Ethereum is moving into a brand new frontier the place synthetic intelligence meets blockchain. The Ethereum Basis has launched a devoted dAI workforce to develop requirements like ERC-8004, designed to offer AI brokers a verifiable id and a trusted option to transact. This isn’t simply one other improve—it positions Ethereum because the spine for the rising machine financial system. On the similar time, ETH’s worth is consolidating close to $4,500, coiling for its subsequent large transfer. The combination of technical momentum and a recent AI narrative has merchants asking whether or not Ethereum is on the verge of a breakout towards $5,200 and past.

Ethereum Worth Prediction: Ethereum’s AI Ambitions

The Ethereum Basis has launched a brand new decentralized AI (dAI) workforce led by Davide Crapis, aiming to place Ethereum because the core settlement and coordination layer for synthetic intelligence brokers. The initiative focuses on ERC-8004, a proposed customary for AI id and transactions, which shall be showcased at Devconnect in November.

The concept is straightforward however highly effective: as AI brokers more and more transact, signal messages, and work together with decentralized purposes, Ethereum might grow to be the impartial floor for belief, popularity, and enforcement. This doesn’t simply broaden Ethereum’s function in finance, however pushes it into the long run machine financial system. If the ERC-8004 customary positive aspects traction, Ethereum might appeal to a brand new wave of builders, tasks, and institutional curiosity—translating to extra community demand and worth upside.

Market Sentiment and Narrative Impression

The AI narrative has been one of many strongest progress tales throughout expertise and monetary markets in 2025. By fusing AI and blockchain in a approach that reduces dependency on centralized gamers, Ethereum is aligning itself with one of the crucial sought-after tendencies. This announcement might act as a medium-term bullish catalyst, particularly heading into the November Devconnect reveal.

Within the brief time period, the information creates renewed confidence in Ethereum’s long-term roadmap. It provides one other layer to Ethereum’s worth proposition, on high of privateness enhancements, L2 interoperability, and person expertise enhancements which might be already underway.

