Ethereum is hovering at $2,818 this Sunday, however the quieter spot worth motion is wildly out of sync with what’s taking place beneath the hood. Derivatives merchants are loading up, shifting measurement throughout venues, and positioning forward of a dense cluster of expiries that would drive ethereum out of its holding sample sooner moderately than later.

Ethereum Derivatives Markets Say One thing Large Is Brewing

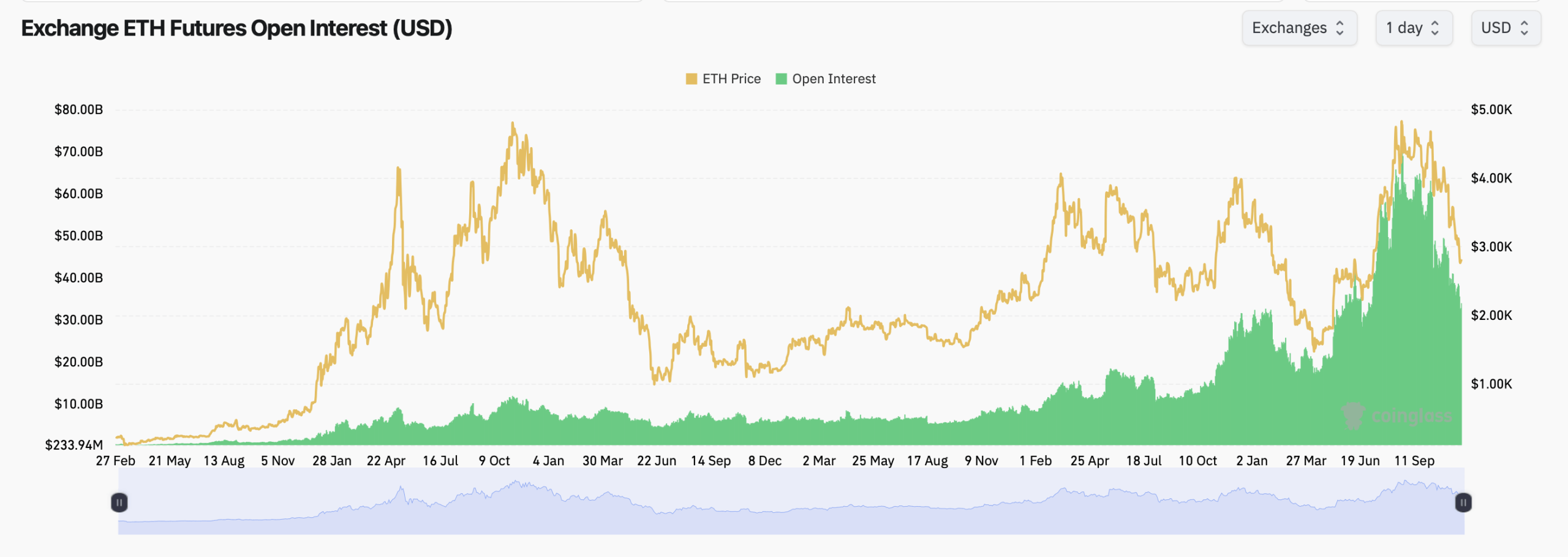

Coinglass.com stats present futures open curiosity stays elevated, displaying a market that refuses to step again whilst spot momentum has cooled. Whole ethereum futures OI stands at $34 billion, with greater than 12 million ETH parked in contracts throughout CME, Binance, OKX, Bybit, Kucoin, Gate, and others.

Binance presently leads with about 2.48 million ETH in open curiosity, whereas CME’s 2.10 million ETH nonetheless exhibits regular institutional publicity. Hour-over-hour motion was uneven — Binance slipped, OKX dipped, and Gate noticed heavier outflows — however Bybit nudged increased, signaling selective bullish positioning. Over the previous 24 hours, the tone was noticeably brighter, with Bybit leaping greater than 5%, Kucoin gaining practically 4%, and Gate climbing above 5%, lifting complete futures OI by 3.13% in a single day.

ETH futures open curiosity as of Nov. 23, 2025, through Coinglass stats.

