Ethereum (ETH), which has just lately seen weak value efficiency and ongoing retracement with little bullish momentum, is now drawing renewed curiosity from main establishments. This Ethereum information has got down to push bearishness available in the market.

Whereas retail traders have shifted to sooner and extra reasonably priced options like Solana ($SOL) and Base, giant establishments stay assured in Ethereum. This development exhibits that Ethereum continues to be a essential participant in managing important real-world property (RWAs), regardless of its challenges.

Ethereum’s Function in Institutional Funding

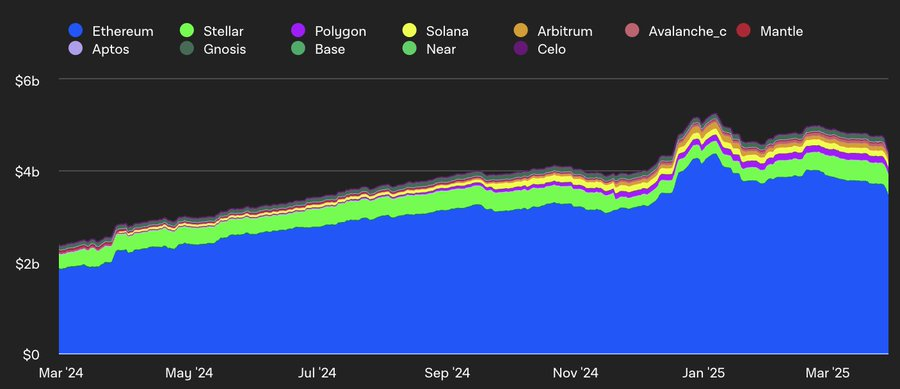

Ethereum’s significance within the monetary world is evident. Over 53% of all real-world property are at present held on the Ethereum blockchain. When factoring in Layer 2 options, this share will increase to 75%.

Nicely-known monetary establishments, like Franklin Templeton and BlackRock, are launching Ethereum-based funds, and BlackRock is working with regulators to hurry up the tokenization of property.

Supply: X

Ethereum’s attraction to those establishments lies in its reliability, safety, and powerful infrastructure. These entities prioritize clear laws, liquidity, and sturdy techniques, qualities that Ethereum presents.

Whereas not probably the most reasonably priced or quickest blockchain for particular person traders, Ethereum offers unmatched safety and belief for large-scale monetary operations, making it the platform of alternative for institutional gamers.

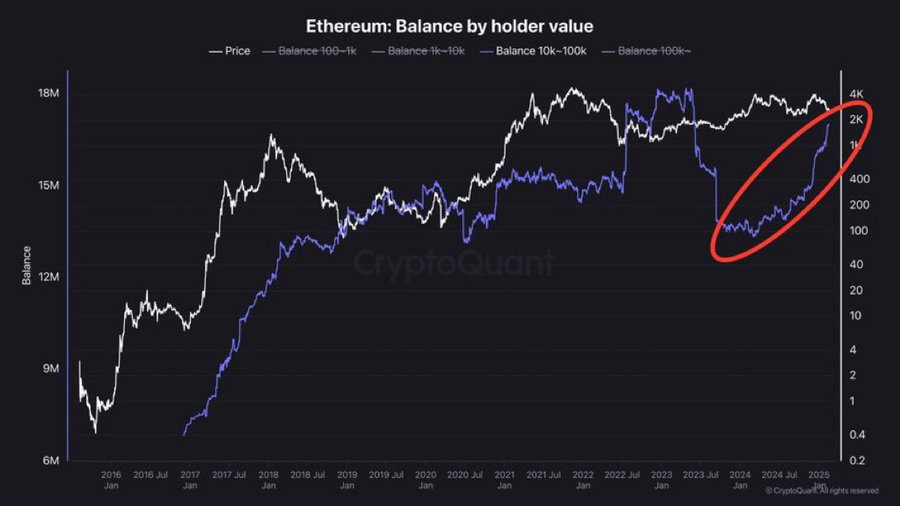

Information: Whale Accumulation Factors to Ethereum’s Rising Worth

Ethereum is having a resurgence in worth, and the boldness is constructing with whales shopping for in. In line with market analyst Crypto_Goos, Ethereum is at present undervalued, and huge holders are capitalizing on this chance.

With elevated buying and selling exercise, the worth of Ethereum has additionally risen continually. Whales buying ETH at an rising charge clarify that they anticipate the blockchain to extend in worth.

Supply: X

Whales have a tendency to know tendencies available in the market, and are typically forward on bigger tendencies. Provided that their present accumulation actually may very well be a sign that Ethereum’s value is about to rise, in gentle of the demand coming from each institutional and retail traders.

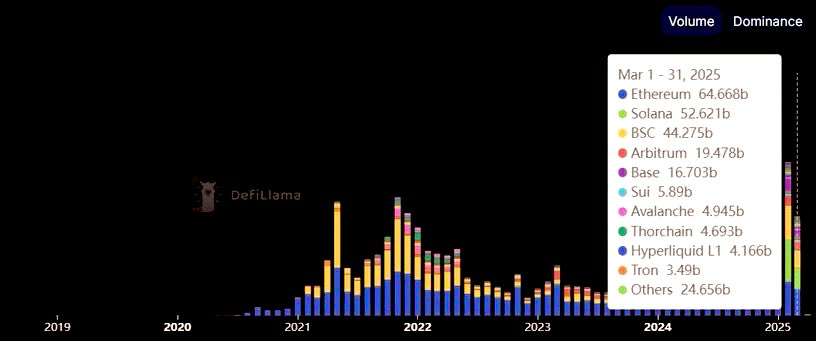

Ethereum Information: Ethereum Surpasses Solana in DEX Buying and selling

Ethereum has reclaimed its place because the chief in decentralized change (DEX) buying and selling, surpassing Solana for the primary time since September 2024. This resurgence displays rising belief in Ethereum’s community, as decentralized finance (DeFi) functions proceed to flourish on its platform.

The rising demand for DeFi options additional strengthens Ethereum’s dominance available in the market.

Supply: X

The expansion of DEX buying and selling can be a results of continued Ethereum’s Layer 2 options growth.

Proudly owning these enhancements ought to be capable to promote Ethereum at decrease transaction prices and velocity up transactions, making Ethereum extra appropriate for retail traders, whereas retaining its attractiveness for institutional customers.

Ethereum, in different phrases, is effectively poised to be the chief of the decentralized finance sector with elevated scale and liquidity.

Ethereum Technical Evaluation

At present, the RSI (14) sits at 41.98 just under the impartial 50 stage, placing Ethereum in an oversold state, however not at excessive ranges as it’s nonetheless above 30 stage. With these readings Ethereum has the potential to surge however bigger Ethereum information narrative appears low for now.

1-day Ethereum Buying and selling Chart. Supply Buying and selling View

The CVD indicator is optimistic at 38.68K and signifies that shopping for strain is larger than promoting strain. This means elevated demand as of now, and will assist value development if the development continues.

Nevertheless, the MACD line is beneath the sign line. This exhibits bearish quick time period momentum and extra draw back will be anticipated except a bullish crossover happens.

.