For some institutional traders, buying and selling $ETH under $2,000 represents a chance quite than a threat, regardless of rising issues about increasing unrealized losses.

$ETH has now entered its sixth consecutive month of decline. This marks the longest shedding streak because the 2018 downtrend.

Tom Lee and K3 Capital Increase $ETH Holdings as Staking Ratio Hits Document Excessive

In accordance with Lookonchain, Tom Lee — founding father of Fundstrat and head of Bitmine — executed giant $ETH purchases throughout the third week of February.

On February 18 alone, Bitmine acquired a further 35,000 $ETH price roughly $69.37 million. The acquisition included 20,000 $ETH, valued at $39.8 million, from BitGo, and 15,000 $ETH, valued at $29.57 million, from FalconX.

K3 Capital additionally made a big transfer. Knowledge from OnchainLens exhibits {that a} pockets linked to the funding fund bought 20,000 $ETH price $40.08 million from Binance.

These sizable transactions replicate sturdy long-term conviction in $ETH, even because the asset trades under $2,000.

Knowledge from CryptoRank signifies that long-term traders have elevated Ethereum accumulation throughout the present downturn.

$ETH Accumulation Addresses. Supply: CryptoQuant.”>

$ETH Accumulation Addresses. Supply: CryptoQuant.”>

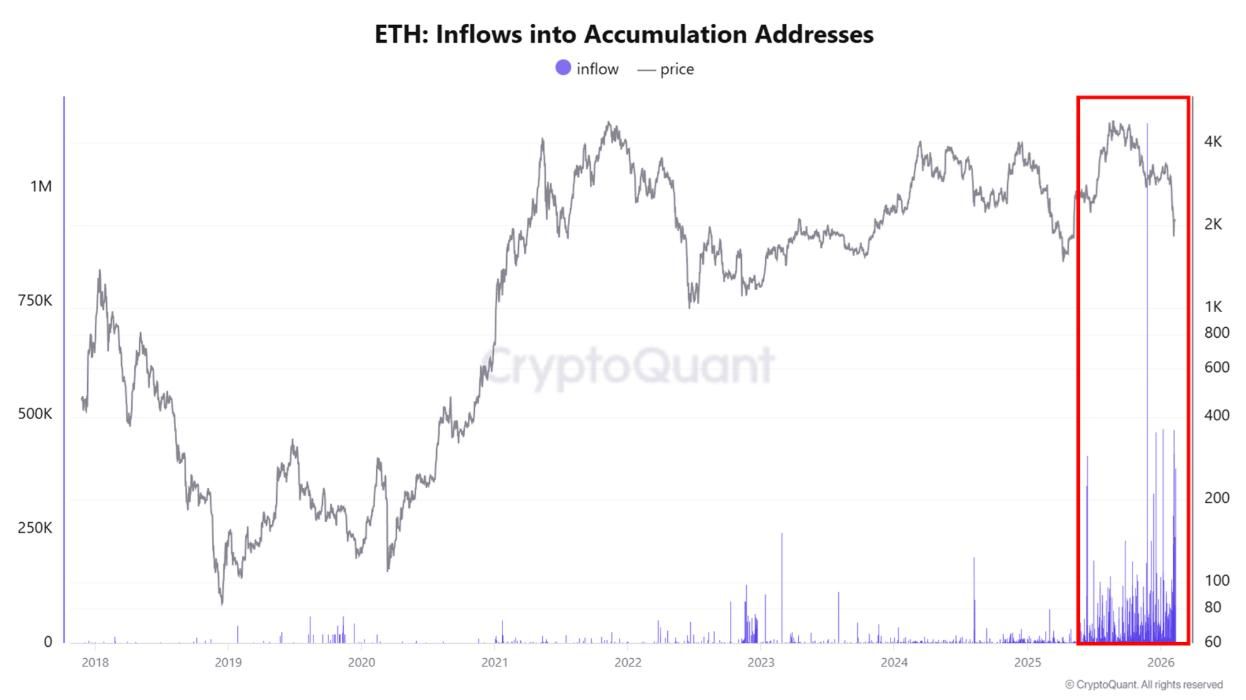

Inflows into $ETH Accumulation Addresses. Supply: CryptoQuant.

In the meantime, knowledge from CryptoQuant exhibits that inflows into $ETH accumulation addresses over the previous six months have reached essentially the most lively interval in historical past. Historical past exhibits that in 2018, $ETH skilled seven consecutive months of decline earlier than recovering.

“The whales and the biggest banks are shopping for and constructing on $ETH. These are the very best inflows into whale‑accumulation wallets we’ve seen. In the meantime, retail has deserted it and is asking for its failure. They’re drained and exhausted after watching the value chop inside this huge vary for 5 years.” – Crypto investor Seth commented.

