Ethereum value has stalled this month as cryptocurrency traders stay on the sidelines, however some elementary and technical catalysts could push it greater.

Ethereum (ETH), the second-biggest cryptocurrency, was buying and selling at $2,700 on Tuesday, a 35% drop from its highest degree in November. This value is notable because it coincides with the place it was buying and selling on the identical date in 2024.

A couple of catalysts could assist to push Ethereum value greater within the coming months. First, knowledge exhibits that spot Ethereum ETFs have continued having inflows from Wall Road traders. They’ve had every day inflows in 7 out of 10 days this month, with their complete inflows since inception rising to $3.15 billion.

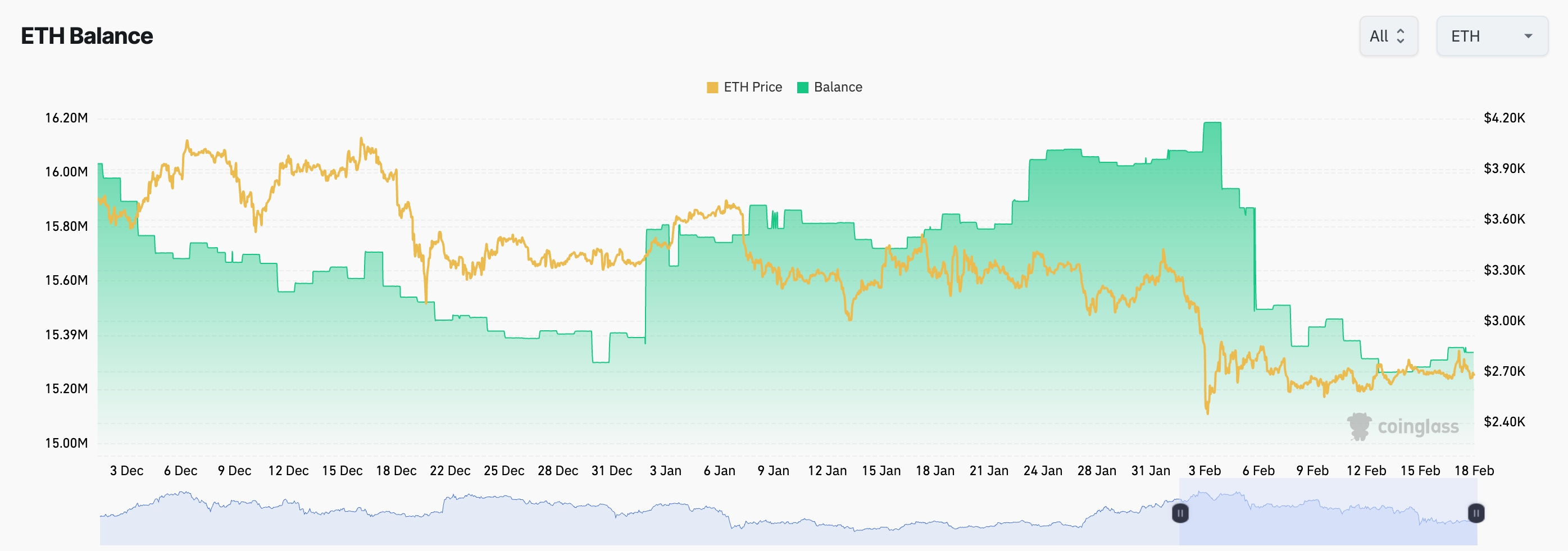

Second, CoinGlass knowledge exhibits that Ethereum balances in centralized exchanges have plunged previously few days. There at the moment are 15.34 million cash, down from this month’s excessive of 16.2 million. Falling balances are an indication that many ETH holders should not promoting and are as an alternative holding them in self-custody.

Ethereum balances on exchanges | Supply: CoinGlass

Third, there are indicators that Ethereum community is catching up with Solana (SOL) when it comes to decentralized change transactions. Protocols on Ethereum dealt with over $2.28 billion within the final 24 hours in comparison with Solana, which has been criticized after quite a few meme coin rug pulls. The newest one was Libra, which surged and crashed final weekend.

You may additionally like: Meteora co-founder Ben Chow resigns amid LIBRA memecoin scandal

Ethereum value has robust technicals

ETH value chart | Supply: crypto.information

Brief-term charts present that Ethereum value could have a robust bearish breakdown after forming a demise cross sample. This sample types when the 50-day and 200-day shifting averages cross one another.

Nonetheless, a more in-depth have a look at longer-term charts factors to a possible ETH value rebound. The weekly chart above exhibits that the buildup and distribution indicator has continued rising, signalling that traders have continued to build up the token.

It additionally exhibits that it’s forming an ascending triangle sample, which is made up of two components: an ascending trendline and a horizontal resistance. A bullish breakout occurs when the 2 traces close to their convergence. ETH has additionally fashioned a megaphone sample, one other bullish signal.

The problem is that the bullish breakout could take time since it’s on the weekly chart. Alerts on a weekly chart could take months or over a 12 months to finish.

A bullish breakout above the higher facet of the triangle at $4,061 will level to extra good points, presumably to the all-time excessive of $4,945 adopted by $5,000.

You may additionally like: Uniswap value types demise cross as change balances dip

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for academic functions solely.