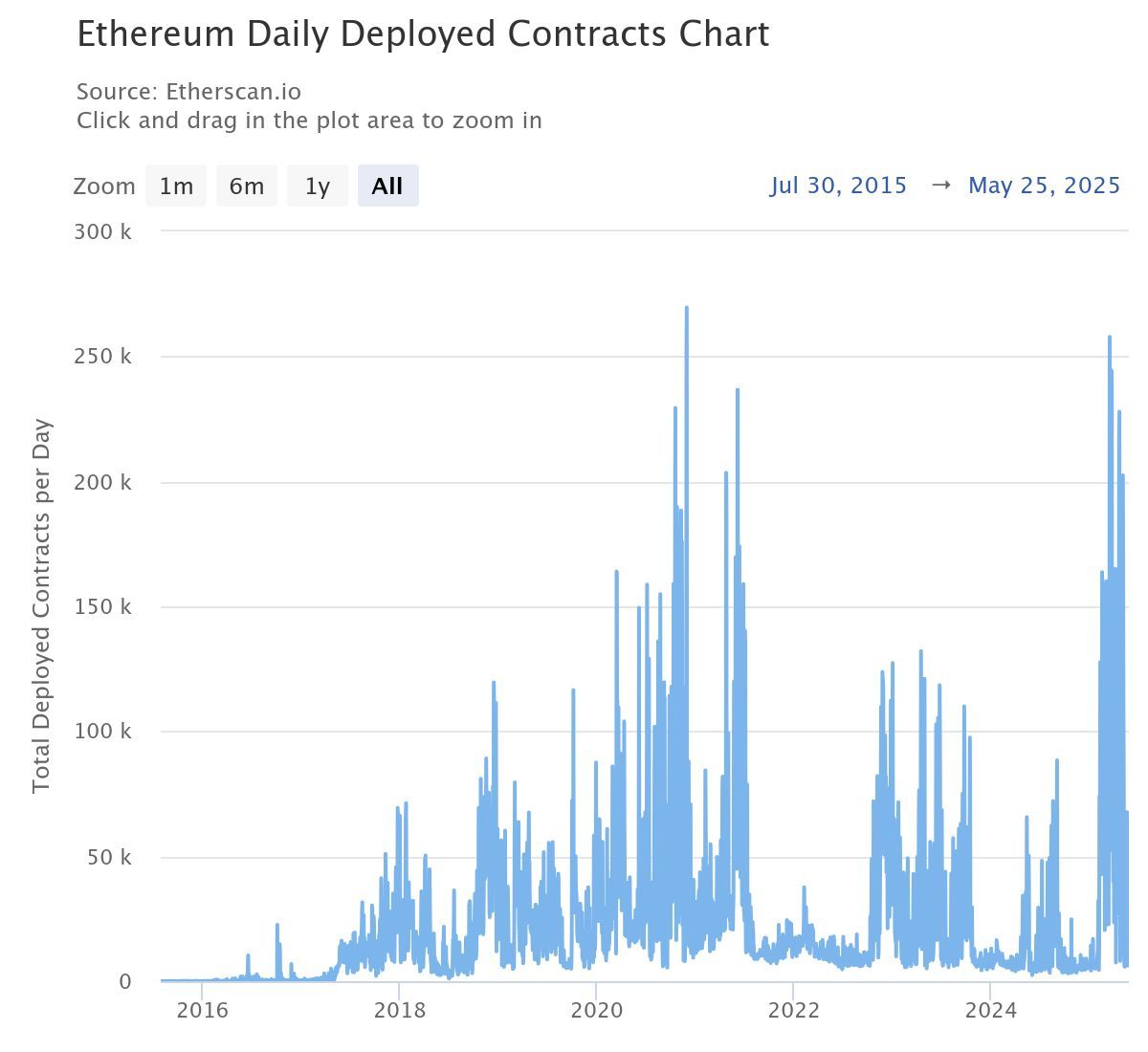

In 2025, Ethereum (ETH) skilled a big surge in sensible contract deployment exercise. The variety of contracts deployed day by day has reached ranges not seen since 2021.

This marks a powerful revival within the Ethereum ecosystem, one of many world’s main blockchain platforms. It additionally strengthens bullish predictions for ETH’s worth, elevating the query: Can Ethereum reclaim its all-time excessive from 2021?

What Might Drive Ethereum to $10,000?

In response to Etherscan knowledge, the variety of sensible contracts deployed day by day on Ethereum has skyrocketed for the reason that begin of the 12 months. The chart exhibits that in Q1 2025, day by day deployments reached the very best degree since 2021, when ETH hit its all-time excessive of over $4,800.

This surge in Q1 was largely in anticipation of the Pectra improve. Moreover, the rising variety of sensible contracts displays Ethereum’s growing utility, which drives up demand for ETH.

Ethereum Every day Deployed Contracts. Supply: Etherscan

Nonetheless, the worth of ETH hasn’t totally mirrored this constructive development. It dropped from $3,700 to $1,400 earlier than recovering to $2,500 on the time of writing.

Regardless of the worth lagging behind sensible contract progress, crypto investor Ted stays optimistic. He believes ETH might quickly surpass its 2021 highs.

“Ethereum day by day contract deployments simply hit ranges not seen for the reason that 2021 bull run. Builder exercise is rising, clear sign of on-chain momentum returning. Value follows fundamentals. ETH to $10,000 this cycle,” Ted predicted.

