Ethereum (ETH) is going through rising strain from whale exercise as giant holders proceed to dump important parts of their holdings.

This ongoing sell-off comes throughout a difficult season for the cryptocurrency, with Ethereum grappling with poor worth efficiency.

Based on knowledge from BeInCrypto, ETH has depreciated by 51.3% because the starting of the yr. Whereas macroeconomic elements have weighed closely on all the crypto market, Ethereum’s struggles have been particularly pronounced. In actual fact, final week, the altcoin plunged to lows not seen since March 2023.

Nonetheless, the tariff pause triggered a modest restoration in ETH shortly after. At press time, Ethereum was buying and selling at $1,623, a slight enhance of 0.3% over the previous day.

Ethereum Value Efficiency. Supply: BeInCrypto

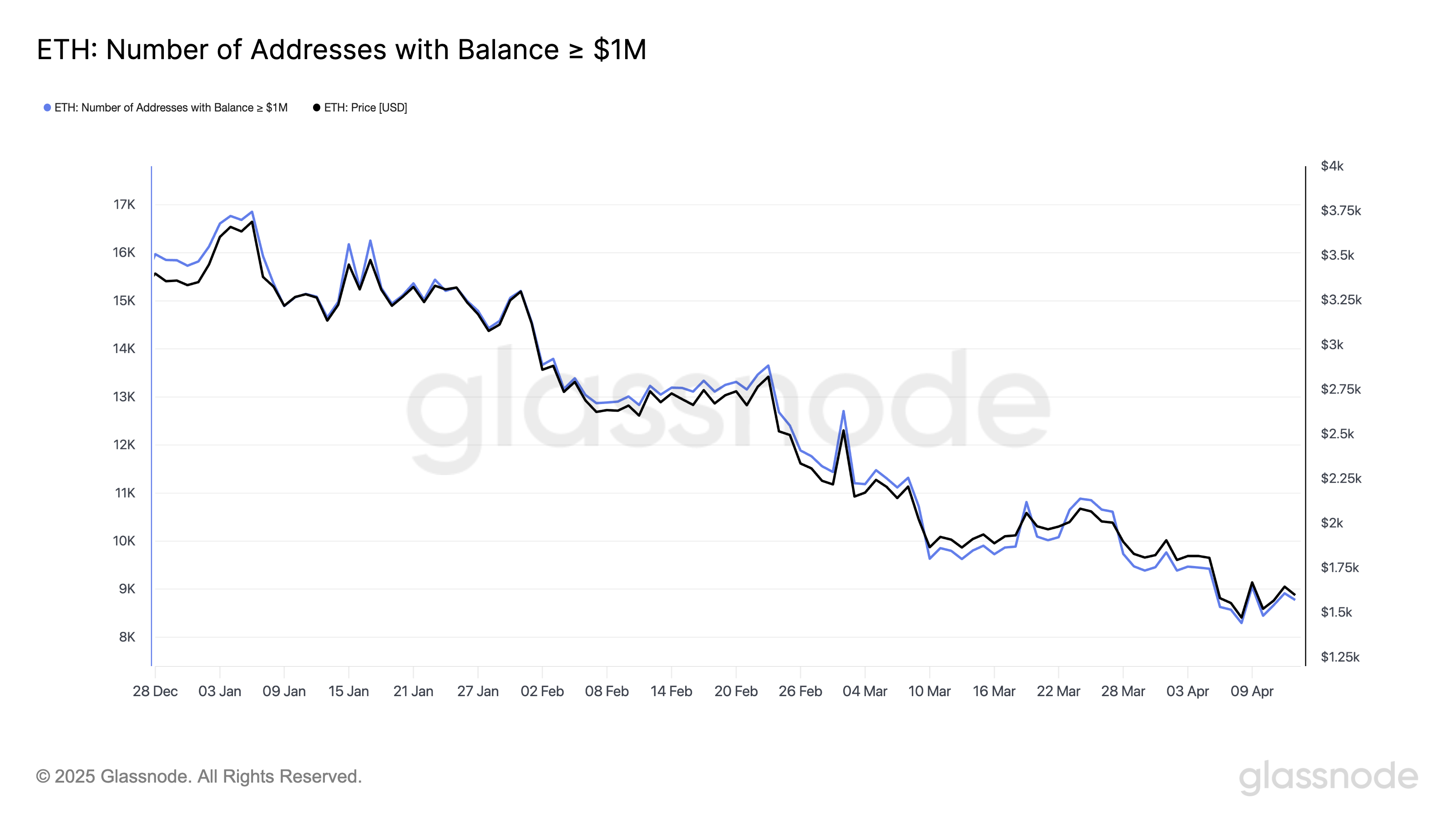

Regardless of this, the underwhelming efficiency has deterred buyers. Glassnode knowledge revealed that the variety of addresses holding no less than $1 million in ETH has decreased sharply year-to-date (YTD). Final week, these addresses dropped to lows not seen since January 2023, reflecting a notable discount in high-net-worth investor confidence.

Holders with no less than $1 million value of ETH. Supply: Glassnode

A more in-depth take a look at the newest whale exercise corroborated the decline. On April 14, a whale deposited 20,000 ETH value $32.4 million into the Kraken alternate, possible making ready for additional gross sales.

“The whale nonetheless has 30,874 ETH ($50.7 million) left, with $104M (+52.4%) in estimated complete revenue,” Spot On Chain famous.

As well as, an on-chain analyst revealed that an early 2015 ICO investor has been promoting constantly. On April 13, the whale offloaded 632 ETH, value roughly $1.0 million.

Because the starting of April, this investor has bought 4,812 ETH, valued at round $8.0 million. Remarkably, the preliminary funding price was as little as $0.3 per ETH, leaving the whale with a considerable stash of 30,189 ETH nonetheless in its possession.

Furthermore, one other dormant ETH whale, which had been inactive for years, has additionally began promoting. The tackle withdrew 3,019 ETH from HTX between August and December 2020. Then, the investor transferred the property to its present promoting tackle three years in the past.

On April 11, the whale made its first deposit of 1,000 ETH to Binance. On April 13, the whale deposited one other 1,000 ETH, elevating considerations of a possible sell-off.

“Happily, the whale solely has 1,018 ETH left, so it won’t trigger an excessive amount of promoting strain available on the market,” the analyst acknowledged.

The latest rise of dormant whales is noteworthy. Whereas their sell-offs nonetheless yield income, their exercise suggests they intention to take care of this development. Based on Glassnode, solely 36.1% of Ethereum addresses are at present worthwhile, indicating {that a} main portion of holders face losses.

Ethereum Holders in Revenue. Supply: Glassnode

In the meantime, the present scenario with Ethereum has led an analyst to attract comparisons to Nokia’s fall from dominance within the late 2000s. As BeInCrypto reported, the analyst warned that Ethereum may very well be headed for a decline, with extra scalable and quicker platforms like Solana (SOL) taking on.

However, the pessimism isn’t widespread. Many analysts nonetheless foresee a possible for restoration, citing upcoming technological upgrades and the market’s undervaluation of ETH.