ETH is buying and selling simply above key help with blended indicators throughout timeframes, making as we speak’s Ethereum worth information notably related for short-term merchants and swing individuals.

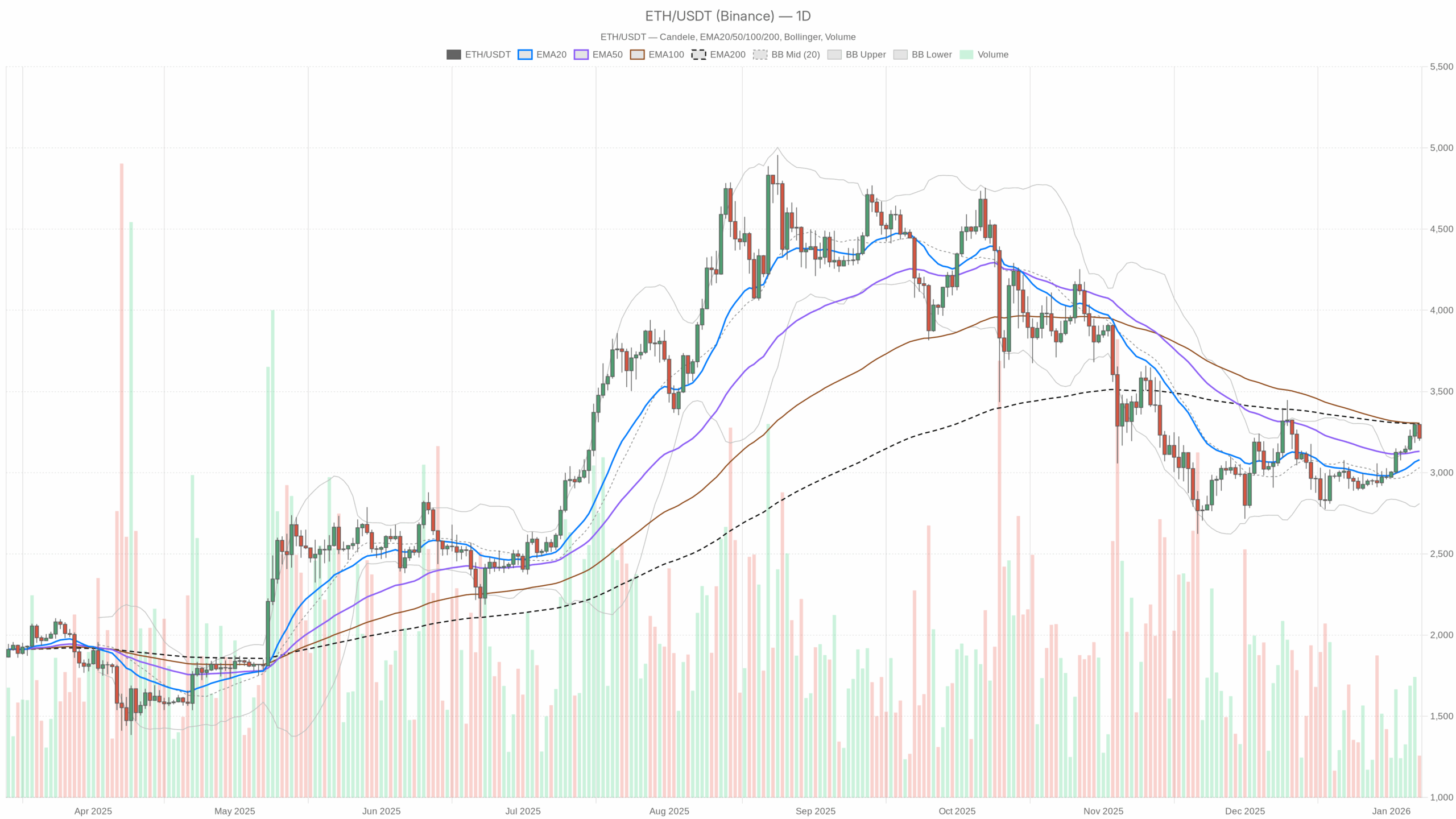

Each day chart (D1): Macro bias – cautiously bullish above $3,100

On the every day timeframe, the principle state of affairs is bullish, however it’s a work-in-progress reasonably than a clear breakout.

