A number of Ethereum (ETH) on-chain metrics counsel a possible short-term worth correction after the cryptocurrency’s 35% rally over the previous 30 days. ETH not too long ago touched the $4,000 mark, prompting considerations that it was overbought.

As the value reaches this key resistance stage, the metrics counsel that promoting stress could intensify, probably resulting in a pullback earlier than any additional upward motion.

Ethereum Flashes Bearish Indicators

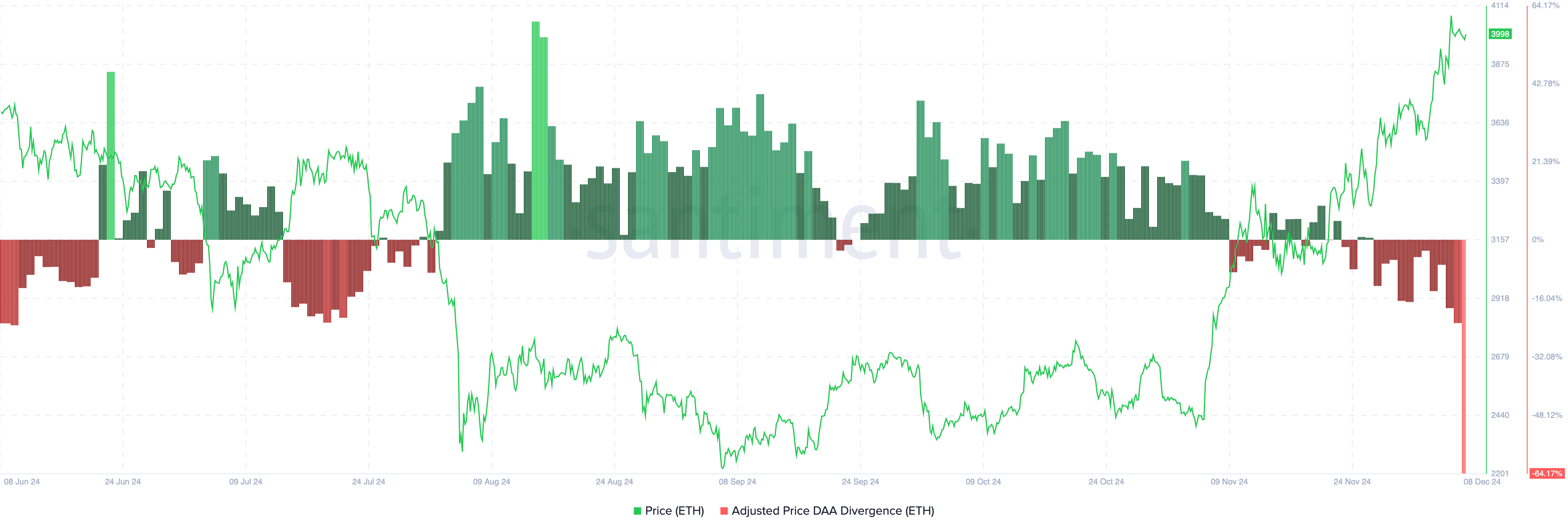

One of many high Ethereum on-chain metrics suggesting this decline is the price-Each day Energetic Addresses (DAA) divergence. Merely put, the value DAA divergence reveals whether or not a cryptocurrency’s worth is rising alongside person engagement or not.

When the metric’s studying is constructive, it implies that person engagement has elevated, and as such, it presents a possibility for the value to go additional excessive. However, when the value DAA is unfavorable, it implies that community exercise has decreased, and due to this fact, the upswing might stall.

Based on Santiment, Ethereum’s worth DAA divergence has dropped to -64.17%. This steep decline signifies a drop in addresses interacting with the cryptocurrency. Given the situations acknowledged above, ETH’s worth might lower consequently.

