Ethereum value has crashed by over 52% from its highest degree in December, and technicals and on-chain metrics level to extra draw back within the close to time period.

Ethereum (ETH) peaked at $4,105 in December and was buying and selling at $1,970 on March 20. This 52% crash makes it one of many worst-performing blue-chip cash available in the market.

Ether has crashed as issues about its future stay. Simply this week, Normal Chartered analysts downgraded their estimate by 60% from $10,000 to $4,000, citing the rising competitors from layer-1 and layer-2 networks which have affected its income development.

Layer-2 networks on Ethereum, like Coinbase’s Base, Arbitrum, and Optimism, have drawn extra customers to their ecosystems due to their decrease charges. For instance, DeFi Llama’s information exhibits that DEX Ethereum protocols dealt with over $9.8 billion in quantity within the final seven days.

Arbitrum dealt with $2.87 billion, whereas Base had $2.8 billion. Prior to now, this quantity would have been dealt with on Ethereum’s mainnet community.

Ethereum can also be seeing intensified competitors from layer-1 networks like Solana (SOL) and BNB Chain. BNB Sensible Chain’s DEX protocols dealt with DEX quantity price over $13 billion within the final seven days.

Ethereum can also be not anticipated to be a significant beneficiary of rising applied sciences like Actual World Asset tokenization due to its increased charges and slower velocity. As an alternative, builders could decide to make use of different scalable and cheaper networks like Mantra (OM) and BNB Chain.

You may also like: Cardano pockets Lace provides Bitcoin help

Ethereum has weak on-chain metrics

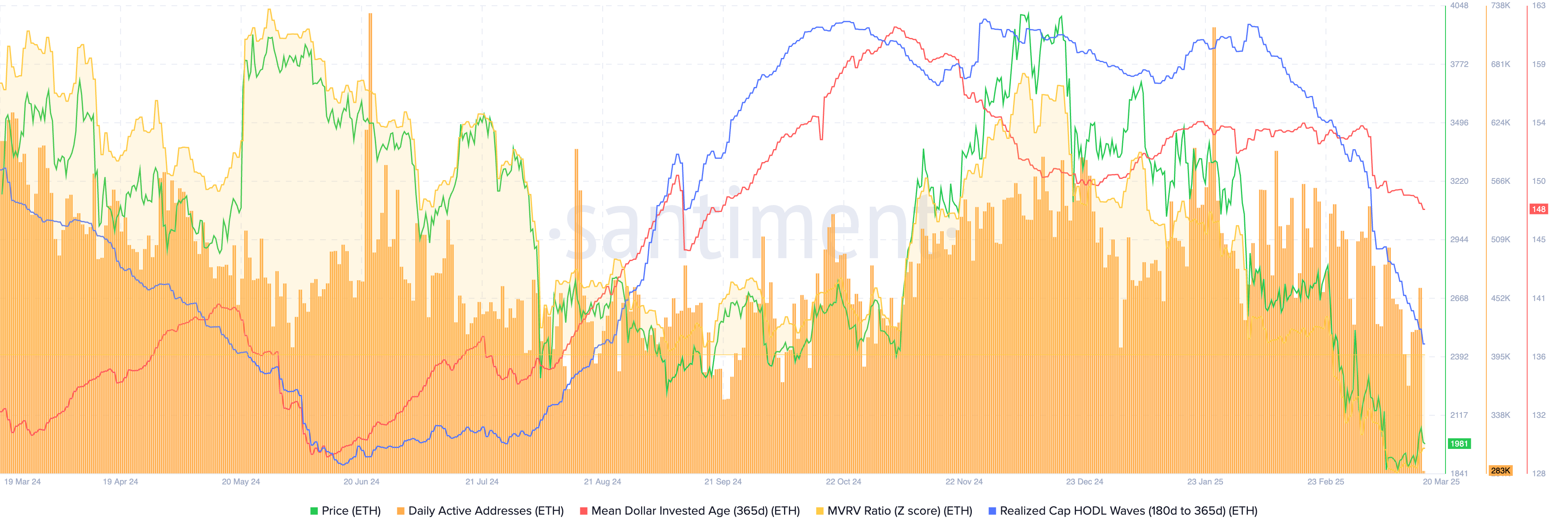

Extra information exhibits that the variety of lively addresses on Ethereum has declined up to now few months. The chart beneath from Santiment exhibits that Ethereum had 461,000 lively addresses on Wednesday, down from 717,000 earlier this yr.

One other notable information level is Ethereum’s realized cap HODL wave, which is proven in blue. It has crashed to the bottom level since August final yr, an indication that long-term holders have began to promote.

The 365-day imply greenback invested age or MDIA, which calculates the length that every coin has stayed in an handle and all the cash used to purchase it, has dropped to its September lows.

Ethereum every day lively addresses, MDIA, and realized cap | Supply: Santiment

Ethereum value technical evaluation

ETH value chart | Supply: crypto.information

The every day chart exhibits that the ETH value has been in a robust downward development over the previous few months. This drop began after it fashioned a triple-top sample at $4,000, with the neckline at $2,120.

Ether then fashioned a demise cross sample because the 50-day and 200-day transferring averages crossed one another. This cross usually results in extra draw back momentum. Additionally, well-liked oscillators just like the Relative Energy Index and Proportion Value Oscillator have dropped.

Due to this fact, the coin will doubtless proceed falling as sellers goal the psychological level at $1,500, which is about 25% beneath the present degree.

You may also like: MoonPay secures $200m credit score line from Galaxy