Ethereum (ETH) has skilled vital value fluctuations in current weeks, with bearish stress mounting amid macroeconomic components and investor sentiment shifts. On the similar time, the U.S. Securities and Trade Fee (SEC) has accredited the primary spot Bitcoin and Ethereum combo ETFs, additional impacting the crypto panorama. This text delves into the most recent Ethereum value actions, key resistance ranges, and the potential influence of those landmark ETFs.

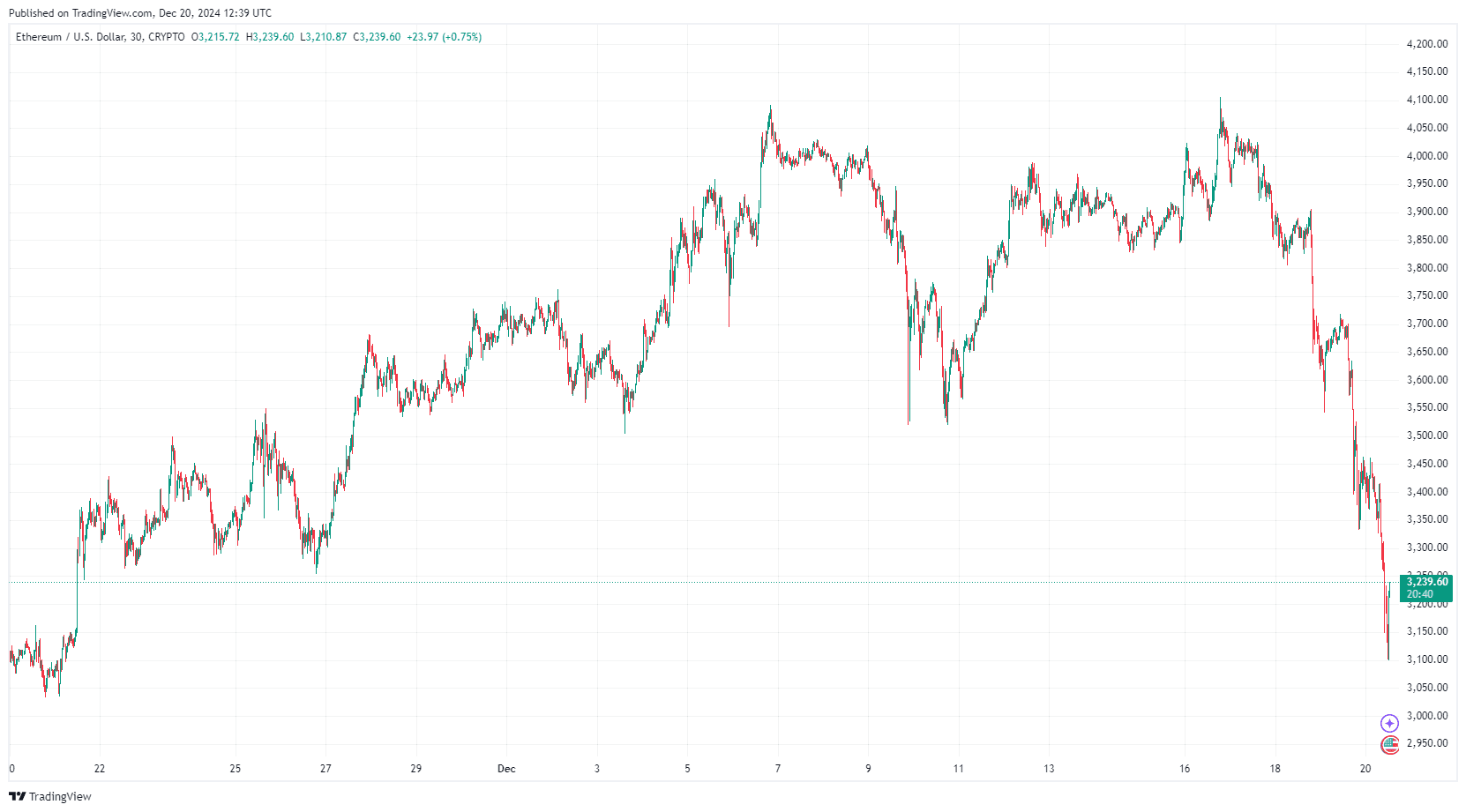

By TradingView – ETHUSD_2024-12-20 (1M)

1- SEC Approves Spot Bitcoin and Ethereum ETFs

The U.S. SEC has just lately accredited the first-ever spot Bitcoin and Ethereum combo ETFs from Hashdex and Franklin Templeton. This historic resolution is about to additional influence the Ethereum market. These ETFs will maintain spot Bitcoin and Ethereum primarily based on market capitalization, with an approximate 80/20 cut up favoring Bitcoin.