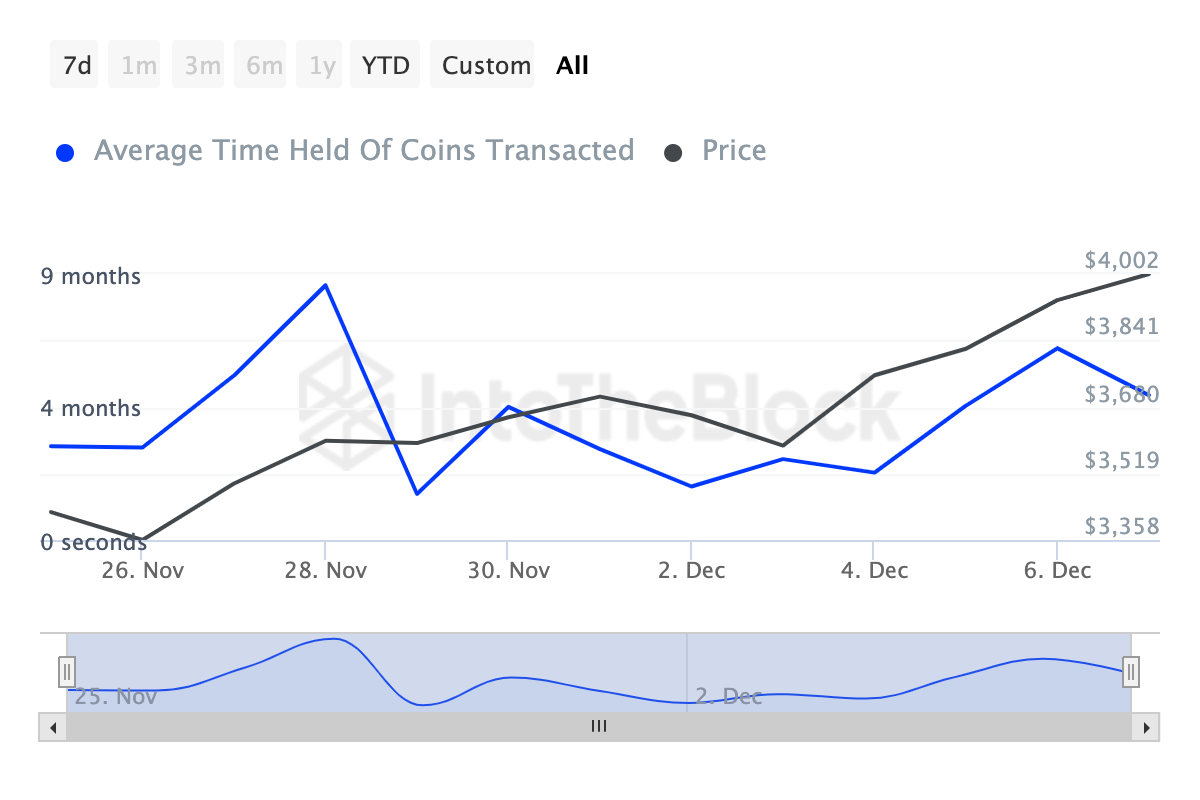

Moreover, BeInCrypto’s evaluation of the Cash’ Holding Time additionally aligns with this bias. The Cash Holding Time measures the period of time a cryptocurrency has been held with out being offered or transacted.

When it will increase, it means most holders have determined to not promote. However a lower, then again, signifies in any other case.

Based on IntoTheBlock, Ethereum’s Cash Holding Time has decreased since December 6, suggesting that the cryptocurrency is dealing with promoting stress. If this pattern continues within the coming days, ETH’s worth might drop beneath the $3,900 threshold.

Ethereum Cash Holding Time. Supply: IntoTheBlock

ETH Value Prediction: Again Under $3,800?

On the 4-hour chart, Ethereum’s worth confronted resistance at $4,073, resulting in a pullback to $3,985. Additionally, the Cumulative Quantity Delta (CVD) has dropped to unfavorable territory.

The CVD is a technical evaluation instrument that gives an in depth view of shopping for and promoting stress out there. With the indicator, merchants can inform the online distinction between shopping for and promoting volumes over a particular time interval.

When the CVD is constructive, it means shopping for stress is dominant. However, a unfavorable CVD signifies rising promoting stress, which is the case with ETH.

Ethereum 4-Hour Evaluation. Supply: TradingView

Ought to this stay the identical, then Ethereum’s worth would possibly drop to $3,788. In a extremely bearish scenario, the value can drop to $3,572. Nonetheless, if the pattern modifications, which may not occur. As a substitute, the cryptocurrency would possibly rise towards $4,500.