Ethereum Worth Prediction: Technical Evaluation of ETH Every day Chart

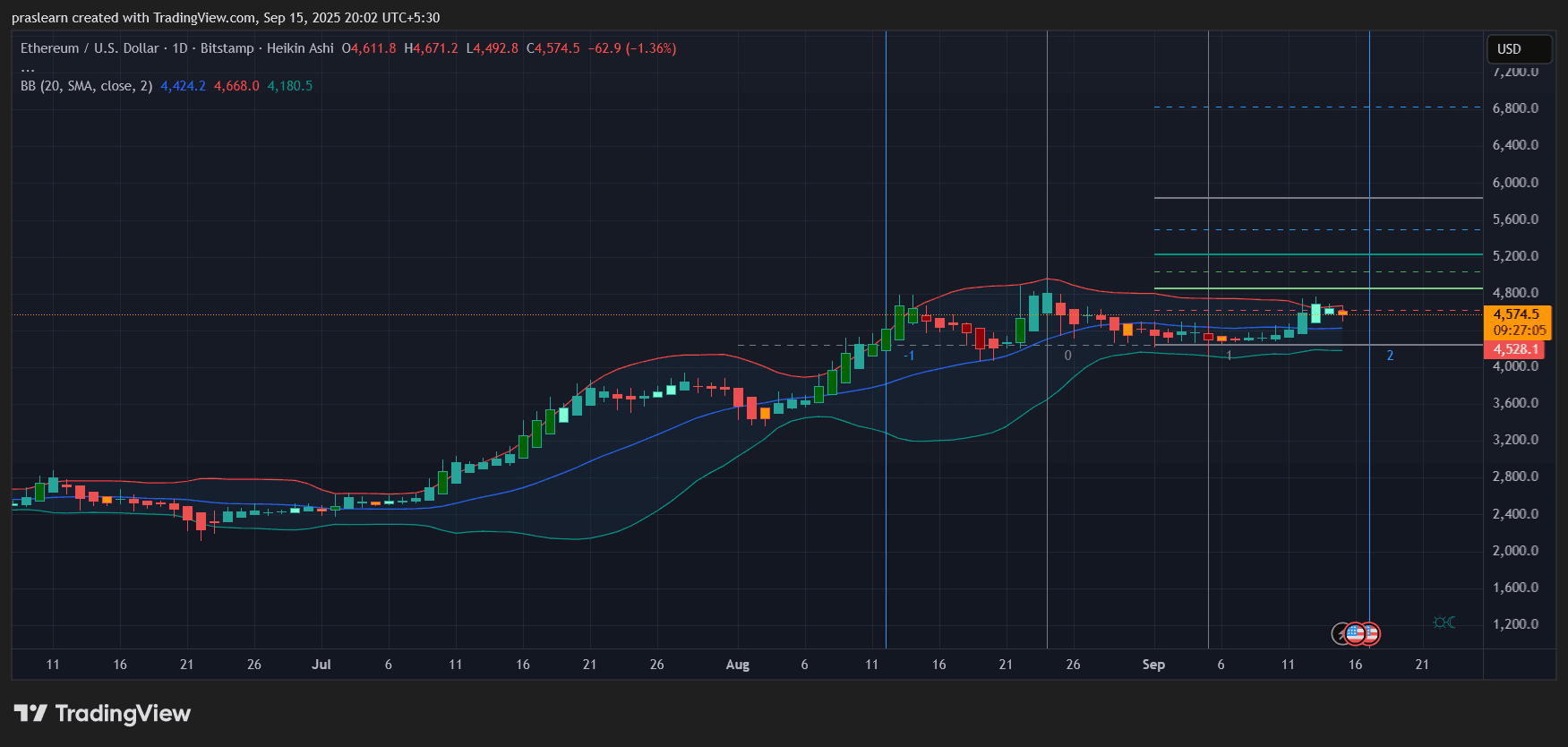

Ethereum worth each day chart, ETH worth is presently buying and selling close to 4574, exhibiting a gentle retracement of 1.36% on the Heikin Ashi candles. The Bollinger Bands spotlight a tightening vary after weeks of sideways motion. The worth is testing the higher mid-zone, just below the resistance band at 4668, which has grow to be the quick ceiling.

Key observations:

- Resistance: Round 4680–4700 is the near-term cap. A decisive breakout right here might open room towards 5200 (Fibonacci extension zone).

- Help: Sturdy assist sits close to 4528, aligning with the decrease consolidation base. Beneath this, the 4420 degree could be crucial.

- Momentum: After weeks of low volatility, ETH worth has just lately tried to push larger. The breakout makes an attempt haven’t but sustained, however the setup resembles a coiled spring, the place a powerful transfer might quickly emerge.

- Pattern Bias: The general construction stays bullish since July, with larger lows intact. Consolidation underneath resistance is often an indication of accumulation slightly than distribution.

Brief-Time period Worth Outlook

If Ethereum worth holds above 4528 and manages a each day shut above 4680, momentum merchants might drive ETH towards the 5000–5200 area rapidly. The AI narrative provides gasoline to this technical setup, making a bullish breakout state of affairs more and more seemingly.

Nonetheless, failure to carry assist at 4528 might see ETH revisiting 4420, and deeper promoting stress would possibly drag it towards 4180. This could weaken the bullish case within the brief run, though the medium-term outlook stays intact as a result of robust fundamentals.

Medium-Time period Ethereum Worth Outlook

With the ERC-8004 reveal at Devconnect approaching, $Ethereum has a narrative-driven catalyst that might propel it previous its consolidation part. A confirmed breakout above 4700 would shift the market sentiment decisively bullish, inserting 5200 and even 5600 in play by November.

The mix of a powerful technical setup and a transformative dAI narrative creates a positive atmosphere for $ETH to check new highs earlier than the top of the yr.