The Ethereum (ETH) value has rebounded sharply from its crash lows close to $3,430, climbing to round $4,130 at press time — a achieve of roughly 20%. Whereas this seems to be like a powerful restoration, the worth chart and on-chain knowledge counsel that the transfer is probably not simple.

Ethereum may proceed to rise, however a short lived pullback would possibly observe earlier than the following leg greater takes form.

Whales Decide Up ETH, However Cautious Cohorts Preserve the Market Cut up

Ethereum’s present rebound seems to be pushed by massive wallets reasonably than smaller holders. Information from Santiment reveals that whale wallets have elevated their holdings from 100.28 million to 100.36 million ETH since October 11.

That’s about 80,000 ETH, price roughly $330 million at at the moment’s Ethereum (ETH) costs. The sluggish but regular rise in whale holdings alerts quiet accumulation after the crash, suggesting confidence amongst long-term gamers.

Ethereum Whales Slowly Including: Santiment

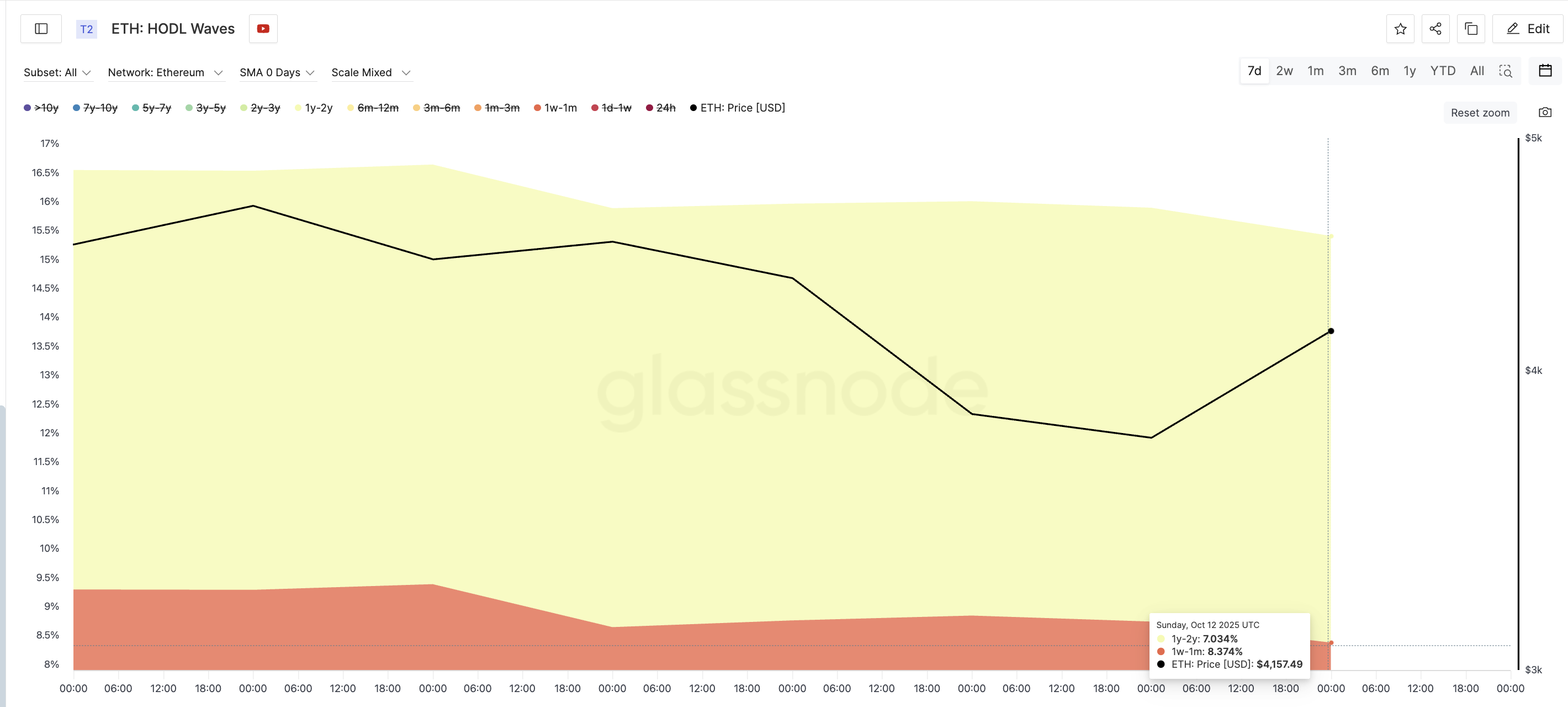

Nonetheless, some key holder teams haven’t proven the identical conviction. In line with Glassnode’s HODL Waves, which categorize cash by how lengthy they’ve been held, two key cohorts have lowered their publicity. The 1-week to 1-month cohort, usually made up of short-term merchants who react shortly to volatility, has trimmed its share from 8.84% to eight.37%.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

In the meantime, the 1-year to 2-year cohort, typically mid-to-long-term holders who assist stabilize costs throughout unsure phases, has declined from 7.16% to 7.03%, post-crash.

Ethereum Holders Nonetheless Cautious: Glassnode

These are the cohorts that normally form short-term momentum and maintain longer recoveries. Their present warning explains why Ethereum’s bounce, whereas promising, nonetheless seems to be uneven. Till these merchants and holders re-enter the market, the restoration might stay largely whale-driven. That would go away the Ethereum value motion extra unstable round resistance zones.

Cup Sample Factors to Ethereum Worth Rise, However a Pullback Might Come Subsequent

On the 4-hour chart, Ethereum is forming a cup sample, typically seen as a bullish reversal sign. The construction reveals value curving upward from round $3,640 towards the $4,130–$4,390 vary, with the formation wanting regular on each side. The lengthy decrease wick from the October 11 crash is excluded from the sample because it was a fast anomaly that didn’t have an effect on the broader construction.

Quantity tendencies validate this formation. Heavy crimson candles appeared on the left facet through the decline. Then, the quantity flattened on the base because the market stabilized. And eventually, inexperienced bars began rising on the suitable facet as shopping for returned.

Based mostly on this setup, the Ethereum value may climb to round $4,390, finishing the cup and aligning each rims at the same stage. As soon as that stage is reached, an ETH value pullback may observe because the deal with begins to kind.

Ethereum Worth Evaluation: TradingView

The deal with section may carry ETH right down to $4,070, or presumably $3,950, with out invalidating the construction. Nonetheless, a detailed beneath $3,950 would break the sample and sign weak point. If the deal with types cleanly and momentum holds, a breakout above $4,390 may set off the following leg up. That may goal $4,550 and $4,750 within the quick time period.

The put up Ethereum Worth Might Rise and Fall to These Ranges Earlier than Its Subsequent Rally — Right here’s Why appeared first on BeInCrypto.