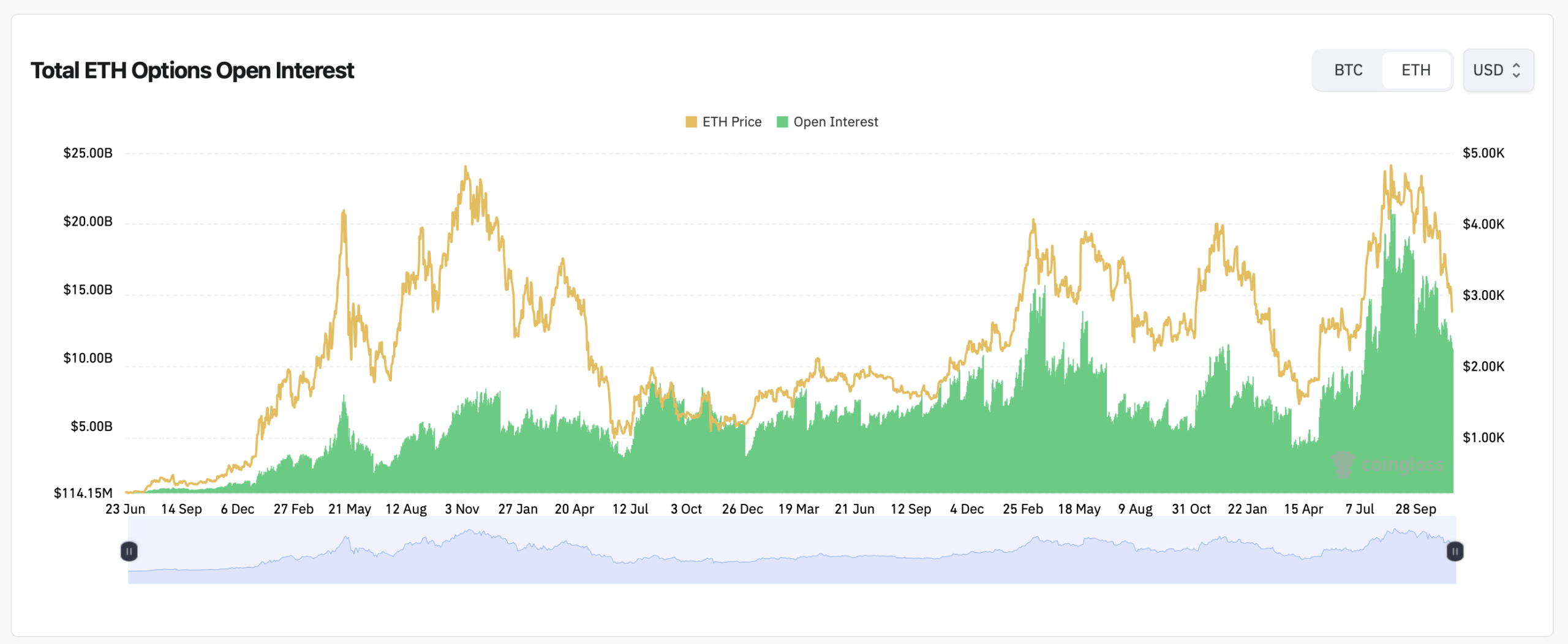

Choices merchants have been much more dialed in. Ethereum choices open curiosity has crossed 3.46 million ETH, with calls making up an assertive 65.80% of the stack. Places stay lively, however they’re clearly the minority at simply over 34%. Within the final 24 hours, calls captured 60% of buying and selling quantity — greater than 105,000 ETH — whereas places accounted for roughly 70,000 ETH. Merchants aren’t signaling concern right here; they’re expressing conviction, even when it’s wrapped in cautious near-term pricing.

Deribit continues to command the lion’s share of ethereum’s choices market, dealing with greater flows and deeper books than some other trade. A lot of the exercise facilities on main expirations in Dec. 2025 and Mar. 2026, the place merchants are betting aggressively on increased worth ranges. A number of the largest name positions — every holding greater than 60,000 ETH — goal substantial worth milestones for late subsequent 12 months.

In on a regular basis phrases, the largest gamers are putting massive, assured bets that ethereum received’t be anyplace close to present ranges by the tip of 2025. Max ache metrics inform their very own story. On Deribit, short-dated expiries cluster within the high-$2,000s to low-$3,000s, whereas bigger December expiries stretch towards the upper-$4,000 area.

Learn extra: Saylor Says Bitcoin Has Discovered Its Flooring, Says ‘A lot of the Liquidation Promoting Is out of the System’

Binance’s curve sits in an analogous lane, with near-term expiries round $3,000–$3,600 and late 2025 clustering nearer to $4,000. OKX maintains the steepest outlook, starting round $2,700–$3,200 for early expirations however rising towards and past the $5,000 zone for mid-2026 contracts. Zoomed out, short-term expectations look cautious, however long-term positioning tilts notably optimistic.

Futures depth in USD phrases additional reinforces that theme. Even with ethereum’s decline from the $4,000 vary earlier this fall, merchants proceed scaling into positions moderately than retreating from them. The regular upward climb in futures OI by the summer season and fall factors to a market making ready for volatility, not avoiding it.

Ethereum might look frozen at $2,818 immediately, however the derivatives market is buzzing with intent. Calls dominate the choices ledger, futures OI stays sturdy throughout institutional and retail hubs, and max ache curves reveal a market that’s conservative within the close to time period however strikingly assured concerning the highway forward. As massive expiries method, merchants are clearly positioning for motion — and ethereum not often stays quiet for lengthy when derivatives merchants begin leaning this difficult in a single route.

FAQ 💡

- What’s ethereum’s worth immediately?Ethereum trades at $2,818 because the market drifts by weekend consolidation.

- How lively is ETH futures open curiosity proper now?Futures open curiosity sits close to $34 billion with sturdy participation throughout Binance, CME, OKX, and others.

- Are merchants favoring calls or places within the ethereum choices market?Calls dominate with greater than 65% of all open curiosity and 60% of current quantity.

- What do max ache ranges recommend for ETH?Quick-term expiries focus on $2,700–$3,300 whereas long-dated expiries level to $4,000–$5,000.