutional gamers to deploy capital rapidly as soon as volatility begins to subside.

Maartunn shared a chart evaluating BTC value actions with the timing of Ethereum-based USDT mints, displaying a transparent sample: spikes in Tether issuance ceaselessly align with native market bottoms. This correlation means that contemporary stablecoin liquidity tends to movement into Bitcoin and Ethereum during times of panic, stabilizing costs and sometimes triggering sharp aid rallies.

Nevertheless, the market stays in a state of worry and uncertainty, with BTC buying and selling close to $110,000 and testing decrease assist ranges. Funding charges stay subdued, and open curiosity continues to unwind after final week’s historic liquidation occasion.

Within the coming days, value motion across the $106K–$110K zone will likely be essential to gauge sentiment. If the mint-driven liquidity begins to flow into into spot markets, Bitcoin may expertise a short-term rebound. But when warning prevails and liquidity stays sidelined, the market may see one other leg of consolidation earlier than a clearer course emerges.

Whole Crypto Market Cap Assessments Key Help

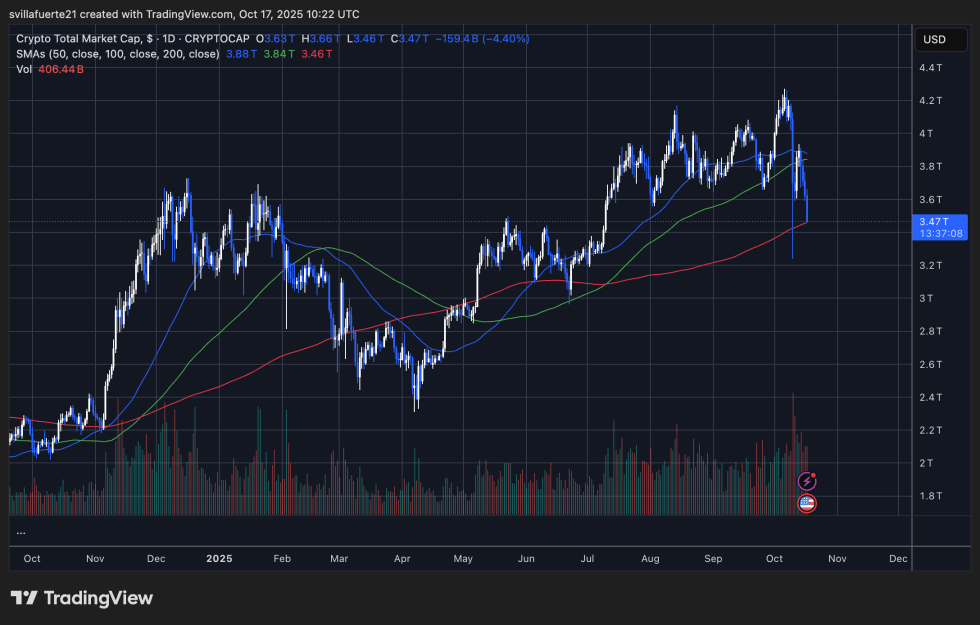

The entire cryptocurrency market capitalization has fallen sharply, dropping over 4.4% within the final 24 hours to round $3.47 trillion, based on the chart. This decline extends the correction that started after the current native peak close to $4.2 trillion, erasing weeks of good points and pushing the market again towards its 200-day transferring common — a essential long-term assist now positioned close to $3.46 trillion.

This stage is critical as a result of it represents each a psychological threshold and a technical pivot level for total market construction. A transparent break under it may open the door to deeper losses, with the subsequent notable assist seen close to $3.2 trillion, whereas a powerful rebound from right here may affirm that the broader uptrend stays intact.

The 50-day and 100-day transferring averages (presently at $3.88T and $3.84T) have each turned downward, reflecting weakening momentum and rising warning amongst traders. The current spike in buying and selling quantity suggests capitulation-like exercise, presumably linked to pressured liquidations throughout Bitcoin, Ethereum, and main altcoins.

For now, the full market cap sits at a crossroads — sustaining the $3.4T zone may mark the beginning of stabilization, however shedding it could affirm a deeper section of correction earlier than any sustainable restoration.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.