With Bitcoin holding regular at round $104k, Ethereum is gearing up for a possible breakout. Will ETH attain the $4,000 mark?

As Bitcoin consolidates above $104,000, Ethereum is gaining bullish momentum. This shift comes as a delayed impact of the U.S. Federal Reserve’s regular rates of interest, which have helped increase the broader altcoin market.

Ethereum has surpassed the $3,200 mark, rising the chance of a breakout. May this rally propel Ethereum to the $4,100 degree? Let’s discover the chances.

Ethereum Eyes Potential Breakout Rally to Cross $4,000

On the 4-hour chart, the Ethereum worth development reveals a bullish reversal with a double-bottom sample. As predicted in our final article, the reversal rally crosses the 23.6% Fibonacci degree at $3,248.

The restoration rally has additionally stretched the higher Bollinger band, reflecting a 1.12% surge within the final 4 hours. Having accomplished a post-retest reversal on the 23.6% Fibonacci degree, Ethereum’s uptrend is more likely to problem the overhead resistance trendline.

With the rally persevering with, the Bollinger bands recommend a possible breakout. Nonetheless, the DMI indicator factors to some minor weak point within the underlying power.

Moreover, the ADX line is trending downward, which means that if the uptrend doesn’t maintain, Ethereum might face a pullback.

Demand Resurfaces in Ethereum ETFs

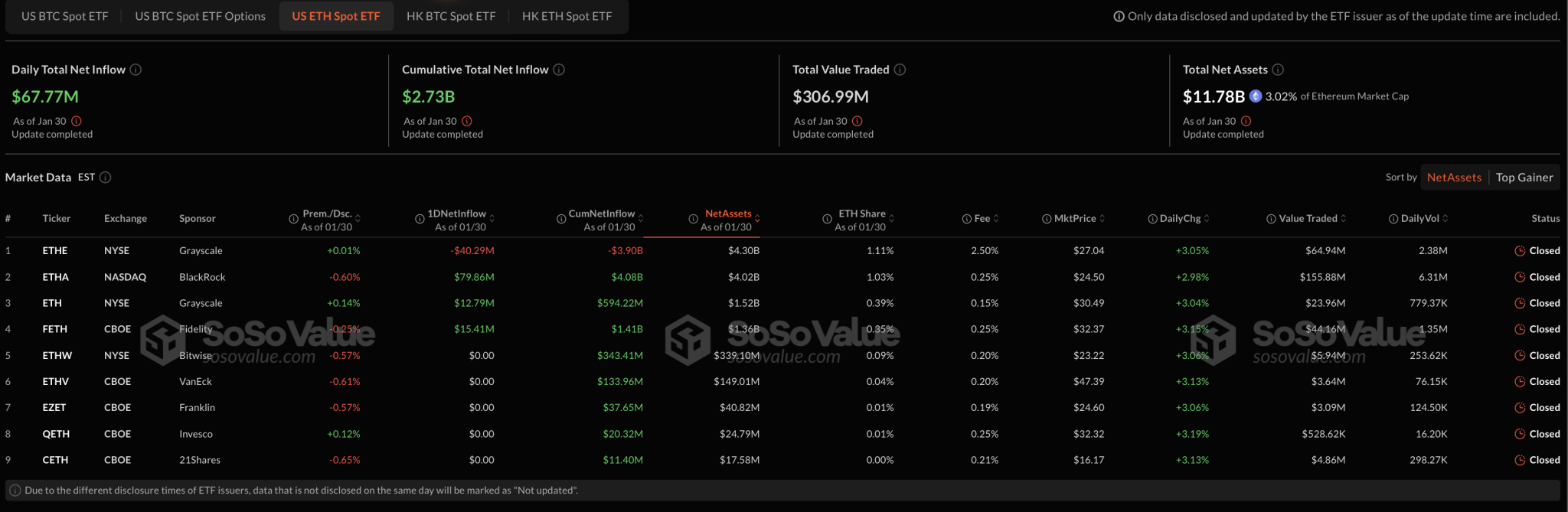

Supporting the bullish case, institutional demand for Ethereum is making a comeback. On January 30, the entire day by day web influx for Ethereum ETFs rose to $67.77 million. Main the cost, BlackRock acquired $79.86 million price of Ethereum.

Different notable patrons included Constancy and Grayscale, with purchases of $15.41 million and $12.79 million, respectively.

The one vendor on January 30 was the Grayscale mini-Ethereum belief, which launched $40.29 million. The remaining 5 U.S. spot Ethereum ETFs registered no inflows.

Ethereum ETFs

Ethereum Value Targets

Primarily based on the In/Out of the Cash chart from Intotheblock, Ethereum nears a vital resistance zone between $3,264-$3,342. This zone holds 6.26M ETH, making it a high-supply zone.

Presently, the at-the-money zone holds 7.85 million ETH between $3,109 and $3,264, indicating a vital degree.

Moreover, Fibonacci ranges on the day by day chart spotlight essential targets on the 50% and 100% retracement ranges, at $3,509 and $4,079, respectively.

On the draw back, the $3,000 help zone is predicted to stay robust via Q1 2025.