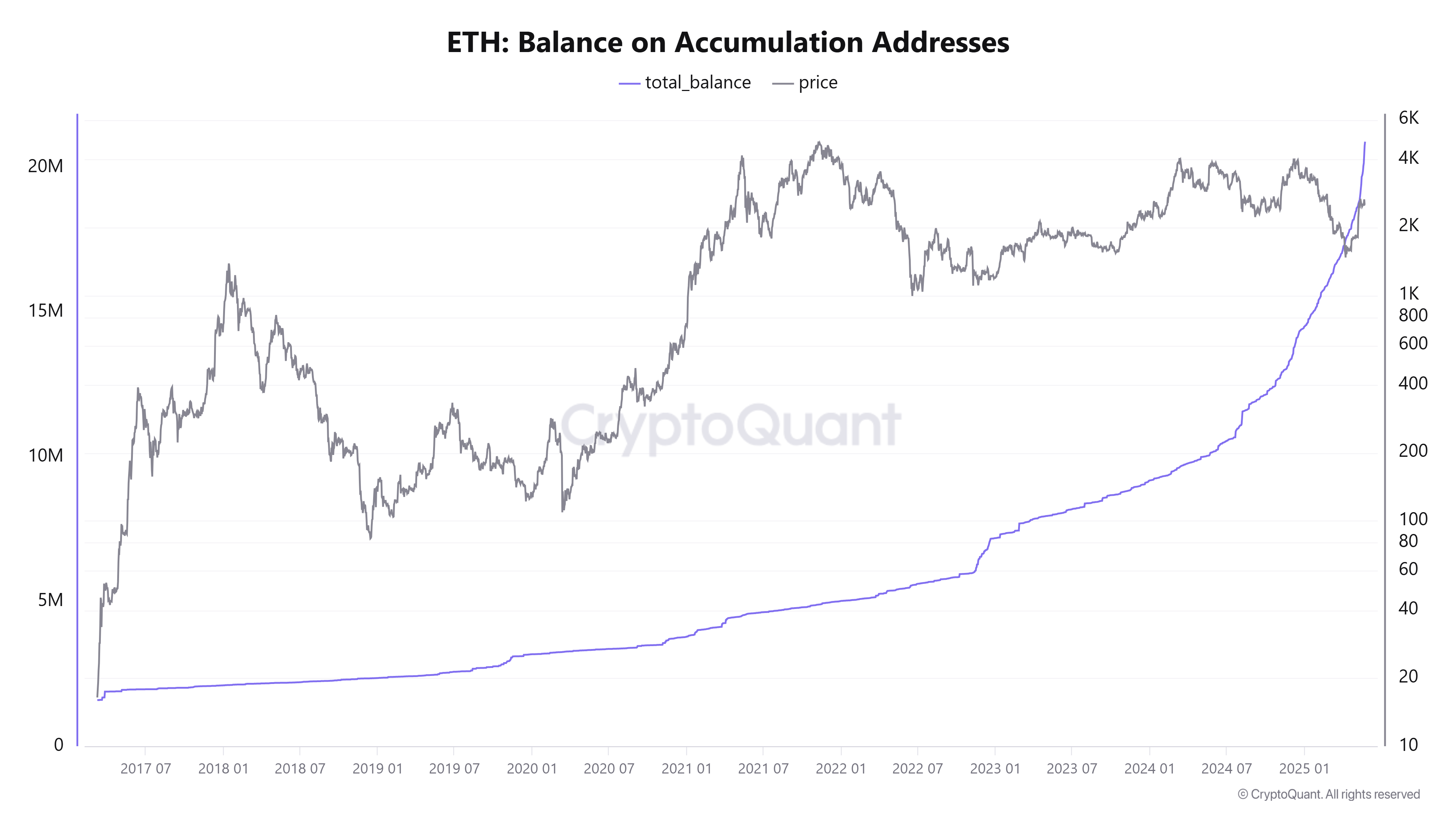

On the similar time, knowledge from CryptoQuant gives additional optimism. The quantity of ETH flowing into accumulation wallets simply hit an all-time excessive. These wallets normally belong to giant buyers, often known as “whales.” The rise in inflows suggests sturdy long-term confidence in ETH’s potential.

In consequence, the ETH stability in accumulation wallets reached a brand new excessive—almost 21 million ETH, or 17.5% of the circulating provide. In 2025, the upward development on this chart highlights intense ETH demand.

ETH Stability on Accumulation Tackle. Supply: CyptoQuant.

Report highs in sensible contract deployment and ETH accumulation reinforce the view that Ethereum appeals to builders and buyers, regardless of a risky crypto market.

Previous Value Efficiency Suggests a Brief-Time period Return to $4,000

Analysts have additionally made bullish worth predictions based mostly on ETH’s chart patterns.

Analyst Cas Abbe used the 2-week Gaussian Channel indicator to evaluate Ethereum’s worth development. By evaluating previous worth conduct, Abbe forecasts that ETH might hit $4,000 in Q3 2025.

Ethereum Value And a couple of-Week Gaussian Channel. Supply: Cas Abbé

“ETH is making an attempt to reclaim the 2W Gaussian Channel. Since 2020, ETH has solely reclaimed this channel twice. Each occasions, it rallied strongly. In 2020, ETH rose from $300 to $4,000. In 2024, it climbed from $2,400 to $4,100. If ETH regains this degree once more, I’m assured it would attain $4,000 in Q3 2025,” Abbe stated.

One other essential issue is ETH’s efficiency in comparison with Bitcoin (BTC) in 2025. Knowledge from CoinGlass exhibits ETH surpassing BTC in Q2. Presently, ETH’s Q2 return is +40%, whereas BTC’s is +33%.

CoinGlass’s historic knowledge additionally reveals that ETH normally outperforms BTC in Q2. ETH’s common Q2 return is 64.22%, in comparison with BTC’s 27.30%.

Nonetheless, latest on-chain evaluation from BeInCrypto highlights rising investor warning. Many buyers are locking in income after ETH rebounded over 80% since early final month. This promoting stress may very well be a headwind for ETH’s path to larger worth ranges.