In response to Bloomberg analyst Eric Balchunas, the Hashdex Nasdaq Crypto Index US ETF and Franklin Crypto Index ETF will launch in January. These ETFs are anticipated to extend market accessibility for retail and institutional buyers, presumably resulting in larger liquidity and value stability within the Ethereum market.

Hashdex’s ETF, buying and selling below the ticker NCIQ, shall be managed by custodians reminiscent of BitGo, Coinbase, Constancy, and Gemini. Franklin Templeton’s ETF, buying and selling below the ticker EZPZ, may have comparable custodians. The SEC’s approval might sign a shift in regulatory attitudes towards crypto-based monetary merchandise, rising mainstream adoption of cryptocurrencies like Ethereum.

2- Influence of Spot ETFs on Ethereum’s Value

Traditionally, ETF approvals have pushed optimistic sentiment within the crypto market. Nonetheless, the present macroeconomic setting may restrict Ethereum’s value restoration. Whereas Bitcoin ETFs have seen vital success, Ethereum-based ETFs have but to attain comparable inflows. U.S. spot Bitcoin ETFs have amassed over $36 billion in internet inflows, whereas Ethereum ETFs have gathered round $2.4 billion since their inception.

Hashdex’s resolution to keep away from launching a devoted Ethereum ETF signifies warning throughout the asset administration neighborhood relating to demand for Ethereum-specific merchandise. Nonetheless, the mix of Bitcoin and Ethereum in a single ETF may improve publicity and demand for Ethereum within the broader market.