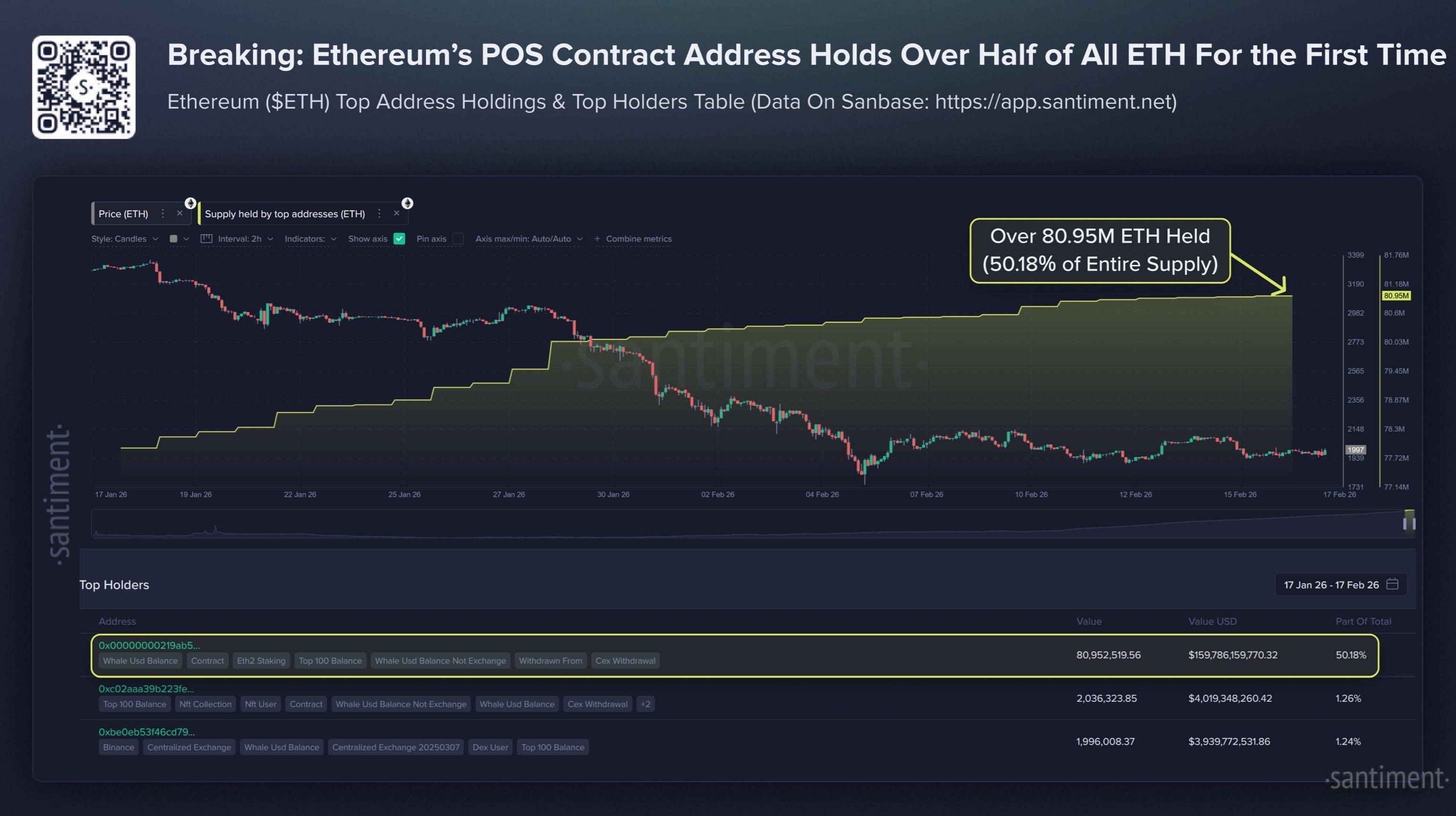

One other key milestone has emerged. For the primary time in Ethereum’s 11-year historical past, greater than half of the full $ETH provide has been staked.

On-chain knowledge platform Santiment reviews that over 50% of the $ETH provide now resides within the Proof-of-Stake (PoS) contract.

$ETH Held by The Ethereum PoS Contract Tackle. Supply: Santiment”>

$ETH Held by The Ethereum PoS Contract Tackle. Supply: Santiment”>

The Complete $ETH Held by The Ethereum PoS Contract Tackle. Supply: Santiment

This contract features as a one-way vault. Traders deposit $ETH into staking to safe the community. Staked cash briefly go away circulation and can’t be traded.

Staking exercise has continued to rise, notably throughout bearish cycles. As extra $ETH turns into locked, the liquid provide declines.

“When over 50% of the provision is locked in staking, liquid provide shrinks. Fewer cash can be found for buying and selling. That reduces promote strain and makes the market extra delicate to new demand.” Validator Everstake acknowledged.

Everstake clarified that fifty.18% represents the full $ETH held by the Ethereum PoS contract handle, whereas the remaining 30% is lively stake.

Nevertheless, current evaluation by BeInCrypto doesn’t rule out the chance that $ETH may decline additional to $1,385 within the brief time period, amid essentially the most unfavorable market sentiment seen in years.

Even when that situation unfolds, on-chain knowledge suggests that enormous traders and establishments proceed to place for a long-term restoration.

The put up Ethereum Slides for six Straight Months, however Establishments Maintain Accumulating Beneath $2,000 appeared first on BeInCrypto.