Ethereum has made a sluggish however regular try at recovering from the numerous 33% value loss noticed towards the top of February. The latest restoration is being largely pushed by investor confidence, with many accumulating ETH at present low ranges.

These buyers are anticipating an eventual value uptick, hoping to capitalize on Ethereum’s potential progress.

Ethereum Finds Investor Assist

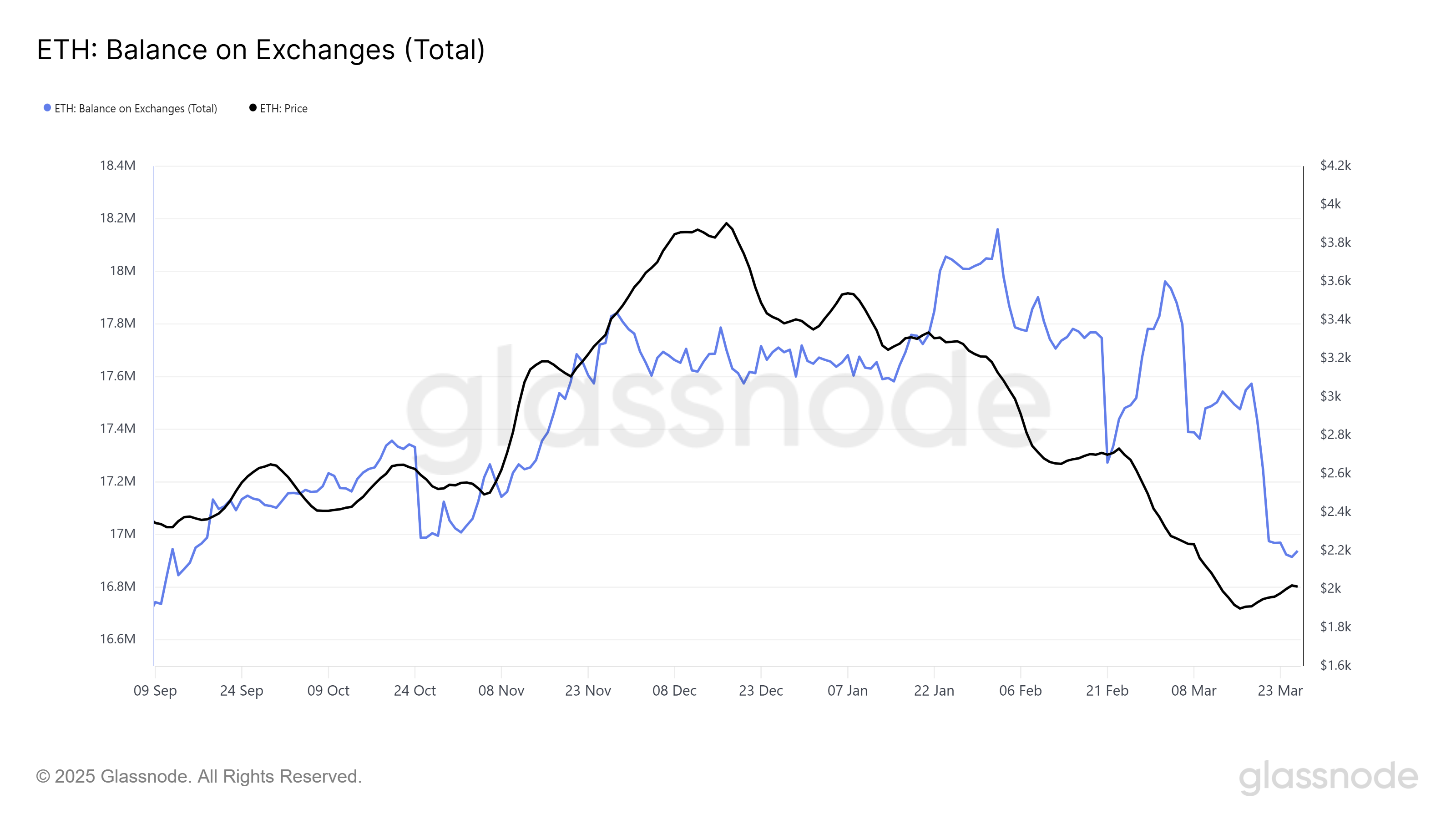

Ethereum’s provide on exchanges has decreased by 635,000 ETH within the final six days, representing a worth of over $1.28 billion. This drop in provide displays a robust accumulation part by buyers who’re buying ETH on the low value ranges at which it’s presently buying and selling. These patrons are betting on future value will increase, contributing to the rising optimism surrounding Ethereum.

