Ethereum worth stays in a bear market, and three dangerous chart patterns counsel that it might expertise a 20% crash quickly.

Ethereum (ETH), the second-biggest coin in crypto, retreated to $2,670 on Monday, down by over 35% from its highest degree in December.

Its efficiency occurred because it confronted substantial competitors within the blockchain business. Most of this competitors is coming from widespread layer-1 networks like Berachain (BERA), Solana (SOL), and BNB Sensible Chain (BNB).

Ethereum can be dropping market share to layer-2 blockchains like Base and Arbitrum, which have change into widespread due to their decrease prices. For instance, DEX protocols on Ethereum dealt with quantity value $81 billion within the final 30 days, whereas Base (BASE) and Arbitrum (ARB) processed $35 billion and $28 billion, respectively.

Third-party information reveals that Ethereum ETFs usually are not attracting as a lot inflows as was anticipated. They skilled outflows within the final two market days, which have introduced the cumulative whole to $3.15 billion. In distinction, Bitcoin ETFs have accrued virtually $40 billion in inflows.

You may additionally like: Binance offloads tens of millions value of ETH and SOL, what might it imply?

Ethereum’s day by day buying and selling quantity has additionally continued falling, transferring to $126 billion, down from the December excessive of $330 billion. Its income has additionally continued falling, transferring to $5 million on Sunday, decrease than over $58 million in November final 12 months.

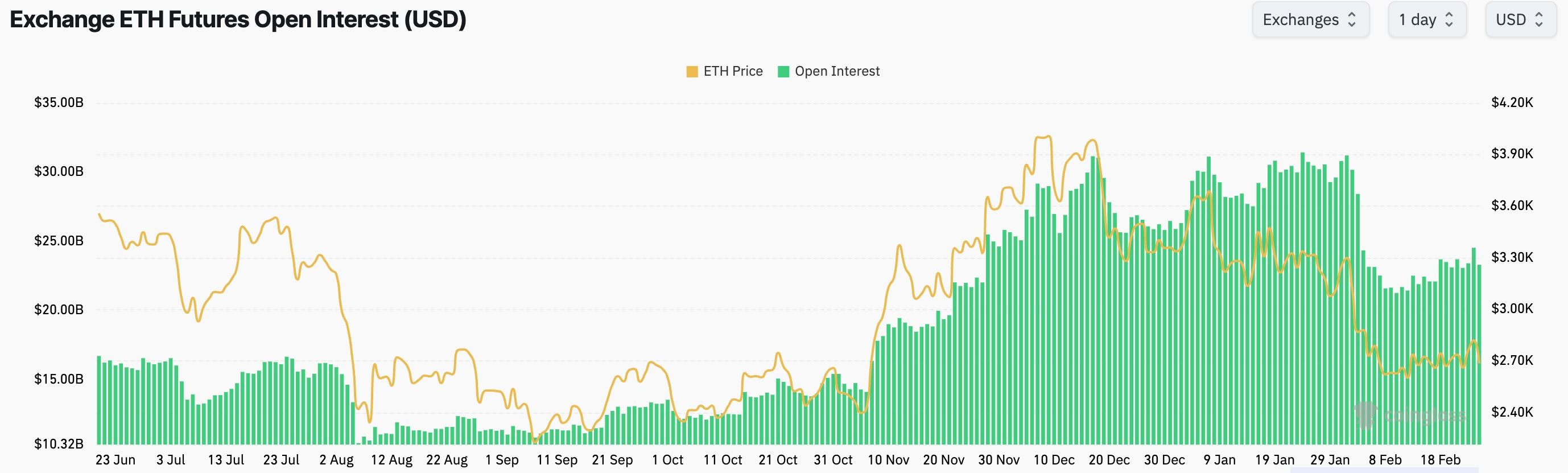

Additional, Ethereum’s futures open curiosity has crashed from its 2024 highs. It has an curiosity of $23.3 billion, down from this month’s excessive of $35 billion.

ETH open curiosity | Supply: CoinGlass

Ethereum worth patterns level to extra draw back

Ethereum worth chart | Supply: crypto.information

The day by day chart reveals that the Ethereum worth could also be liable to extra draw back. It shaped a loss of life cross on February 9 because the 50-day and 200-day Weighted Transferring Averages crossed one another.

The coin has additionally shaped a rising wedge sample, which occurs when there are two ascending converging trendlines. It has additionally shaped a bearish pennant sample, comprising an extended vertical line and a triangle.

Generally, these patterns often result in extra draw back, with the following degree to observe being at $2,166, its lowest degree this month. A break under that degree will level to extra draw back, probably to $2,000.

You may additionally like: PI community inching in direction of $1.60 amid Binance itemizing hopes