Some days in the past, Ethereum (ETH) confirmed readiness to climb towards $3,000. However as final month neared its finish, the momentum modified, main the second most dear cryptocurrency to drop beneath $2,600.

Will ETH’s worth get well? That is one factor that traders will need to know. On this on-chain evaluation, BeInCrypto explains why the altcoin would possibly quickly reverse the pattern.

Ethereum Bearish Outlook Eases

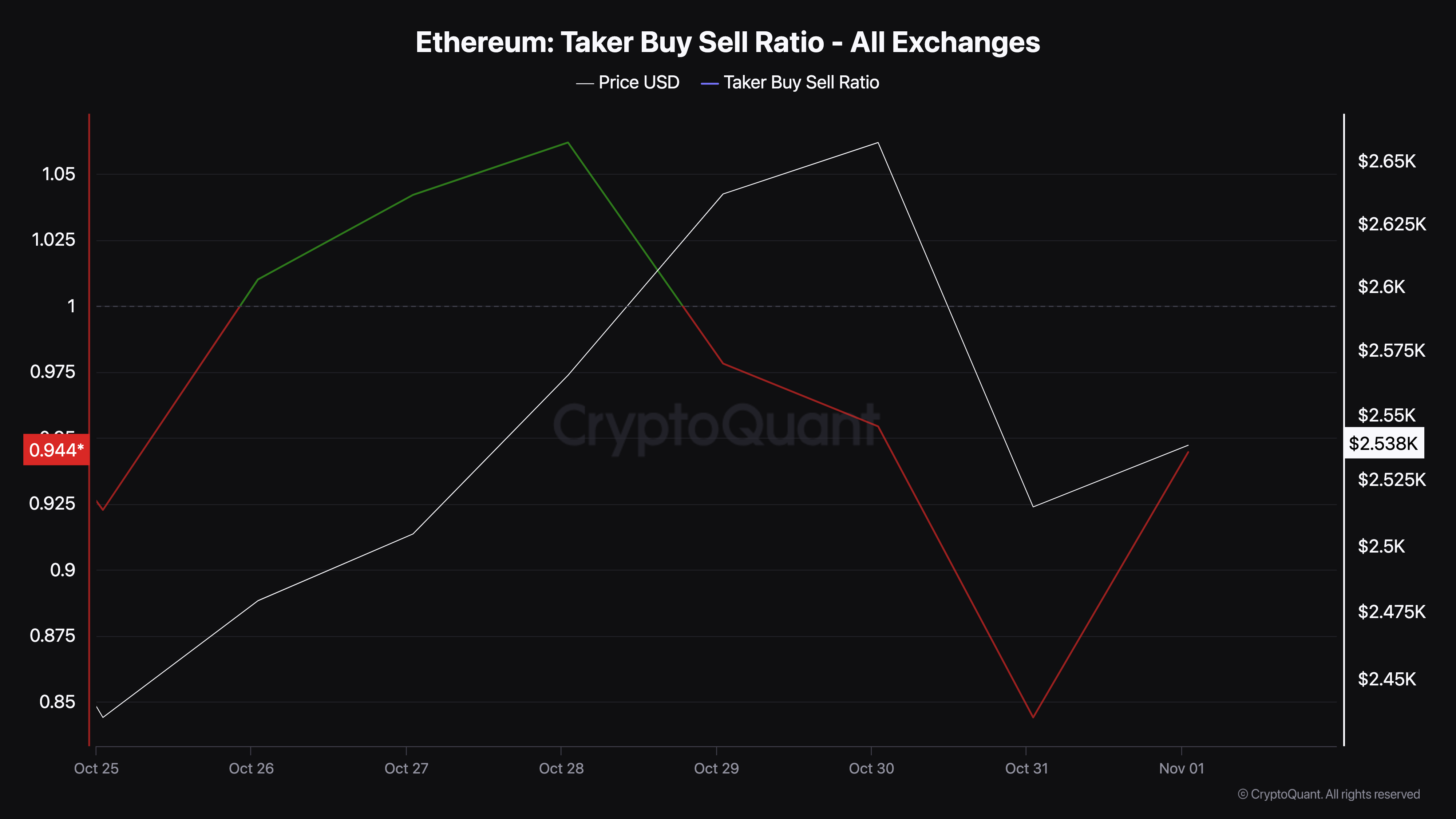

In keeping with CryptoQuant, Ethereum’s worth lower precipitated a decline within the Taker Purchase/Promote Ratio. This ratio is calculated because the purchase quantity divided by the promote quantity in perpetual swap trades.

When the worth is above 1, it means the pattern is bullish. Nonetheless, a price beneath 1 signifies that the pattern is bearish. On October 31, Ethereum’s Taker Purchase/Promote Ratio was 0.84, which means that the sentiment was bearish at the moment.

However as of this writing, the studying has elevated and is on the verge of hitting a score of 1. Ought to the indicator’s score proceed to climb, then ETH’s worth may also comply with in the identical path, suggesting that it might get near $2,800 because it was some days again.

Learn extra: Ethereum ETF Defined: What It Is and How It Works

Ethereum Taker Purchase/Promote Ratio. Supply: CryptoQuant

One other metric supporting the bias is the 30-day Market Worth to Realized Worth (MVRV) ratio. The MVRV ratio compares a crypto asset’s present market worth to its realized worth, providing insights into market tops and bottoms.

When the MVRV ratio is excessive, it typically alerts that the asset may be overvalued, suggesting a market high. Conversely, a low MVRV ratio can point out undervaluation, pointing towards a possible backside.

As of now, Ethereum’s MVRV ratio has turned constructive, a shift final seen in mid-October, which coincided with ETH’s worth surge above $2,700. This historic sample means that if the MVRV ratio continues to rise, we might see an identical upward motion in Ethereum’s worth.

Ethereum MVRV Ratio. Supply: Santiment

ETH Worth Prediction: Rebound Doubtless

On the each day chart, Ethereum’s worth is on the verge of dropping beneath $2,500. Whereas this would possibly play out, the help round $2,345 is probably going to assist the altcoin rebound.

Nonetheless, if that occurs, the cryptocurrency may have the resistance at $2,790 to cope with. As seen beneath, the Steadiness of Energy (BoP) indicator has jumped. The BoP measures the energy of bulls in comparison with bears.

When the studying decreases, bears are in management. However when the BoP rises, bulls are in management, which seems to be the case on the time of writing. Ought to this stay the identical, then Ethereum’s worth would possibly rise to $2,824.

Learn extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Ethereum Every day Worth Evaluation. Supply: TradingView

In a extremely bullish state of affairs, ETH might rise as excessive as $3,262. Then again, a decline beneath the help might invalidate this bias. In that state of affairs, ETH might drop to $2,115.