The truth that Ethereum’s change provide is being absorbed so shortly signifies buyers’ perception in a value rebound. Because the holders of this accrued ETH look to HODL, the lower in obtainable provide might result in upward strain on the worth.

Ethereum Provide On Exchanges. Supply: Glassnode

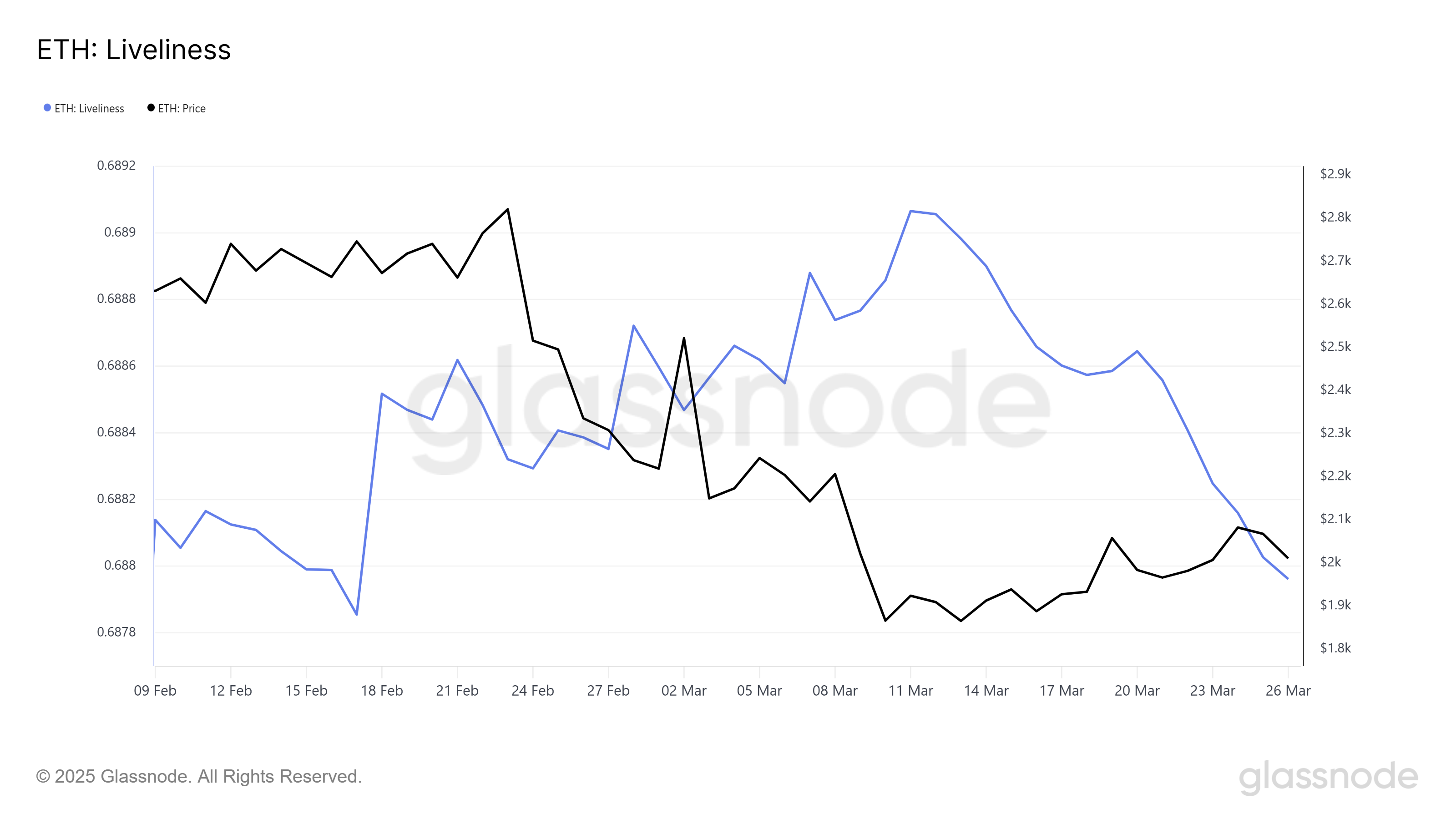

Ethereum’s macro momentum is additional supported by the Liveliness indicator, which tracks the exercise of long-term holders (LTHs). The Liveliness indicator lately hit a month-to-month low, signaling that LTHs are accumulating and holding onto their ETH. This shift in direction of HODLing by Ethereum’s key holders suggests confidence within the altcoin’s future efficiency.

The rising help from LTHs and their accumulation efforts point out a perception in Ethereum’s long-term worth. As these holders proceed to lock up their ETH, it reduces the circulating provide, which may contribute to cost appreciation.

