Ethereum value has remained in a decent vary this month as its ecosystem faces substantial challenges and growing competitors.

Ethereum (ETH), the second-largest cryptocurrency, was buying and selling at $3,310 on January 22, roughly 20% beneath its November highs. Compared, Bitcoin (BTC), Solana (SOL), and Ripple (XRP) have just lately retested their all-time highs.

Ethereum has additionally continued to lose market share in key areas. As an example, Jito has overtaken Ethereum in payment income this yr, producing $157 million in comparison with Ethereum’s $112 million.

Ethereum’s decentralized alternate quantity has additionally dropped considerably beneath that of Solana. Solana-based protocols like Raydium and Orca dealt with over $123 billion in quantity over the previous seven days, in comparison with Ethereum’s $26 billion. This surge was largely pushed by the recognition of the Official Trump and Melania cash.

The worth of Ethereum has additionally struggled attributable to ongoing token gross sales by the Ethereum Basis and rising alternate balances. Based on CoinGlass, these balances elevated to fifteen.8 million ETH, up from 15.3 million on January 1.

You may additionally like: Ethereum value regular as balances in exchanges drop, open curiosity rises

Nonetheless, there are optimistic catalysts pointing to a possible Ethereum value rebound. Spot Ethereum ETFs have seen constant inflows, reflecting some demand from Wall Road buyers. Over the previous 5 days, cumulative inflows rose to $2.74 billion.

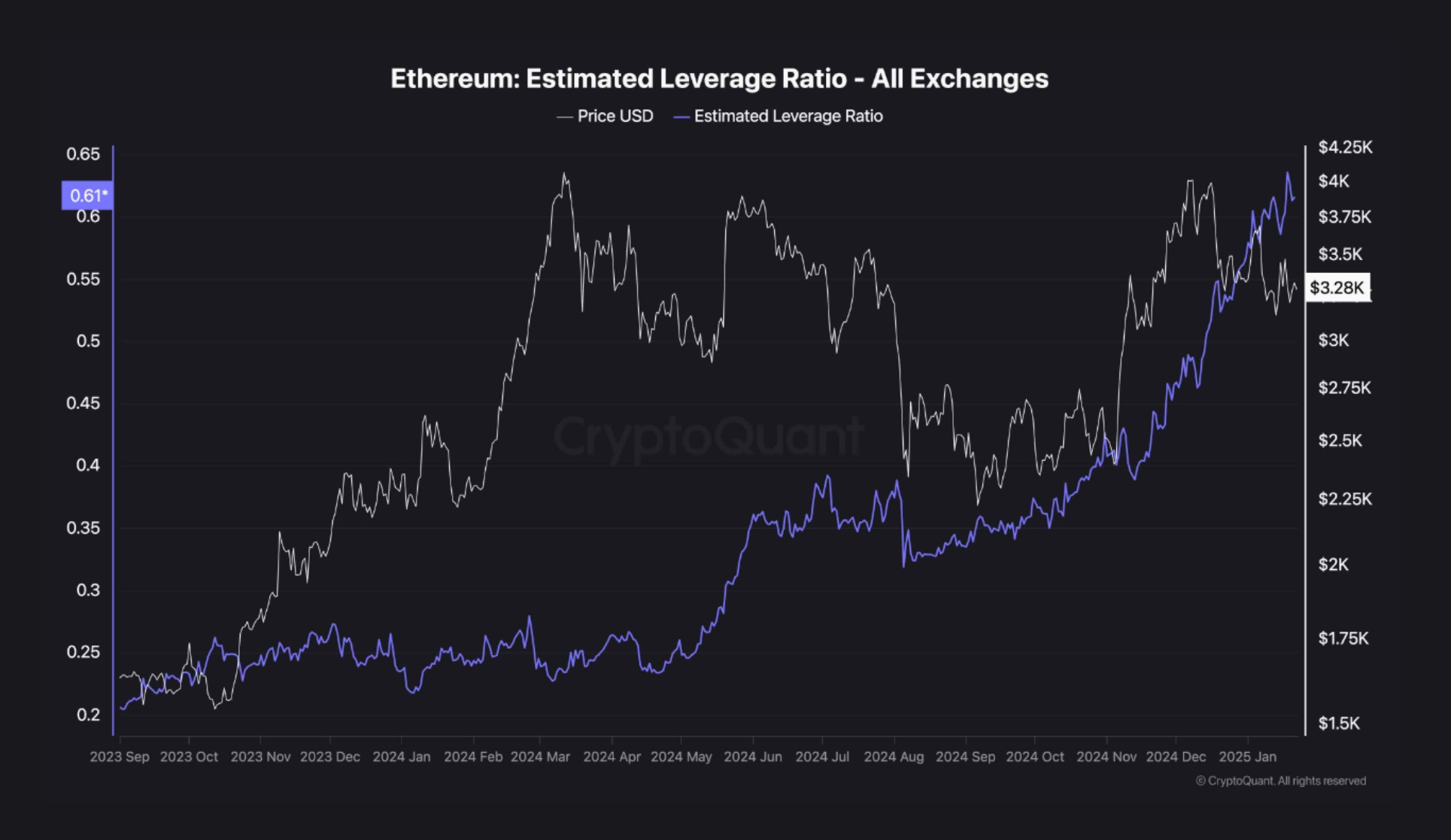

Moreover, knowledge reveals Ethereum’s leverage ratio has been climbing in latest months, reaching 0.6 in comparison with 0.24 in September 2023. Apparently, the leverage ratio and Ethereum’s value have diverged, which may point out additional positive factors forward.

ETH leverage ratio | Supply: CryptoQuant

One other promising issue is that Ethereum’s futures open curiosity has remained elevated in latest weeks. On January 22, open curiosity stood at over $30.3 billion, a big enhance from December’s low of $20 billion.

Ethereum value technical evaluation

ETH value chart | Supply: crypto.information

The each day chart reveals that Ethereum value encountered sturdy resistance at $4,000, which represents the higher boundary of a cup and deal with sample. The cryptocurrency is presently forming the deal with part of this sample.

The deal with resembles a falling wedge, outlined by two descending and converging trendlines. Falling wedge patterns are sometimes bullish and point out potential positive factors. Furthermore, ETH has remained above the 200-day Exponential Transferring Common.

In consequence, Ethereum is more likely to expertise a powerful bullish breakout, with the following goal doubtlessly at $4,000, marking a 21% enhance from its present degree.

You may additionally like: Official Trump value prediction: Is it a promising meme coin or short-lived hype?