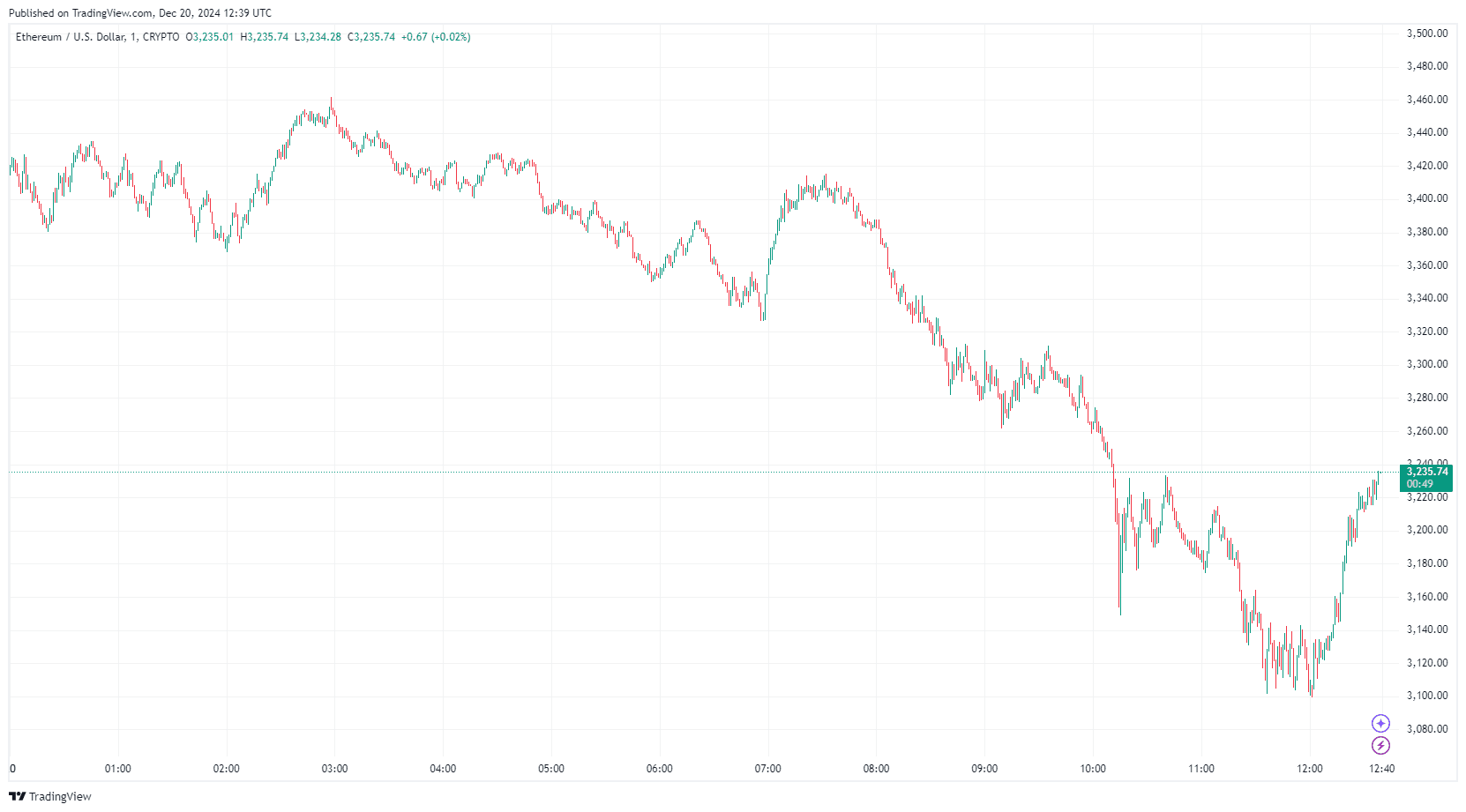

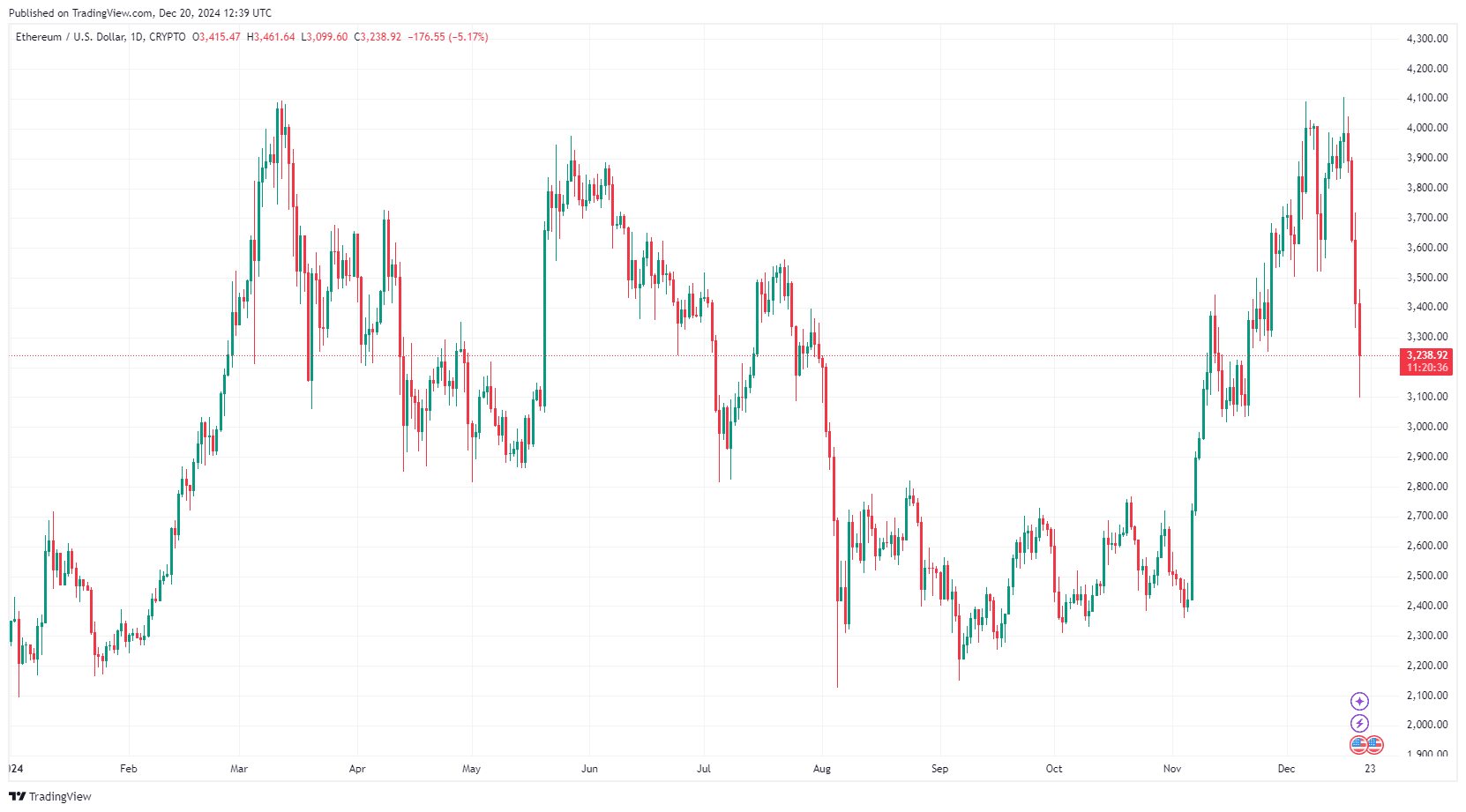

By TradingView – ETHUSD_2024-12-20 (1D)

3- Futures Merchants Flip Bearish on Ethereum

Knowledge from CoinGlass reveals a shift in Ethereum’s futures market sentiment. Open curiosity for Ethereum futures hit a brand new all-time excessive of $28.70 billion on December 17. Nonetheless, the lengthy/quick ratio dropped to 0.9, indicating that extra merchants are betting on a decline in ETH costs. This shift from lengthy to quick positions displays rising bearish sentiment available in the market.

For the primary time since November 6, the aggregated premium of futures positions turned detrimental, additional highlighting the shift towards bearish sentiment. Merchants have elevated quick positions, pushing the ETH value under the essential $4,000 mark. Given these tendencies, Ethereum’s value may see continued fluctuations within the $3,500 to $4,000 vary, as famous by market analyst Byzantine Common, who predicted ongoing value motion on this zone.