Ethereum Liveliness. Supply: Glassnode

Is ETH Value On Monitor To Breaking Out?

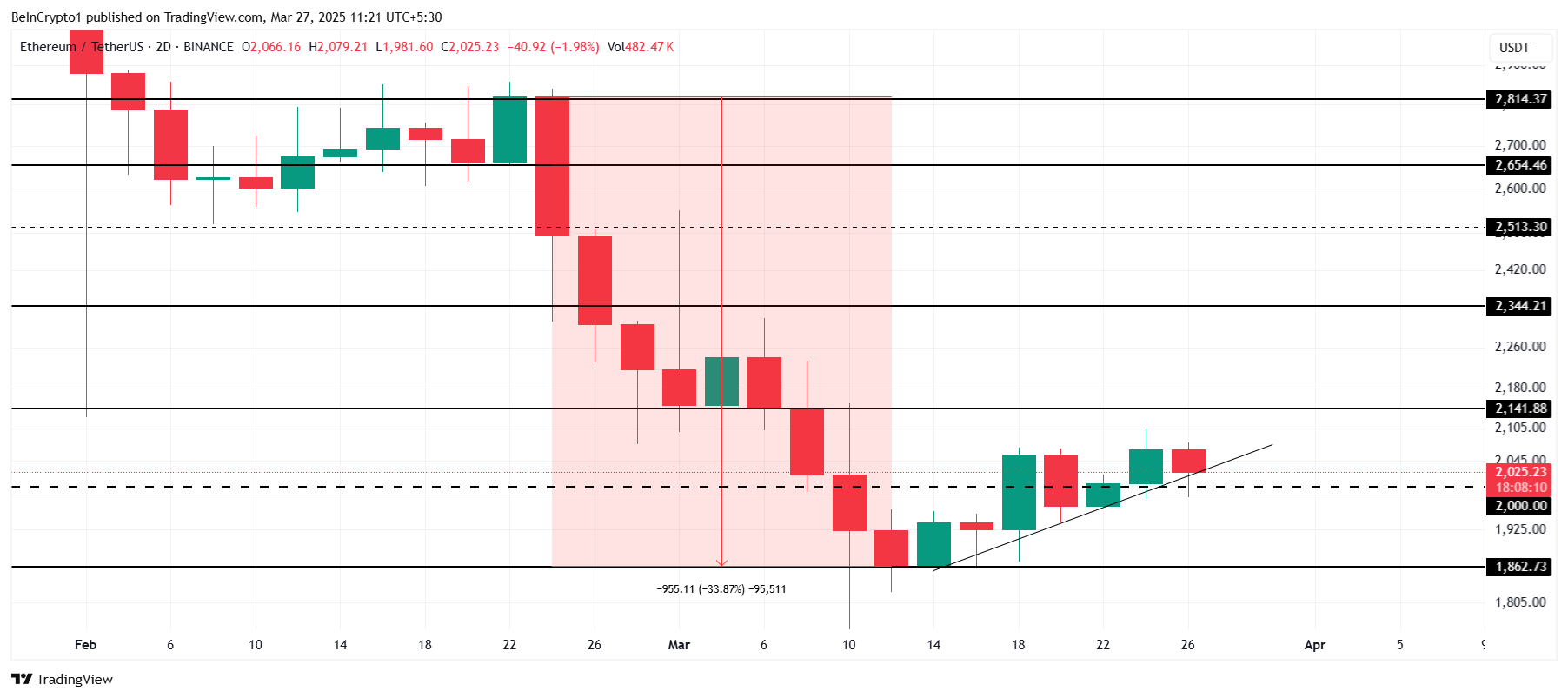

At present buying and selling at $2,025, Ethereum value has reclaimed the $2,000 stage as help on the every day chart. Nonetheless, it has but to breach the $2,141 resistance, which is vital to solidifying its restoration try. Efficiently breaking by this barrier would verify Ethereum’s upward momentum and set the stage for additional positive factors within the coming days.

If Ethereum efficiently secures $2,141 as help, it may very well be on monitor to get better the 33% decline from late February. A sustained break above this resistance might push ETH towards $2,344, serving to to reclaim misplaced floor and proceed the bullish development. This might sign renewed confidence in Ethereum’s market outlook.

Ethereum Value Evaluation. Supply: TradingView

Nonetheless, if the bullish momentum fails to materialize and Ethereum struggles to breach the $2,141 barrier, the altcoin might face a pullback. A failure to push previous this resistance would possible result in a decline again under $2,000, doubtlessly testing the $1,862 help stage.