- The Ethereum worth correction is poised for a significant help take a look at on the backside trendline of the flag sample.

- The Ethereum ecosystem day by day exercise index surged to a brand new excessive of 1.985 million addresses as we speak, accentuating real community well being and rising consumer adoption.

- ETH’s concern and greed dropped to 35%, highlighting a bearish sentiment amongst market contributors.

ETH, the native cryptocurrency of the Ethereum ecosystem, plunged over 2.6% on Thursday to a $3,800 buying and selling worth. The sell-off possible adopted broader sell-the-news sentiment out there after the U.S. Fed lower the rate of interest by 25 foundation factors. Regardless of the mounting promoting strain, Ethereum’s on-chain information indicators a rock-solid basic basis for its ecosystem, bolstering potential for renewed restoration.

ETH Exercise Hits File Excessive as Community Engagement Surges Previous 1.98M Addresses

Final Wednesday, the Federal Reserve lower its rate of interest by 25 bps to scale back the goal vary to three.75%–4.00%. The transfer was aimed toward boosting the job market and financial progress, however the crypto market witnessed a sell-the-news dip.

Consequently, the Ethereum worth plunged over 2.59% as we speak, to presently $3,808. Whereas the value motion hints at continued correction, a contemporary evaluation from CryptoQuant highlights a notable milestone in on-chain information.

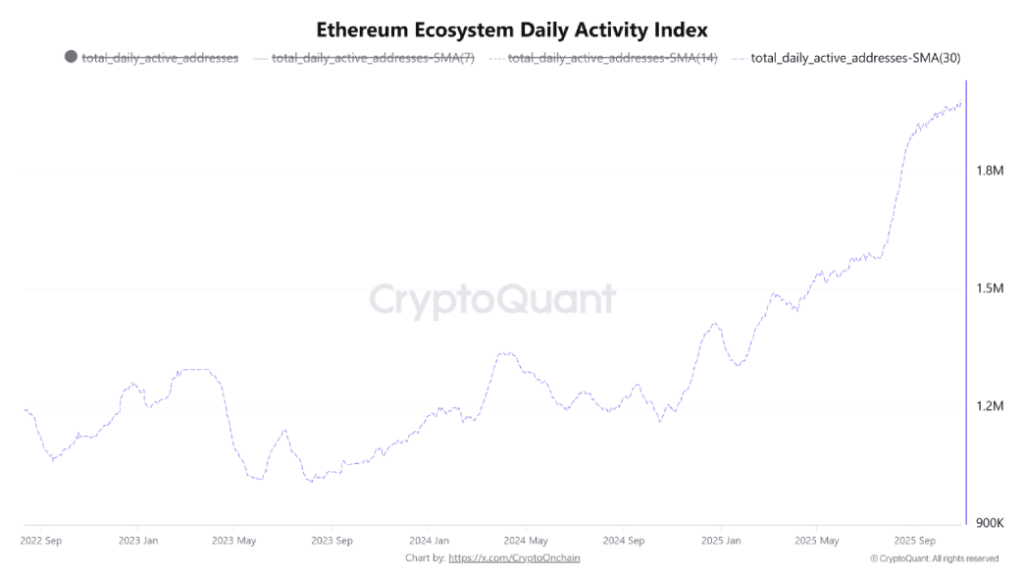

As proven within the chart under, the Ethereum Ecosystem Each day Exercise Index, which aggregates tackle exercise from 76 massive tokens created on the community, has hit an all-time excessive of 1.985 million energetic addresses on a 30-day easy transferring common foundation.

The metric is an indicator of sustained engagement all through Ethereum’s ecosystem, night out short-term volatility to mirror medium-term engagement. The latest data seems to point out a gentle upward development within the participation inside Ethereum’s decentralized ecosystem relatively than spike up for a second, indicating a deepening depth of consumer participation.

In contrast to buying and selling metrics, that are liable to speculative conduct, this index is targeted on pockets exercise, signaling how typically customers work together with functions throughout totally different areas of decentralized finance (DeFi), NFT marketplaces, and different blockchain platforms.

What is exclusive in regards to the present development is the distribution of the expansion. Exercise has elevated throughout dozens of tokens relatively than concentrating in a single or two key initiatives, which might point out that focus and liquidity are being distributed all through the broader Ethereum-based altcoin market. Such diversification of engagement tends to be adopted by durations of upper capital rotation into smaller crypto property.

This surge in community participation comes because the broader crypto market makes an attempt to stabilize after latest market volatility. Historic information has proven that spikes in ecosystem exercise of Ethereum are sometimes accompanied by early indicators of altcoin markets going into overdrive. The most recent numbers, as per the CryptoQuant analyst, characterize one of the vital prolonged and sustained growths in Ethereum’s consumer base but.

Ethereum Worth Nearing Main Assist Take a look at

Within the final 4 days, the Ethereum worth reveals a pointy bearish reversal from $4,000 to $3,800, accounting for a ten.5% loss. The falling worth, backed by elevated candle size and rising buying and selling quantity, accentuates the vendor’s conviction to drive a chronic downfall.

With sustained promoting, the Ethereum worth may plunge one other 6.5% to check the underside trendline of a bull flag sample at $3,500 mark. Since late August 2025, the coin worth has been consolidating inside the two downsloping trendlines of the flag channel, providing merchants dynamic resistance and help.

Apparently, a retest of the underside trendline has typically recuperated the bullish momentum in worth to drive a restoration starting from 20% to 25%. If the flag help holds, the Ethereum worth may witness the same rebound and re-challenge the overhead resistance at round $4,400.

ETH/USDT -1d Chart

A bullish breakout from this resistance is essential to verify the continuation of the upward-trending journey.