Pattern and EMAs

Each day shut: $3,212

EMA20: $3,079 | EMA50: $3,132 | EMA200: $3,302

Value is buying and selling above the 20-day EMA and is actually re-testing the 50-day EMA from above, whereas nonetheless beneath the 200-day EMA.

What this means: Brief- and medium-term development construction has turned constructive once more, so consumers have regained the tactical higher hand. Nevertheless, the broader, longer-term development (vs the 200-day) continues to be not totally repaired. ETH is in a restoration section inside a bigger consolidation, not in a transparent macro uptrend but.

RSI (momentum)

RSI 14 (D1): 60.6

What this means: Momentum is on the bullish facet of impartial with out being overheated. There’s room for worth to increase larger earlier than the transfer seems stretched. It displays regular shopping for reasonably than a blow-off transfer.

MACD (development energy)

MACD line: 44.2 | Sign: 5.5 | Histogram: +38.7

What this means: The MACD is firmly in optimistic territory with a large hole over the sign line. Pattern-following flows are shifting in favor of the bulls. Nevertheless, the histogram is already fairly elevated, which regularly precedes a slowdown or sideways digestion even when the broader up-leg stays intact.

Bollinger Bands (volatility envelope)

Center band: $3,031 | Higher band: $3,254 | Decrease band: $2,810

Value: $3,212 (buying and selling between mid and higher band, comparatively near the highest)

What this means: ETH is using the higher half of its volatility envelope, which is typical of an advancing market, however it isn’t pinned to the band. That factors to a constructive up-move with managed volatility reasonably than an explosive, unstable breakout. Pullbacks in the direction of the center band (~$3,030) could be regular, not essentially trend-ending.

ATR (volatility)

ATR 14 (D1): $87.9

What this means: Common every day vary is underneath $100, which is reasonable for ETH at these ranges. Volatility is elevated sufficient to supply buying and selling alternative however not in panic territory. That favors swing setups with outlined threat reasonably than lottery-style breakouts.

Each day pivots (reference ranges)

Pivot level (PP): $3,235

First resistance (R1): $3,274

First help (S1): $3,173

ETH is at the moment buying and selling a bit beneath the every day pivot, nearer to S1 than R1.

What this means: On as we speak’s session construction, the market is leaning barely defensive intraday though the broader every day development is constructive. Bulls haven’t seized management of the session; they’re defending reasonably than aggressively urgent larger.

1-hour chart (H1): Brief-term bias – impartial to mildly bearish

The hourly chart is the place the strain reveals up: every day indicators are constructive, however the 1H seems like a minor distribution section after the current push.

Pattern and EMAs

Hourly shut: $3,211

EMA20: $3,236 | EMA50: $3,224 | EMA200: $3,127

Value is beneath the 20 and 50-hour EMAs however nonetheless comfortably above the 200-hour EMA.

What this means: The short-term intraday development is softening, as sellers have nudged worth underneath the quick intraday averages. However, the broader intraday construction for the reason that final swing low stays intact. It seems extra like a pullback in an rising uptrend than a full development reversal, no less than so long as ETH holds above the 200-hour close to $3,130.

RSI (momentum)

RSI 14 (H1): 43

What this means: Momentum on the hourly is barely damaging, in line with a light cooldown. It’s not excessive sufficient to sign capitulation or breakout strain, however extra of a managed breather the place sellers have the short-term initiative.

MACD (development energy)

MACD line: -4.4 | Sign: 2.6 | Histogram: -7.1

What this means: The hourly MACD has flipped into damaging territory, confirming that the final upswing has misplaced steam. Pattern followers on brief timeframes are doubtless de-risking or ready for a recent sign. This contradicts the bullish every day MACD and underscores that the present transfer is a pullback inside a bigger, still-constructive construction.

