As Ethereum ($ETH) makes an attempt to recuperate from the current crash, the Ethereum Rainbow Chart has provided a glimpse of how the asset may commerce on the finish of this month.

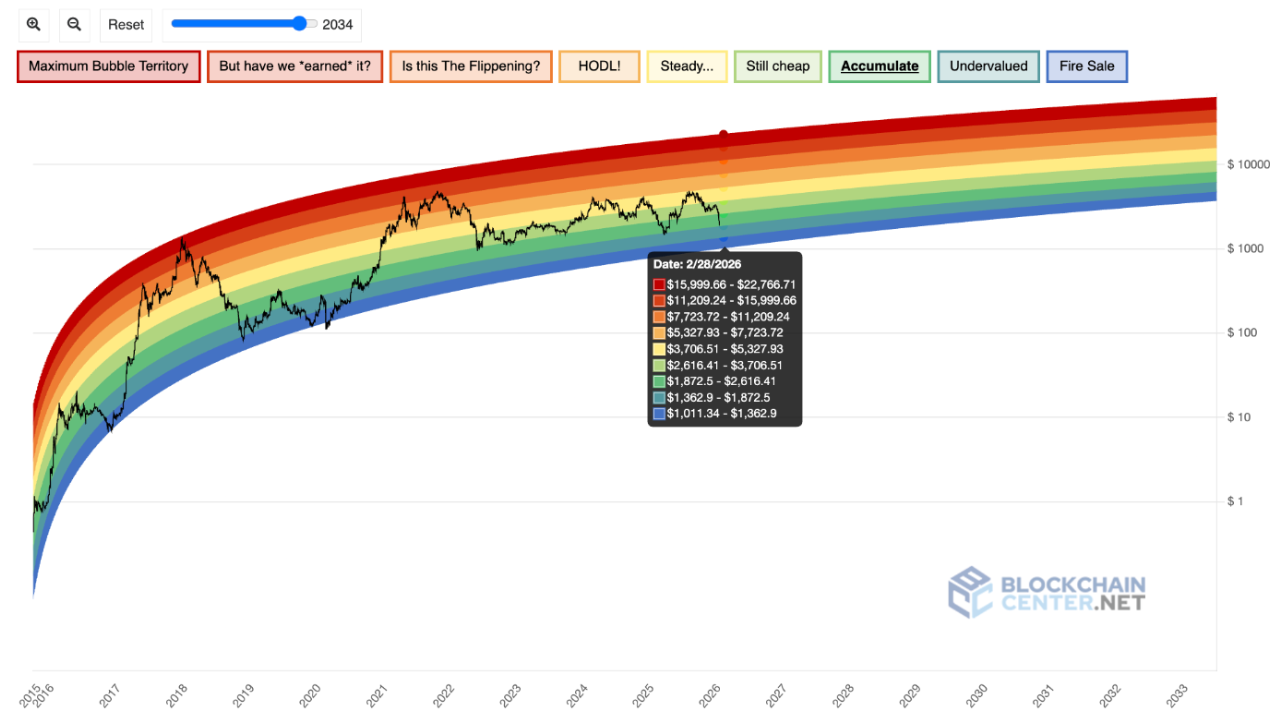

Notably, the chart overlays $ETH’s historic worth motion on logarithmic progress curves and segments future valuations into color-coded sentiment bands, starting from excessive overvaluation to deep undervaluation.

Ethereum has since reclaimed the $2,000 help zone, with the cryptocurrency buying and selling at $2,009 as of press time, up over 4% prior to now 24 hours. Nonetheless, on the weekly chart, the asset stays within the crimson, down greater than 13%.

$ETH worth prediction

Based mostly on the chart’s February 28, 2026, studying, Ethereum may commerce wherever between roughly $1,011 and $22,767, relying on market circumstances.

On the prime finish, the ‘Most Bubble Territory’ band spans $15,999.66 to $22,766.71, signaling excessive speculative extra and traditionally elevated correction threat. Slightly below it, the ‘However have we ‘earned it? band, starting from $11,209.24 to $15,999.66, displays aggressive upside the place worth progress could also be operating forward of fundamentals.

The following zone, Is that this the ‘Flippening?’, sits between $7,723.72 and $11,209.24 and represents a robust bull-market section typically related to Ethereum considerably outperforming the broader crypto market.

Mid-range valuations fall into the ‘HODL!’ band at $5,327.93 to $7,723.72, a zone traditionally linked to sustained uptrends the place long-term holders have a tendency to stay assured. Under that, the ‘Regular…’ band covers $3,706.51 to $5,327.93, suggesting steady progress consistent with long-term adoption developments.

The ‘Nonetheless low cost’ band, between $2,616.41 and $3,706.51, implies Ethereum stays undervalued relative to its historic progress curve. Deeper worth territory seems within the ‘Accumulate’ band at $1,872.50 to $2,616.41, sometimes considered as a gorgeous long-term entry zone.

Additional down, the ‘Undervalued’ band ranges from $1,362.90 to $1,872.50, whereas the bottom zone, ‘Hearth Sale’, spans $1,011.34 to $1,362.90, traditionally related to capitulation phases.

Ethereum’s potential worth vary

With Ethereum buying and selling round $2,000 on February 8, the token at the moment sits throughout the ‘Accumulate’ band.

If $ETH continues to trace the Rainbow Chart’s median historic trajectory into late February 2026, a transfer into the ‘Regular…’ or ‘HODL!’ zones could be believable, implying a possible worth vary of roughly $4,000 to $6,000.

Nonetheless, stronger-than-expected adoption, elevated community utilization, or a renewed crypto bull cycle may push Ether into increased bands, whereas broader market weak point may preserve costs nearer to the decrease valuation ranges outlined by the mannequin.

Featured picture through Shutterstock