Ethereum trades close to $2,000 after a pointy pullback, whereas longer-term chart work factors to a last leg increased inside a multi-year construction. Brief-term value motion now tightens right into a triangle, establishing the subsequent decisive transfer as momentum cools.

Ethereum Tracks “Increasing Diagonal” Rely as $9K–$18K Zone Marks Subsequent Goal

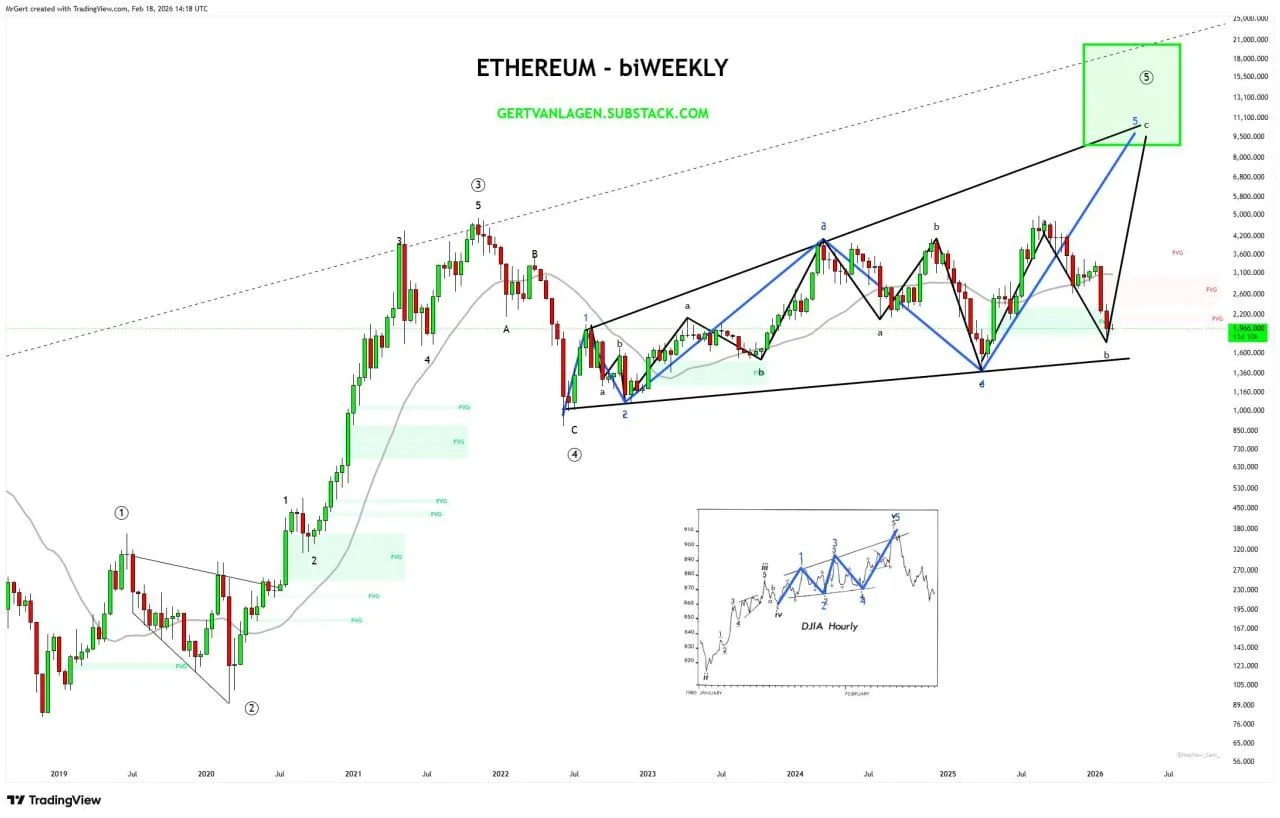

Ethereum has continued to hint what analyst Gert van Lagen described as a “textbook Increasing Diagonal” on a biweekly chart. In a publish on X, he stated wave ⑤ that started in 2018 is now in its late section, with the subwave labeled ⑤-5-a already printing an all time excessive.

Ethereum Biweekly Chart. Supply: Gert van Lagen on X

Van Lagen stated the subsequent leg, ⑤-5-b, prolonged decrease after Ethereum misplaced the next time-frame easy transferring common. He added that the decline crammed a good worth hole marked between roughly $1,800 and $2,300, a zone highlighted on the chart as prior imbalance.

The analyst framed ⑤-5-c because the remaining upside push throughout the construction, putting a projected goal zone between $9,000 and $18,000. He set invalidation at a break under the extent labeled ⑤-4 on the chart, which might negate the rely underneath his framework.

$ETH Holds Sub-$2,000 Base as Brief-Time period Triangle Types on Each day Chart

Ethereum traded close to $1,972 on the every day ETHUSD chart as value compressed right into a slim triangle under the $2,100 space. The sample adopted a pointy drop from the low $3,000s and confirmed decrease highs urgent down whereas increased lows edged up from the mid-$1,800s. The construction marked short-term indecision as value stayed capped under former assist close to $2,000, now performing as resistance.

Ethereum U.S. Greenback 1D Chart. Supply: Rendoshi on X

On the identical chart, prior swings confirmed an analogous compression section earlier in 2025 that resolved increased after value reclaimed close by resistance. The present setup sits under a broader vary that spans roughly $1,150 on the draw back and $4,950 on the upside, ranges marked as historic assist and resistance on the every day view. Value stays properly under the higher boundary, which has capped advances since late 2024.

Momentum on the RSI hovered within the decrease band and confirmed a small rebound from sub-30 readings as value stabilized. The indicator mirrored cooling draw back strain after the newest selloff, whereas value motion continued to print tight candles close to the triangle’s apex. The chart highlighted repeated assessments of the identical assist zone with no clear break, protecting the short-term course unresolved because the market waits for a decisive transfer.