Bollinger Bands

Center band: $3,245 | Higher band: $3,296 | Decrease band: $3,194

Value: $3,211, buying and selling near the decrease band

What this means: Value hugging the decrease band on H1 is traditional short-term strain. Nevertheless, with the every day nonetheless sturdy, this sort of lower-band check usually resolves into both a sideways base or a mean-reversion bounce, except promoting quantity sharply accelerates.

ATR (volatility)

ATR 14 (H1): $23.3

What this means: Typical hourly swings of low-to-mid $20s give sufficient room for tactical trades however don’t point out a volatility shock. The market is repricing step by step reasonably than collapsing.

Hourly pivots

Pivot level (PP): $3,214

R1: $3,226

S1: $3,199

Value is fractionally beneath the hourly pivot and nearer to S1.

What this means: In as we speak’s intraday construction, bears have a slight edge. A reclaim and maintain above the hourly pivot could be an early signal that the pullback is operating out of gasoline.

15-minute chart (M15): Execution context – managed dip

The 15-minute chart is helpful solely to know the very short-term tape; it doesn’t outline the broader bias.

Pattern and EMAs

M15 shut: $3,211

EMA20: $3,222 | EMA50: $3,235 | EMA200: $3,227

Value is beneath all three EMAs on the 15-minute.

What this means: Very short-term, the market is in a neighborhood down-swing. That is the place the strain is most evident, however this timeframe is noisy. It primarily tells us that sellers are in command of the most recent leg of the intraday public sale.

RSI (momentum)

RSI 14 (M15): 40.6

What this means: Brief-term momentum is weak however not oversold. There’s room for another push decrease on this timeframe earlier than discount hunters sometimes step in.

MACD (development energy)

MACD line: -8.1 | Sign: -9.1 | Histogram: +1.0

What this means: Each MACD and sign are damaging, however the histogram has ticked again above zero. That’s usually what you see throughout an early try to stabilize after a promote leg: the downtrend continues to be there, however the tempo of promoting is slowing and a short-term base could also be forming.

Bollinger Bands

Center band: $3,217 | Higher band: $3,233 | Decrease band: $3,200

Value: $3,211, within the decrease half of the band vary

What this means: ETH is sitting within the decrease half of its very short-term volatility vary, in line with a pullback, however not but at an excessive. That leaves room for both a marginal new low or a sideways chop earlier than a clearer course emerges.

ATR (volatility)

ATR 14 (M15): $9.6

What this means: The standard 15-minute bar is shifting underneath $10, pointing to orderly worth motion. This isn’t the form of tape the place you normally see pressured liquidations; it’s extra algorithmic rebalancing and native revenue taking.

15-minute pivots

Pivot level (PP): $3,214

R1: $3,216

S1: $3,209

Value is at the moment beneath the native pivot and nearer to S1.

What this means: Micro-structure favors sellers for now. Brief-term scalpers will look ahead to both a rejection from the pivot/R1 space or a flush via S1 in the direction of the decrease 15m band close to $3,200.

Market context: ETH vs the remainder of crypto

ETH sits in a market the place total capitalization is drifting decrease (complete cap -1.65% in 24h), whereas quantity is up practically 10%. That’s traditional for a managed risk-off rotation: merchants are actively repricing, not strolling away. Bitcoin dominance at 56.6% and a concern studying of 42 affirm that the group nonetheless prefers BTC and steady performs over broad altcoin threat.

On the structural facet, DeFi exercise on Ethereum-centric DEXs like Uniswap v3 and v4 is powerful, with double-digit every day payment development and really sturdy 7–30 day will increase, whereas extra curve-style venues present declining charges. That’s in line with a market concentrating liquidity and hypothesis on core DeFi rails reasonably than chasing each experimental venue. For ETH, it is a medium-term optimistic: community utilization and costs are holding up even throughout a cautious macro tape.

Current headlines, such because the Fortune piece framing 2026 as a fork within the highway for Ethereum, underline the narrative strain on ETH to justify its valuation via actual scaling and execution. Value-wise, the market shouldn’t be exhibiting panic round that narrative. As a substitute, the chart reveals a market keen to provide ETH room so long as key helps maintain. This aligns carefully with the present Ethereum worth information deal with resilience over euphoria.