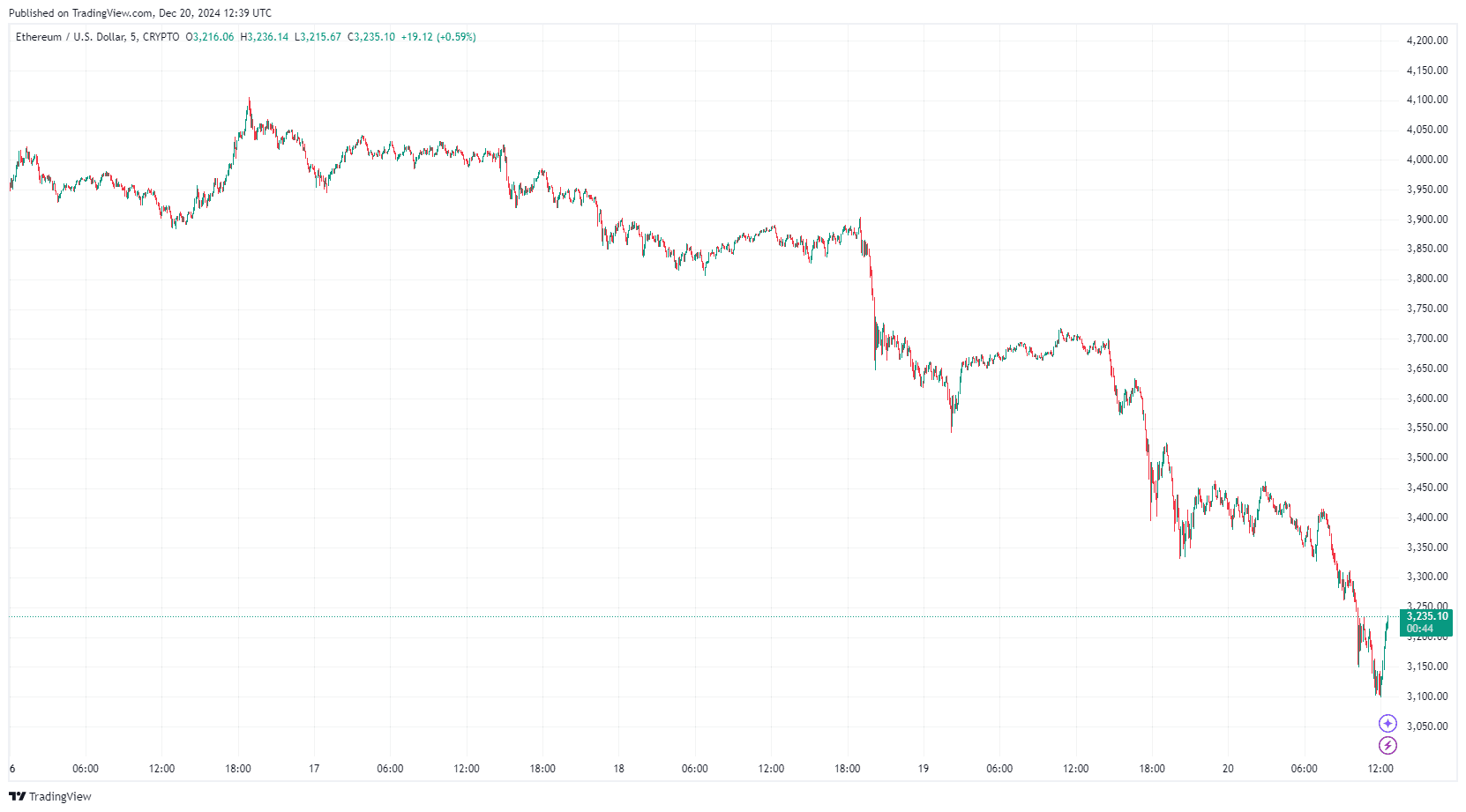

By TradingView – ETHUSD_2024-12-20 (5D)

4- Ethereum Key Assist and Resistance Ranges

Regardless of the bearish outlook, Ethereum’s market construction nonetheless reveals indicators of upper highs (HHs) and better lows (HLs). From a technical perspective, ETH might retest the area between $3,715 and $3,628. This vary holds vital assist from a 200-day Exponential Transferring Common (EMA) and coincides with a good worth hole (FVG). If the value breaks under this zone, it may set off additional declines, with assist close to $3,500.

The cumulative liquidation of lengthy positions between $3,700 and $3,800 has exceeded $500 million, making this vary essential for bullish restoration. On the flip aspect, short-leveraged positions are concentrated between $3,850 and $4,200, including additional resistance. If Ethereum’s value breaches these key ranges, volatility is prone to persist.

5- Ethereum Value Efficiency – Why is ETH Value Down?

Ethereum’s value just lately plunged from a excessive of $4,109 to a low of $3,260, marking a pointy 20% decline. The decline was triggered by elevated market stress following steerage from the U.S. Federal Reserve. The Fed’s announcement to restrict rate of interest cuts to solely two in 2025 raised investor considerations about liquidity available in the market, inflicting a broad selloff within the crypto sector.

This isn’t the primary time Ethereum’s value has confronted resistance on the $4,000 mark. Since 2021, this key stage has been examined 5 occasions however stays a robust resistance level. In 2024 alone, Ethereum did not maintain a breakout above $4,000 on three events. Analysts recommend this stage stays a major hurdle for any future bullish momentum.

By TradingView – ETHUSD_2024-12-20 (YTD)

Ethereum value decline, pushed by Federal Reserve coverage shifts and bearish futures market sentiment, has examined key assist ranges. The $4,000 resistance continues to behave as a vital threshold for future bullish momentum. In the meantime, the approval of spot Bitcoin and Ethereum combo ETFs by the SEC introduces new potential for mainstream crypto adoption and market stability.

With each bullish and bearish forces at play, Ethereum’s future value motion hinges on broader market sentiment, regulatory developments, and technical evaluation. Buyers shall be watching how the launch of ETFs impacts Ethereum’s liquidity and demand.