Ethereum is present process some of the important resets in over a 12 months, brought on by its worth breaking under $4,000. This retest has been most seen in futures open curiosity, the place billions of {dollars} in positions have been worn out throughout main exchanges. This fast unwinding comes as a correction transfer to weeks of extreme leverage throughout uptrends that had pushed derivatives exercise to unsustainable ranges.

Large Open Curiosity Wipeout Throughout Main Exchanges

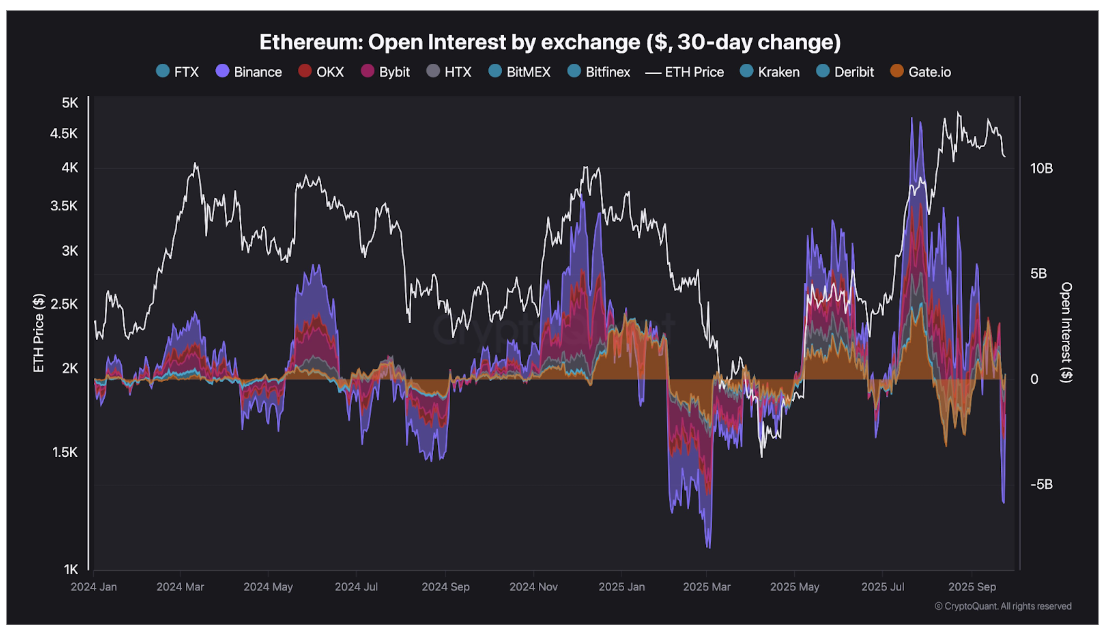

The newest Ethereum worth correction was a broader market reset fairly than a mere dip, with leveraged merchants dealing with the brunt of the losses. Knowledge exhibits that Ethereum’s open curiosity skilled a steep downfall over the simply concluded week throughout a number of crypto exchanges. In response to knowledge from on-chain analytics platform CryptoQuant, billions value of Ethereum positions have been worn out final week, with Binance main the downturn with the steepest month-to-month common drop.

Ethereum’s slide beneath the $4,000 mark proved to be the breaking level for over-leveraged merchants. The transfer unleashed a wave of liquidations throughout derivatives markets, compounding promoting strain.

Knowledge exhibits that greater than $3 billion was erased on September 23 by means of Binance alone, adopted by over $1 billion only a day later. Bybit additionally shed $1.2 billion in positions, whereas OKX recorded a $580 million decline. The sharp discount is seen in mixture open curiosity, which has slumped to its lowest stage since early 2024.

Because the chart knowledge exhibits, futures leverage and open curiosity have been intently tied to the worth rally in July and August, and on the similar time, it declined in lockstep with the worth.

Ethereum Open Curiosity by trade

Spot Ethereum ETF Outflows Add To Market Pressure

Ethereum’s break under $4,000 and the decline in open curiosity coincides with every week of heavy outflows from spot Ethereum ETFs in america. In accordance to knowledge from Farside Traders, $795.56 million flowed out over 5 buying and selling days final week, which is the most important weekly exodus for the reason that merchandise launched.

The sell-off intensified towards the top of the week, with Thursday recording $251.2 million in outflows, adopted by one other $248.4 million on Friday. Waning institutinal participation contributed massively to the sell-side strain, with buyers exhibiting warning amid uncertainty over whether or not regulators will permit staking options in these ETFs. This synchronized exit from each derivatives and institutional merchandise has amplified volatility, making a convergence of strain throughout Ethereum’s buying and selling ecosystem.

After dipping as little as $3,845, ETH bulls have managed to carry above $3,800. On the time of writing, Ethereum is buying and selling at $4,002. Regardless of this try to regain stability, the main altcoin remains to be down by about 10% in a weekly timeframe, contemplating it was buying and selling round $4,490 this time final week. The bullish state of affairs now lies in whether or not ETH can reclaim and maintain a transfer above $4,000.

Featured picture from Unsplash, chart from TradingView