Eventualities for ETHUSDT

Bullish state of affairs

The bullish case leans on the every day chart: optimistic MACD, RSI above 60, and worth above the 20/50-day EMAs. On this state of affairs, the present intraday pullback is only a pause earlier than continuation.

Key steps for bulls:

- On decrease timeframes, ETH must reclaim the hourly pivot round $3,214 after which push again above the H1 20/50 EMA cluster ($3,224–3,236). That will sign the dip is being purchased, not bought into.

- A every day shut again above the D1 pivot at $3,235 after which via R1 close to $3,274 would affirm demand is robust sufficient to problem the higher Bollinger band and transfer towards the 200-day EMA round $3,300.

- If worth can maintain above the $3,300–3,320 space (200-day EMA and prior provide), the narrative shifts towards a extra sturdy uptrend reasonably than only a bounce in a spread.

What invalidates the bullish state of affairs?

A decisive every day shut beneath $3,100–3,120, the place worth would lose the 20-day EMA and drift away from the 50-day, would undercut the bullish construction. A breakdown underneath the hourly 200 EMA (~$3,130) with follow-through quantity could be an early warning that the restoration leg is failing.

Bearish state of affairs

The bearish case is constructed from the hourly softness and macro backdrop: BTC dominance is excessive, the market is in concern, and ETH continues to be underneath its 200-day EMA. Right here the present transfer is seen as one other failed try to reclaim the longer-term development.

Key steps for bears:

- Hold ETH suppressed underneath the hourly EMAs and keep RSI on H1 beneath 50, turning every bounce right into a decrease excessive.

- Break beneath the rapid helps round $3,199 (H1 S1) and $3,173 (D1 S1), opening the door to a deeper imply reversion towards the every day center Bollinger band and structural help close to $3,050–3,030.

- If promoting accelerates and worth closes a number of hours, and particularly a full day, beneath $3,000, the narrative shifts towards a bigger vary or perhaps a retest of the decrease band area within the $2,800–2,850 zone.

What invalidates the bearish state of affairs?

A powerful reclaim of the $3,250–3,280 zone on convincing quantity, with hourly indicators flipping again optimistic (MACD > 0, RSI again above 55–60) and a every day shut north of the pivot and close to R1, would put bears on the again foot. In that case, the present downturn could be downgraded to a easy intraday shakeout.

How to consider positioning proper now

ETH is in a kind of in-between spots: every day construction is constructive, intraday construction is corrective. Meaning directional conviction ought to come from the every day chart, whereas the decrease timeframes information timing and threat.

For merchants, it is a market that rewards persistence and clear invalidation reasonably than aggressive leverage. Volatility throughout timeframes (every day ATR ~ $88, hourly ATR ~ $23) is excessive sufficient that poor entries get punished rapidly, however not so wild that all the pieces is random. The secret is to anchor selections across the massive ranges:

- $3,100–3,130: line within the sand for the present every day up-leg.

- $3,235–3,275: intraday battle zone that decides whether or not this pullback is purchased or bought.

- $3,300–3,320: main sentiment pivot tied to the 200-day EMA.

Uncertainty stays elevated as a result of macro rotation into BTC, the concern studying, and the still-unresolved narrative round Ethereum’s execution roadmap. That blend can create sharp, headline-driven spikes in each instructions. Anybody energetic on this pair ought to dimension trades for opposed swings equal to no less than one every day ATR and keep away from assuming that as we speak’s intraday course will essentially outline the entire week.

If you wish to monitor markets with skilled charting instruments and real-time information, you possibly can open an account on Investing utilizing our associate hyperlink:

Open your Investing.com account

This part accommodates a sponsored affiliate hyperlink. We might earn a fee at no extra value to you.

Disclaimer: This text is a market evaluation and expresses a technical and opinionated view primarily based on the info obtainable on the time of writing. It’s not monetary recommendation, and it doesn’t take note of your particular person aims, monetary state of affairs, or wants. Buying and selling and investing in cryptocurrencies entails substantial threat, together with the danger of lack of capital. At all times conduct your personal analysis and think about consulting a licensed monetary skilled earlier than making funding selections.