Ethereum value rally misplaced momentum this week, shifting from a excessive of $3,387 on January 13 to the present $3,288 as considerations concerning the Market Construction Invoice rose.

Abstract

- ETH value has pulled again up to now few days as demand for cryptocurrencies waned.

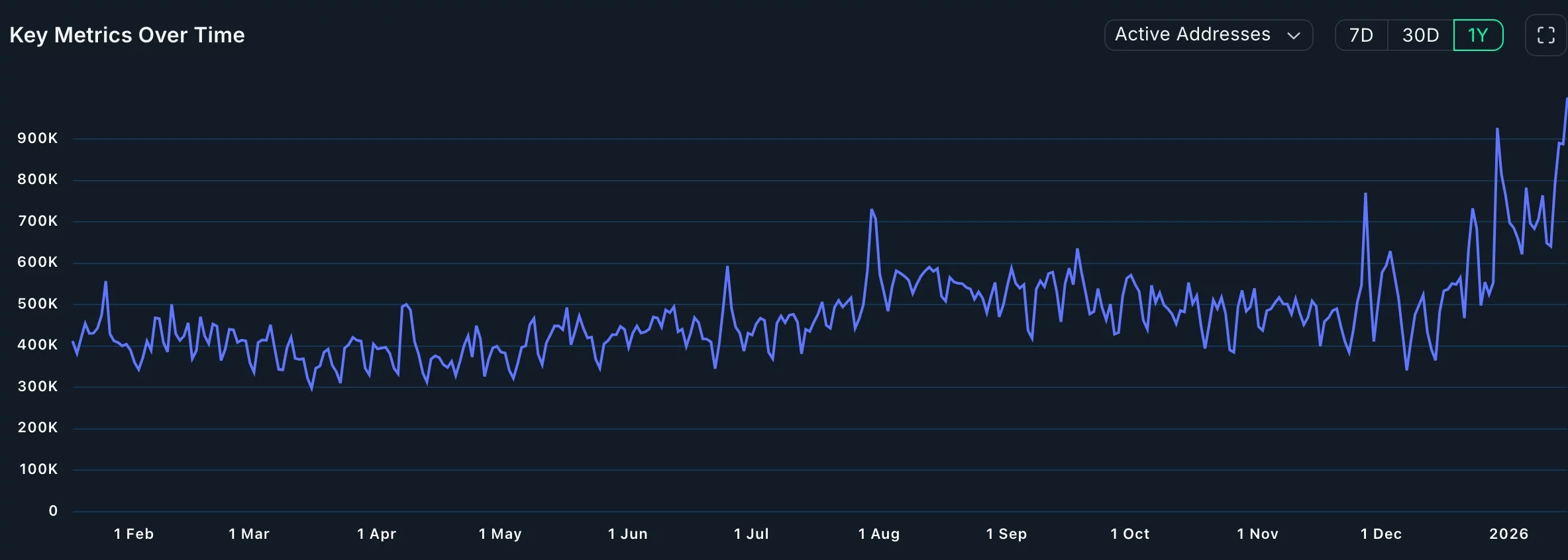

- Ethereum has encouraging fundamentals, together with increased community exercise.

- The token has shaped a rising wedge chart sample on the day by day chart.

Ethereum (ETH) token has dropped by 33% from its highest degree in August final 12 months, mirroring the efficiency of the broader crypto market.

The token has pulled again regardless of its sturdy fundamentals. For instance, knowledge compiled by SoSoValue exhibits that spot Ethereum ETFs have added over $584 million in inflows this 12 months, bringing the cumulative complete internet inflows to over $12.9 billion. All these funds have over $20 billion in belongings, with BlackRock’s ETHA having over $11.7 billion in belongings.

Ethereum’s community can be doing properly, with the variety of transactions and customers persevering with their progress momentum. The variety of transactions rose by 30% to over 58 million within the final 30 days, whereas energetic addresses rose by 64% to 13.1 million.

Ethereum’s stablecoin transactions have continued hovering this 12 months, with the provision of those tokens rising to $170 billion and the transaction quantity rising to $977 billion within the final 30 days. The community’s stablecoin transactions rose to over 50.4 million.

You may additionally like: Monero value eyes $930 as Fibonacci extension breakout continues

Extra knowledge exhibits that Ethereum buyers are shifting staking swimming pools, the place they’re incomes about 2.85% in annual returns. Information exhibits the staking market has jumped to over $118 billion, up by $1 billion within the final 30 days. BitMine has continued staking its large Ethereum hoard, which is a bullish factor.

Ethereum value technical evaluation

ETH value chart | Supply: crypto.information

The day by day timeframe chart exhibits that the Ethereum value has retreated from final 12 months’s excessive of $4,946 in August to the present $3,290. It has failed to maneuver above the 200-day Exponential Shifting Common, an indication bulls are shedding momentum.

The token has shaped a rising wedge sample, which is characterised by two ascending and converging trendlines. A wedge is among the most typical bearish reversal patterns.

It has additionally shaped a bearish pennant and bearish divergence patterns. Subsequently, the coin will possible have a robust bearish breakout, doubtlessly to the important thing help degree at $2,623, its lowest degree on November 21. This goal is about 20% under the present degree.

On the flip facet, a transfer above the important thing resistance degree at $3,500 will invalidate the bullish outlook and level to extra upside.

You may additionally like: NFT consumers rise 120% regardless of gross sales staying flat at $61.5 million